Hanwha Asset to raise $1 bn from insurance arms to launch global funds

Jun 15, 2017 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s Hanwha Asset Management Co. Ltd. will launch three global funds for infrastructure, real estate and private equity investments, with $1 billion commitments from two insurance units of its parent group.

Hanwha Life Insurance Co. Ltd. and Hanwha General Insurance Co. Ltd. will commit the pledged capital to the blind-pool funds in installments starting from this month through June 2019, they said in recent regulatory filings.

Hanwha Life will deploy $940 million to the three funds on capital calls, with Hanwha General to allocate $60 million to them. Both insurers will be only investors in the funds.

They said the commitment decisions, which won approval from their board of directors this week, are aimed at making strategic asset allocations and achieving higher investment returns for a long term.

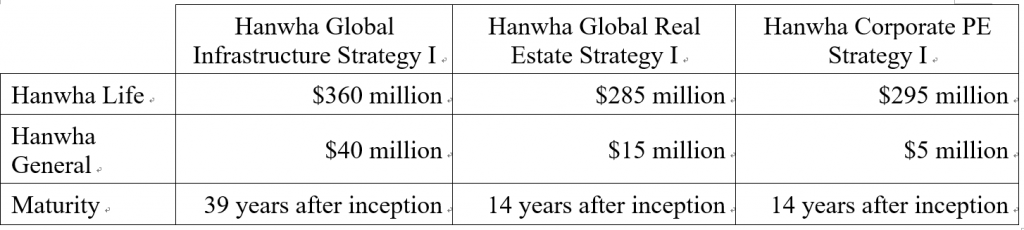

The following are details of the three funds and planned allocations:

Yong Seok Pae, an ex-private equity team head under the National Pension Service’s global alternative investment division, will spearhead the management of the three blind-pool funds.

Since moving to Hanwha Asset last year, Pae has been heading its alternative investment division as a managing director.

Hanwha Asset is wholly owned by Hanwha Life.

The fund launches for the Hanwha Group’s financial companies come after Samsung Group’s real estate investment firm launched a series of overseas investment firms with commitments from affiliated financial services companies.

By Ikhwan Kim

lovepen@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)