Mirae Asset mulls committing up to $26 mn to AIIB-backed India infra fund

Aug 09, 2017 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Mirae Asset Financial Group is likely to commit 20 billion won to 30 billion won ($18 million to $26 million) to a $750 million infrastructure fund for India which Asia Infrastructure Investment Bank (AIIB) aims to close by the end of this year.

AIIB is to commit up to $150 million to the India Infrastructure Fund and seeks to raise an additional $600 million from other investors, according to AIIB’s announcement posted on its website.

Mirae’s brokerage arm, Mirae Asset Daewoo Ltd., will make a principal investment in the fund on behalf of the parent group, after winning approval of its investment decision-making body, according to investment banking sources on August 8.

If executing the investment, Mirae will become the first South Korean company to commit to an AIIB-backed fund.

South Korea’s National Pension Service and sovereign wealth fund Korea Investment Corporation are also known to consider participating in the fund which is expected to attract American pension funds and European insurers.

“We thought it is a good investment target with high growth potential,” said a Mirae Asset source.

The India Infrastructure Fund, which Morgan Stanley is to manage as a general partner, will be operational through 2023.

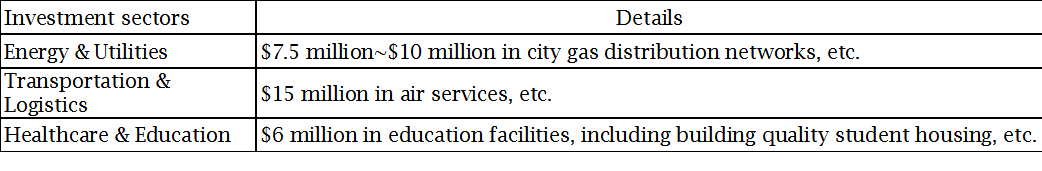

It will invest in infrastructure platforms and high growth infrastructure services companies in energy and utilities; transportation and logistics; and other sectors, including telecommunications, healthcare and education.

The fund is expected to allocate $5 million to $7.5 million to each project in co-investments which are expected to generate internal rate of returns of 15 to 18% given India’s robust economic growth.

It is the first time for China-led AIIB, launched in January 2016, is raising an investment fund, rather than extending loans to a project. AIIB may seek to raise a second such fund, depending on the performance of the first fund.

It is the first time for China-led AIIB, launched in January 2016, is raising an investment fund, rather than extending loans to a project. AIIB may seek to raise a second such fund, depending on the performance of the first fund.

As India placed infrastructure as a top priority, it spent $140 billion on infrastructure in 2016 alone.

India will likely need to spend $4.45 trillion in infrastructure between 2016 and 2040 and may face an investment shortfall of $526 billion by 2040, said Global Infrastructure Hub of G20 in its recent Global Infrastructure Outlook report.

By Hugh YH Jeong

hugh@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)