private consumption

Scope

Date

~

-

Mergers & Acquisitions

Mergers & AcquisitionsHyundai Oilbank set to sell oil storage arm ahead of IPO

Hyundai Oilbank Co., a South Korean refiner, is selling a majority stake in its wholly owned Hyundai Oil Terminal Co. to a Seoul-based private equit...

Jul 16, 2021 (Gmt+09:00)

-

Hydrogen economy

Hydrogen economyKorea forms ambitious public-private green ammonia alliance

South Korea has taken a major step forward in building the hydrogen economy by forming an extensive green ammonia alliance involving 13 private firm...

Jul 16, 2021 (Gmt+09:00)

language -

Mergers & Acquisitions

Mergers & AcquisitionsBlackRock in talks to acquire Korea’s ESG-focused IGIS Private Equity

BlackRock Inc., the world’s largest asset manager, is in talks to acquire IGIS Private Equity, a South Korea-based firm specialized in eco-fri...

Jul 12, 2021 (Gmt+09:00)

language -

Economy

EconomyBOK ratchets up warning over asset price bubble, private debt

The recent asset price rises in South Korea, in particular in the equities and real estate markets, have been too rapid, even considering an expecte...

Jun 23, 2021 (Gmt+09:00)

language -

IPOs

IPOsBlackstone-invested handbag maker Simone applies for IPO review

South Korea’s luxury handbag maker Simone Acc. Collection Ltd., 30% owned by US private equity firm Blackstone, has kicked off a process to li...

Jun 11, 2021 (Gmt+09:00)

-

ASK 2021 Interview

ASK 2021 InterviewGoldman Sachs zeros in on midmarket, ESG infrastructure deals

Goldman Sachs Asset Management focuses on middle-market, value-add strategy for infrastructure deals, targeting the sectors undergoing a digital tra...

Jun 03, 2021 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsIMM Private Equity to acquire 40% stake in SK Lubricants for $900 million

Seoul-based IMM Private Equity will acquire a 40% stake in South Korea’s SK Lubricants Co., wholly owned by SK Innovation Co., for about one t...

Apr 22, 2021 (Gmt+09:00)

-

Earnings

EarningsKakao’s private affiliates post record growth in 2020

South Korean tech giant Kakao’s unlisted subsidiaries have posted record-high growth figures for the previous financial year. According to Kak...

Mar 19, 2021 (Gmt+09:00)

language -

Sovereign wealth funds

Sovereign wealth fundsKIC names new private equity, absolute return heads

The Korea Investment Corporation (KIC) has named new heads of its private equity and absolute return groups this week, following the replacement of ...

Mar 03, 2021 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsIMM Private Equity to set up operation-focused unit

This is the first in our bi-weekly Deal briefs series, covering the latest M&A deals and key events in South Korea’s capital markets. We w...

Dec 01, 2020 (Gmt+09:00)

-

Korean Investors

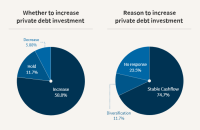

Korean InvestorsKorean LPs favor direct lending for private debt investment

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Nov 17, 2020 (Gmt+09:00)

-

Stepstone

Stepstone[ASK2020] Private Debt: Playing Offense or Defense?

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] The US middle market private credit opportunity

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 Ju...

Oct 30, 2020 (Gmt+09:00)

-

Ares SSG Management

Ares SSG Management[ASK2020] Direct Lending (or Private Credit) in Asia

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating integrated businesses across Credit, Privat...

Oct 30, 2020 (Gmt+09:00)

-

Park Square

Park Square[ASK2020] The Opportunity in European Private Debt

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] Introduction to Australia’s Private Debt Market

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Tikehau Capital

Tikehau Capital[ASK2020] Trends in European Private Debt and Private Equity Post Covid19

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

Oct 28, 2020 (Gmt+09:00)

-

Korean investors' survey

Korean investors' surveyKorean investors pick private debt as preferred asset class

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Oct 27, 2020 (Gmt+09:00)

-

Interview

InterviewKorean police fund raises risk appetite for private debt

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

Oct 27, 2020 (Gmt+09:00)

-

Korean Air

Korean AirKorean Air seals $835 mn in-flight business sale to private equity firm

Korean Air Lines Co. Ltd. signed a definitive agreement on August 25 to sell its in-flight duty-free and meal service business to South Korea’s ...

Aug 25, 2020 (Gmt+09:00)

-

Ardian

ArdianArdian looking to expand Asia private equity investment

Paris-based Ardian is looking to increase private equity investments in Asia, setting its sight on technology, media, online service and healthcare se...

Jul 15, 2020 (Gmt+09:00)

-

Private equity

Private equityKIC forms $400 mn joint venture with NongHyup for private equity co-investment

Korea Investment Corporation (KIC) has announced a $400 million joint venture with NongHyup, or the National Agricultural Cooperative Federation, to...

Jul 13, 2020 (Gmt+09:00)

-

Sovereign wealth fund

Sovereign wealth fundKIC promotes private equity head to lead alternative investment

Korea Investment Corporation (KIC) has appointed private equity head James Jongho Kim as alternative investment group head and deputy chief investment...

Jun 30, 2020 (Gmt+09:00)

-

Asset allocation

Asset allocationNPS boosts private debt and venture capital investment in Q1

The National Pension Service (NPS) has beefed up investments in private debt and venture capital funds by adding Antares Capital Advisers and Insight ...

Jun 03, 2020 (Gmt+09:00)

-

[RFP] POBA to commit $250 mn to US, Asia-focused private debt funds

The Public Officials Benefit Association (POBA) plans to commit $250 million to five private debt funds focusing on mid-cap companies in North America...

Sep 15, 2019 (Gmt+09:00)

-

Alcentra, BlueBay win GEPS’ $90 mn Europe private debt mandates

The Government Employees Pension Service (GEPS) will commit 40 million euros ($45 million) each to blind-pool private debt funds of Alcentra Ltd. and ...

Nov 11, 2018 (Gmt+09:00)

-

[Interview] Carlyle sees huge potential in private credit: Co-CEO

The Carlyle Group, one of the world’s biggest private equity firms, puts the expansion of credit business as a top priority as the private debt market...

Sep 07, 2018 (Gmt+09:00)

-

[ASK 2018 SUMMIT Panel Talks] Korean LPs seek riskier private debt investment

Major South Korean institutional investors plan to raise exposure further to credit investments in search of steady cashflows and expect to see more i...

Jun 04, 2018 (Gmt+09:00)

-

Antares Capital raising $200 mn from Korea for private debt fund

Antares Capital LP, a leading US middle-market lender, is raising $200 million from South Korean institutional investors for a private debt fund to wh...

Feb 17, 2018 (Gmt+09:00)

-

POBA commits $150 mn to private debt funds of Antares, Ares and Golub

The Public Officials Benefit Association (POBA) has committed an aggregate $150 million to Antares Capital, Golub Capital and Ares Management as the t...

Jan 29, 2018 (Gmt+09:00)

Latest News

- 1 Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

- 2 CJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

- 3 Trump Jr. meets Korean business chiefs in back-to-back sessions

- 4 Samsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

- 5 Kookmin Bank raises $700 mn in forex bonds amid strong demand