CerberusŌĆÖ new Europe property fund may attract over $370 mn from Korean investors

Aug 12, 2016 (Gmt+09:00)

3

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

National Pension Service (NPS), Korea Investment Corporation (KIC) and a South Korean insurer are considering putting a combined $370 million into a real estate fund that Cerberus Capital Management is launching to buy distressed assets in Europe, and other domestic institutions are mulling participation in the fund, pension fund and investment banking sources said on August 10.

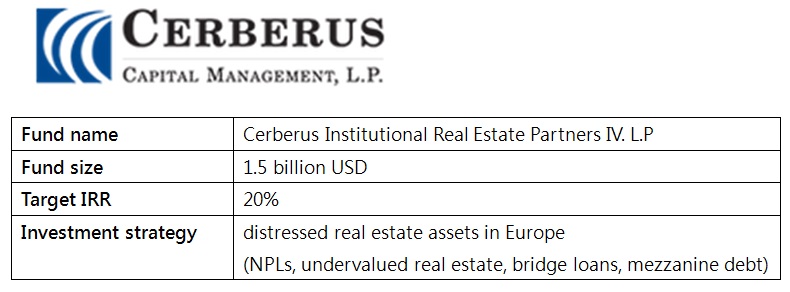

Cerberus, a U.S. private equity firm specializing in distressed asset investments, is aiming to raise a total of $1.5 billion in the fund, the fourth of its kind, amid expectations that tightened banking regulations under the Basel III and strict asset quality reviews by the European Central Bank will continue to prod European banks to shed non-core assets to bolster their capital base.

NPS, the worldŌĆÖs No.3 pension fund, is mulling investing $200 million in the Cerberus Institutional Real Estate Partners IV, on top of the $200 million it had already committed to the third fund of its sort. KIC, a sovereign wealth fund, is considering putting $150 million into the fund, and Lotte Insurance Co. Ltd. may invest $20 million in the new fund, according to the sources. Kyobo Life Insurance Co. Ltd. and Korea Specialty Contractor Financial Cooperative, a financial services provider for construction companies, are now performing due diligence on the fund for possible investments.

ŌĆ£Between 2014 and 2015, the NPLs sold by European banks had amounted to $230 billion,ŌĆØ said one of the sources from a domestic pension fund. ŌĆ£Going forward, Ōé¼1 trillion worth of NPLs held by European banks will likely come to the market.ŌĆØ

The new real estate fund of Cerberus will buy non-performing loans (NPLs) in Europe, including Spain, Italy, Germany, Britain and Ireland, as well as undervalued real estate assets, secured loans, bridge loans and mezzanine debt. It aims for 20% returns a year, broadly in line with the 10~20% of a net internal rate of returns its previous three real estate funds had posted as of end-September 2015.

The South Korean pension scheme and KIC have made steady commitments to NPL funds, including one of Oaktree Capital Management, a leading U.S. distressed asset manager, since the 2008 global financial crisis. But returns on the NPL investments disappointed as the bad loan market had not expanded as fast as expected.

ŌĆ£After the financial crisis, liquidity provided by central banks to markets through zero interest rate and quantitative easing policies, etc., had put the brakes on asset quality deterioration,ŌĆØ said the pension fund source. ŌĆ£When it comes to the U.S. market, overheating investment competition has led to a bubble in distressed asset prices. ThatŌĆÖs why we decided to invest in the Cerberus fund focused on Europe.ŌĆØ ┬Ā

European real estate loan (RE loan) and real estate-owned (REO) transactions surged to a record Ōé¼85.9 billion of closed sales in 2015, according to Cushman & Wakefield, a real estate adviser. However, it estimated that the closed transaction volume in 2016 will decrease to around Ōé¼70 billion to Ōé¼80 billion due to a limited supply from Britain.

New York-based Cerberus Capital, overseeing $30 billion of assets, was the top buyer of European real estate loans and REO transactions in both 2014 and 2015, purchasing over Ōé¼28 billion of European RE loans and REOs in 2015 alone, data from Cushman & Wakefield showed.

Separately, CVC Credit Partners, a leading NPL investor focused on Europe and the United States, said late in June that the structural changes in the European banking landscape, which may be impacted by the Brexit decision, would create attractive investment opportunities. In a press release on June 30 2016, CVC announced the closing of its Ōé¼650 million fund to buy stressed and distressed corporate credit across Europe.

By Donghoon Lee

leedh@hankyung.com

┬Ā

Cerberus, a U.S. private equity firm specializing in distressed asset investments, is aiming to raise a total of $1.5 billion in the fund, the fourth of its kind, amid expectations that tightened banking regulations under the Basel III and strict asset quality reviews by the European Central Bank will continue to prod European banks to shed non-core assets to bolster their capital base.

NPS, the worldŌĆÖs No.3 pension fund, is mulling investing $200 million in the Cerberus Institutional Real Estate Partners IV, on top of the $200 million it had already committed to the third fund of its sort. KIC, a sovereign wealth fund, is considering putting $150 million into the fund, and Lotte Insurance Co. Ltd. may invest $20 million in the new fund, according to the sources. Kyobo Life Insurance Co. Ltd. and Korea Specialty Contractor Financial Cooperative, a financial services provider for construction companies, are now performing due diligence on the fund for possible investments.

ŌĆ£Between 2014 and 2015, the NPLs sold by European banks had amounted to $230 billion,ŌĆØ said one of the sources from a domestic pension fund. ŌĆ£Going forward, Ōé¼1 trillion worth of NPLs held by European banks will likely come to the market.ŌĆØ

The new real estate fund of Cerberus will buy non-performing loans (NPLs) in Europe, including Spain, Italy, Germany, Britain and Ireland, as well as undervalued real estate assets, secured loans, bridge loans and mezzanine debt. It aims for 20% returns a year, broadly in line with the 10~20% of a net internal rate of returns its previous three real estate funds had posted as of end-September 2015.

The South Korean pension scheme and KIC have made steady commitments to NPL funds, including one of Oaktree Capital Management, a leading U.S. distressed asset manager, since the 2008 global financial crisis. But returns on the NPL investments disappointed as the bad loan market had not expanded as fast as expected.

ŌĆ£After the financial crisis, liquidity provided by central banks to markets through zero interest rate and quantitative easing policies, etc., had put the brakes on asset quality deterioration,ŌĆØ said the pension fund source. ŌĆ£When it comes to the U.S. market, overheating investment competition has led to a bubble in distressed asset prices. ThatŌĆÖs why we decided to invest in the Cerberus fund focused on Europe.ŌĆØ ┬Ā

European real estate loan (RE loan) and real estate-owned (REO) transactions surged to a record Ōé¼85.9 billion of closed sales in 2015, according to Cushman & Wakefield, a real estate adviser. However, it estimated that the closed transaction volume in 2016 will decrease to around Ōé¼70 billion to Ōé¼80 billion due to a limited supply from Britain.

New York-based Cerberus Capital, overseeing $30 billion of assets, was the top buyer of European real estate loans and REO transactions in both 2014 and 2015, purchasing over Ōé¼28 billion of European RE loans and REOs in 2015 alone, data from Cushman & Wakefield showed.

Separately, CVC Credit Partners, a leading NPL investor focused on Europe and the United States, said late in June that the structural changes in the European banking landscape, which may be impacted by the Brexit decision, would create attractive investment opportunities. In a press release on June 30 2016, CVC announced the closing of its Ōé¼650 million fund to buy stressed and distressed corporate credit across Europe.

By Donghoon Lee

leedh@hankyung.com

┬Ā

Yeonhee Kim edited this article

More to Read

-

-

-

Private equityPrivate markets open to more high-net-worth individuals: Hamilton Lane

Private equityPrivate markets open to more high-net-worth individuals: Hamilton LaneApr 16, 2024 (Gmt+09:00)

-

InfrastructureInfrastructure secondaries continue to rise amid inflation: Stafford

InfrastructureInfrastructure secondaries continue to rise amid inflation: StaffordApr 09, 2024 (Gmt+09:00)

-

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervalued

Private equityCarlyleŌĆÖs Rubenstein sees commercial real estate undervaluedApr 08, 2024 (Gmt+09:00)

Comment 0

LOG IN