Mergers & Acquisitions

MBK Partners’ vice chair vows to hike Korea Zinc’s value to $20.6 billion

Kim Kwang-il has reaffirmed that the MBK-Young Poong alliance has no plans to sell Korea Zinc to China later

By Jan 08, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The battle over Korea Zinc Inc.'s management control between Korea Zinc Chairman Choi Yun-birm and the Young Poong Corp.-MBK Partners alliance has been protracted for months, with the zinc and lead smelter’s shares fluctuating wildly.

Amid the hustle and bustle, Kim Kwang-il, vice chairman of MBK Partners, a private equity firm focused on Northeast Asia, sees Korea Zinc’s corporate value at 30 trillion won ($20.6 billion) in four years if the world’s No. 1 zinc smelter is properly managed.

“We need to solve the management dispute as soon as possible and focus on normalizing its management system,” he said in an interview with The Korea Economic Daily at MBK’s Seoul office on Wednesday.

He said a vote on the introduction of a cumulative voting system at Korea Zinc's extraordinary shareholders' meeting on Jan. 23 is the biggest and most immediate issue for Korea Zinc’s shareholders.

The upcoming shareholder meeting has drawn interest in whether the proposed adoption of a cumulative voting system – viewed as Chairman Choi's final card to defend managerial control – will succeed.

The cumulative voting system allows shareholders to allocate their votes based on the number of directors being elected. For example, if three directors are to be appointed, each share is granted three votes, which can all be assigned to a single candidate or distributed among several candidates.

CUMULATIVE VOTING SYSTEM

Young Poong, a major shareholder of Korea Zinc, has joined hands with MBK Partners to buy more Korea Zinc shares to acquire a controlling stake in the company – a tender offer that began Sept. 13.

In its defense against the bid, Korea Zinc Chairman Choi has partnered with US private equity firm Bain Capital.

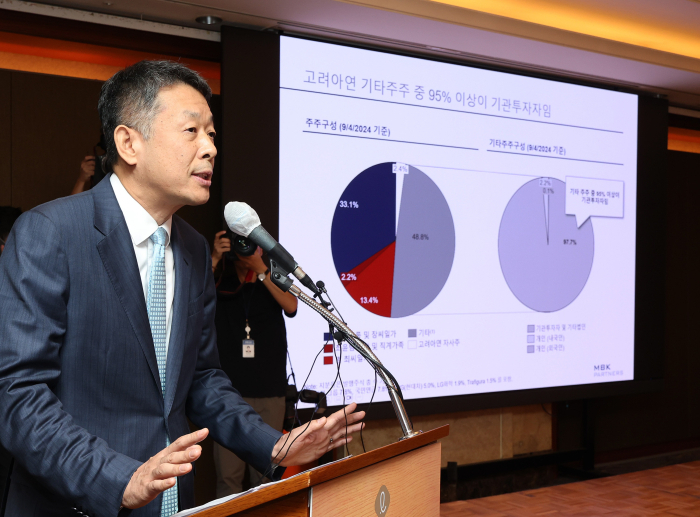

The Young Poong-MBK consortium has steadily increased its stake in Korea Zinc to 40.97%. In terms of their voting rights, their stake is equivalent to 46.7%.

“Considering the usual shareholder attendance rate, we effectively hold a majority stake. While we expect to win at the shareholders’ meeting, the adoption of cumulative voting could be a variable,” he said.

Critics argue that cumulative voting, intended to protect minority shareholders, could be exploited to simply block the Young Poong-MBK consortium's influence in management.

“Given that the majority of Korea Zinc’s shares are concentrated in the hands of the top two shareholders, it is impossible for minority shareholders to secure board seats through cumulative voting. It will only intensify conflicts among major shareholders and create more negative effects,” said the MBK vice chairman.

“Once the current management dispute is resolved and governance reforms are complete, we will amend the articles of incorporation to introduce cumulative voting in a way that protects minority shareholders,” he said.

Kim said he is willing to talk with Korean Zinc Chairman Choi for reconciliation.

“Even if the MBK-Young Poong alliance wins at the shareholders' meeting, Choi will remain the second-largest shareholder. I am willing to explore ways to lead the company together with him,” he said.

EBITDA MULTIPLE OF 14

The MBK executive said he expects Korea Zinc’s corporate value to rise to 13-14 times its earnings before interest, taxes, depreciation and amortization (EBITDA) if its governance structure is improved.

Under Chairman Choi's leadership, Korea Zinc’s market capitalization has hovered around an EBITDA multiple of 9-10.

If and when the MBK-Young Poong alliance secures control, Kim said they plan to continue to pursue Choi’s strategy of transforming Korea Zinc from a smelting company into a key player in the electric vehicle materials sector.

Despite the current EV uptake slowdown, sustained investment could see Korea Zinc achieve 19 trillion won in annual revenue and 2 trillion won in EBITDA by 2029, he said.

“With improved earnings performance and governance, Korea Zinc's corporate value could reach 30 trillion won in four years,” he said.

NO PLAN TO SELL TO CHINA

Responding to industry concerns that MBK may want to sell Korea Zinc to Chinese rivals after a turnaround, Kim said the alliance has no such plans.

“We have no plans at all to sell Korea Zinc to Chinese buyers. We expect domestic conglomerates aiming to grow their EV materials business to acquire the company in 10 years or so,” he said.

While some industry officials said MBK acts like an activist fund, Kim said governance reform is not MBK’s main investment strategy but is “one of its tools as a buyout fund."

“Our key global LPs (limited partners) have already experienced how governance reform in Japan has led to value creation. They are optimistic about applying similar buyout strategies in Korea, where governance remains a key weakness,” Kim said.

MBK is in the middle of raising its sixth blind fund, targeting $7 billion, with $5 billion secured so far.

Kim, who joined MBK in 2005 after a successful career as an M&A lawyer at the Seoul-based international law firm Kim & Chang, has been a leader in Korea’s private equity sector for over 20 years.

“For Korea’s capital markets to progress, someone must open a new path. I hope this investment becomes a starting point for improving outdated governance structures,” he said.

Write to Jong-Kwan Park and Jun-Ho Cha at pjk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Rights offeringsKorea Zinc chair reported to prosecutors over rights issue

Rights offeringsKorea Zinc chair reported to prosecutors over rights issueJan 08, 2025 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKorea Zinc, MBK-Young Poong alliance to fight over cumulative voting

Mergers & AcquisitionsKorea Zinc, MBK-Young Poong alliance to fight over cumulative votingJan 06, 2025 (Gmt+09:00)

4 Min read -

BatteriesSouth Korea approves Korea Zinc’s precursor as national core technology

BatteriesSouth Korea approves Korea Zinc’s precursor as national core technologyNov 19, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsMBK’s Korea Zinc bid aimed at corporate governance, shareholder value

Mergers & AcquisitionsMBK’s Korea Zinc bid aimed at corporate governance, shareholder valueNov 05, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea Zinc, MBK face proxy war for zinc smelter

Mergers & AcquisitionsKorea Zinc, MBK face proxy war for zinc smelterOct 28, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN