KKR infrastructure

Scope

Date

~

-

Fiera Capital

Fiera Capital[ASK2020] Investing in Global Mid-Market Infrastructure

Fiera Capital is an independent global asset management firm with a multi-boutique approach, with over USD125 billion in assets under management...

Oct 30, 2020 (Gmt+09:00)

-

Hamilton Lane

Hamilton Lane[ASK2020] Infrastructure trends and opportunities

Hamilton Lane (NASDAQ: HLNE) is a leading alternative investment management firm providing innovative private markets solutions to sophisticated...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] The outlook for US Infrastructure Debt

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Aberdeen Standard Investments

Aberdeen Standard Investments[ASK2020] Global PPP Infrastructure, Market Overview and Outlook

Aberdeen Standard Investments is dedicated to helping investors around the world reach their investment goals and broaden their financial horizon...

Oct 28, 2020 (Gmt+09:00)

-

Infrastructure fund

Infrastructure fundKKR’s $3 bn Asia infra fund to raise $200 mn from Korea

South Korean pension funds and insurance companies will commit $200 million in aggregate to KKR’s first Asia infrastructure fund targeting to ra...

Oct 27, 2020 (Gmt+09:00)

-

Alternatives

AlternativesKorean insurers, Shinhan Alternative commit $130 mn in KKR CMBS fund

South Korea's insurers along with Shinhan Alternative Investment Management Inc. have committed $130 million in the real estate stabilized credit (RES...

Oct 23, 2020 (Gmt+09:00)

-

Pre-IPOs

Pre-IPOsKKR mulls investment in Hyundai Heavy's maintenance arm

South Korea's leading shipbuilder Hyundai Heavy Industries Holdings Co. is in talks with global private equity firm KKR to secure investments as part ...

Oct 23, 2020 (Gmt+09:00)

-

Waste management

Waste managementKKR buys $386 mn stake in Korean sewage disposal firm

KKR & Co. has purchased a combined 440.8 billion won ($386 million) worth of shares in TSK Corp., a leading South Korean sewage and wastewater tre...

Oct 19, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield set to raise $610 mn for new infrastructure debt fund: report

Brookfield Asset Management Inc. will collect around 700 billion won ($610 million) from South Korean institutional investors for its second infrastru...

Oct 11, 2020 (Gmt+09:00)

-

Electric vechicle

Electric vechicleUrgent need to expand Korea's EV charging infrastructure: lobby group

It is critical that the South Korean government and carmakers swiftly move to increase local charging stations for electric vehicles and secure raw ma...

Sep 17, 2020 (Gmt+09:00)

-

Private equity

Private equityKKR’s strategic relationship with Shinhan Financial fizzles

Back in 2018, KKR & Co. tentatively agreed to buy a minority stake in South Korea’s Shinhan Financial Group to build a strategic relationshi...

Sep 15, 2020 (Gmt+09:00)

-

Infrastructure

InfrastructureKOTAM to raise $800 million for global infrastructure credit investment

Korea Transportation Asset Management (KOTAM) is set to raise $800 million in a global infrastructure credit fund, which US-based I Squared Capital (I...

Sep 10, 2020 (Gmt+09:00)

-

Infrastructure

InfrastructureMirae Asset to launch $252 mn Europe infrastructure fund

Mirae Asset Global Investments Co. is preparing to launch a 300 billion won ($252 million) vehicle to invest in a European infrastructure fund.Accordi...

Sep 08, 2020 (Gmt+09:00)

-

Private equity

Private equityKKR to expand Korea waste management portfolio to sewage treatment

KKR & Co. is set to acquire a non-controlling stake in a South Korean sewage management company in a deal worth up to 200 billion won ($170 millio...

Aug 27, 2020 (Gmt+09:00)

-

Private equity

Private equityHanwha Life commits $400 mn to KKR’s new Asia buyout fund

Hanwha Life Insurance Co. Ltd., South Korea’s second-biggest life insurer, has committed around $400 million to KKR & Co.’s new Asia b...

Aug 25, 2020 (Gmt+09:00)

-

Waste management

Waste managementKKR wraps up $739 mn purchase of Korean waste management firms

KKR & Co. of the US has finalized the 875 billion won ($739 million) purchase of two South Korean waste treatment companies after completing its f...

Aug 21, 2020 (Gmt+09:00)

-

Waste management

Waste managementGoldman, Keppel Infrastructure, SK Eng vying for top Korean waste disposal firm

South Korea’s largest waste treatment company EMC Holdings Co. Ltd. has drawn binding bids from Goldman Sachs Principal Investment Area (PIA) Gr...

Aug 10, 2020 (Gmt+09:00)

-

Private equity

Korean investors jointly set up a $770 million SPC to invest in KKR funds

Local institutional investors have injected $500 million (600 billion won) into a special purpose company to invest in diverse funds managed by privat...

Jul 28, 2020 (Gmt+09:00)

-

Korean Investors

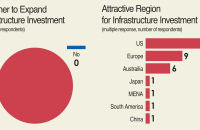

Korean Investors[Survey] Korean investors upbeat on infrastructure, aircraft leasing in 2017

Major South Korean pension funds and insurers are planning to expand offshore infrastructure portfolios next year, and zooming in on aircraft finance ...

Jul 22, 2020 (Gmt+09:00)

-

Waste management

Waste managementKKR tipped to buy Korean waste treatment firms for $713 mn

KKR & Co. has been named as preferred buyer of two South Korean companies providing industrial and medical waste treatment services in a deal wort...

Jun 10, 2020 (Gmt+09:00)

-

Waste management

Waste managementKeppel Infrastructure and MBK join bid for Korean sewage treatment firm

Singapore’s Keppel Infrastructure and MBK Partners are among 15-odd preliminary bidders for South Korea’s largest wastewater treatment com...

Jun 08, 2020 (Gmt+09:00)

-

Pension funds

Pension funds[Interview] Teachers’ Pension picks infrastructure, daily necessities sectors

South Korea’s Teachers’ Pension will chase infrastructure facilities and industrial park properties in developed countries for overseas al...

May 25, 2020 (Gmt+09:00)

-

Waste management

Waste managementKKR eyeing South Korean waste disposal firm valued at $645 mn

KKR & Co. is preparing to join the race for a South Korean industrial and medical waste treatment company valued at about 800 billion won ($645 mi...

May 23, 2020 (Gmt+09:00)

-

Alternative investment

Alternative investmentIMM enters China’s infrastructure market with $40 mn investment

IMM Investment Corp. has acquired a minority stake in China’s private water supplier for $40 million, in the first investment by a South Korean ...

Apr 24, 2020 (Gmt+09:00)

-

M&A

M&AKKR consortium buys Seoul office tower from NPS

A consortium of KKR & Co. and two South Korean companies have closed the acquisition of a Seoul office tower from the National Pension Service (NP...

Feb 29, 2020 (Gmt+09:00)

-

Debt financing

Debt financingMeritz Securites funds KKR’s German media group acquisition

Meritz Securities Co. Ltd. has provided 200 million euros ($218 million) in a senior loan to fund KKR & Co.’s $3.4 billion purchase in 2019 ...

Feb 11, 2020 (Gmt+09:00)

-

Private equity

Private equityKKR secures $1.2 bn exits in Korea for two Asia funds

KKR & Co. has sold a modern logistics facility it had developed in a South Korean port in a transaction estimated to be worth more than 200 billio...

Feb 05, 2020 (Gmt+09:00)

-

Private equity

Private equityShinhan Financial to raise $200 mn for KKR’s tailor-made funds

Shinhan Financial Group will raise $200 million for two KKR funds of funds (FoFs) tailor-made for the South Korean banking group, under a strategic pa...

Jan 10, 2020 (Gmt+09:00)

-

Pension fund

Pension fundNPS joins in billion-dollar LNG midstream deals of Blackstone, KKR

The National Pension Service (NPS) made an investment of the trillion-won ($860 million) level in two LNG midstream assets in North America last month...

Jan 07, 2020 (Gmt+09:00)

-

Alternative investment

Alternative investmentAMP Capital’s $6.2 bn infrastructure fund raises $1.2 bn from Korea

Twenty-four South Korean institutional investors, including the National Pension Service, the Korean Teachers’ Credit Union and the Public Offic...

Nov 18, 2019 (Gmt+09:00)

Latest News

- 1 BMW Surpasses Mercedes in Sales – Imported Car Market 'Shake-Up'

- 2 Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

- 3 CJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

- 4 Trump Jr. meets Korean business chiefs in back-to-back sessions

- 5 Samsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google