NPSŌĆÖ 2016 overseas alternative investment return drops to 12.34%

Mar 02, 2017 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

MBK eyes stake in Korean software developer Tmaxsoft

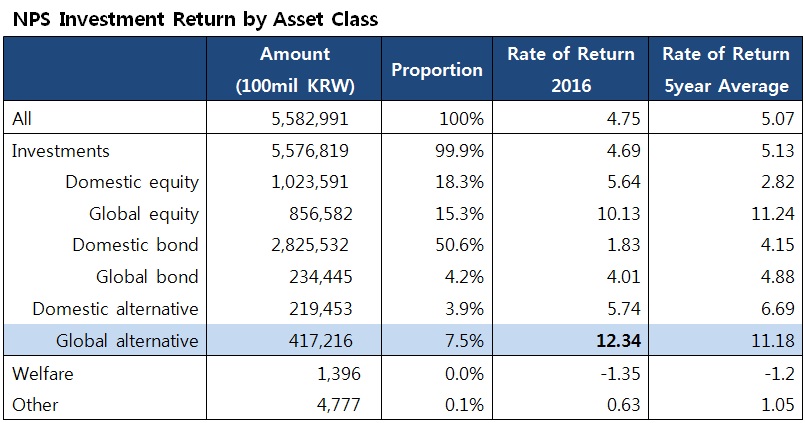

Overseas alternative investments remained the best-performing segment for South KoreaŌĆÖs National Pension Service (NPS) for the third consecutive year in 2016, but their return declined further to 12.34% from the previous yearŌĆÖs 14.90%, according to preliminary data from the countryŌĆÖs Ministry of Health and Welfare.┬Ā

Overseas alternative assets had far┬Āoutperformed other asset classes for the worldŌĆÖs No. 3 pension scheme. But their average return continued to shrink┬Āsince peaking at 15.26% in 2014, while the NPS have been expanding alternative investments into a broader range of targets.┬Ā

NPSŌĆÖ overseas alternative investments amounted to 41.7 trillion won ($37 billion) at the end of 2016, accounting for 7.5% of total assets, or 27.7% of its entire overseas investments. The share of overseas alternative investments increased from 6.3% at end-2015.

Between 2012 and 2016, overseas alternative investments delivered an average return of 11.18%, compared with┬Ā5.07%┬Āon total investments during the same period. For the recent 10-year period between 2007 and 2016, the return on total investments was 5.38% on average.

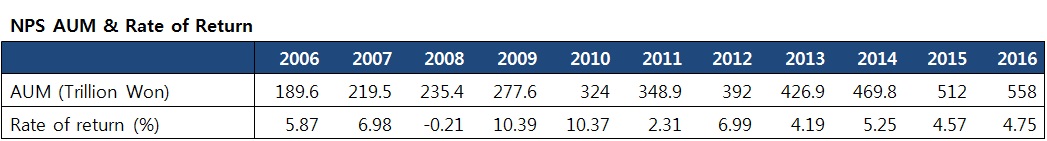

Overall, NPS made a 4.75% return from 2016 investments, an increase from the previous yearŌĆÖs 4.57%, buoyed by a double-digit return on┬Āglobal stock portfolios: overseas stocks delivered a 10.13% return, the strongest since 2014.

NPSŌĆÖ 2016 return was the highest among global pension funds, according to the welfare ministry which cited preliminary data: CanadaŌĆÖs CPP (3.7%), ABP of the Netherlands (2.7%), NorwayŌĆÖs GPFG (2.7%), JapanŌĆÖs GPIF (1.8%) and CalPERS (-0.1%).

The welfare ministry said in a statement on Feb. 28, which included the preliminary data, that NPS will boost the number of staff in its overseas offices to 40 this year from 23 in 2015, as it plans to lift the proportion of overseas assets to 35% or above by end-2021. It allocated 150.8 trillion won to overseas assets, or 27.1% of its assets of 558.3 trillion won at end-2016.

The statement was released, shortly after the NPS reported its end-2016 investment status to a committee of the ministry which oversees the pension fund. But it did not provide a breakdown on individual alternative asset classes.

Meanwhile, the pension fund will lower the proportion of overseas stocks managed by outside investment firms by 10% points to 55% to 75% to save management fees. Overseas stocks made up 15.4% of the fundŌĆÖs assets at end-2016, worth 85.7 trillion won.

Note: 2016* data is preliminary.

Source: The Ministry of Health and Welfare

By Chang Jae Yoo

yoocool@hankyung.com

Yeonhee Kim edited this article

-

-

-

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

-

-