M&A deals in South Korea hit 7-year low in 2024

MBK is poised to make its first hostile takeover of a Korean company with Korea Zinc deal

By Dec 23, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s mergers and acquisitions market shrank further in 2024, with leading business groups seeking to unload non-core assets to bolster liquidity. Investment firms struggled to raise funding amid the weakening Korean won, sluggish exports and political uncertainties.

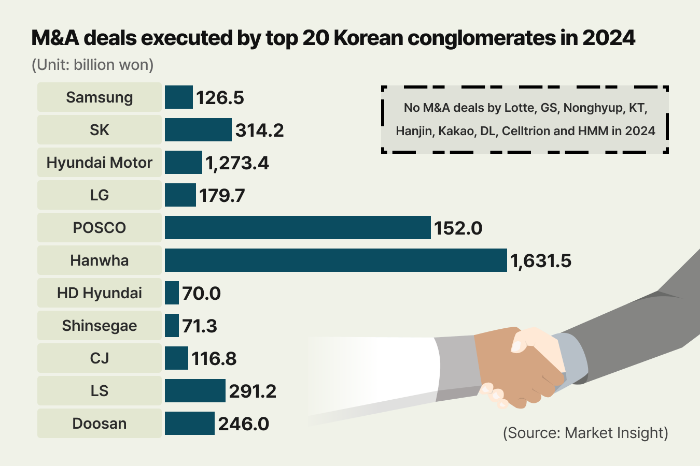

M&A deals executed by the top 20 Korean conglomerates sank to their lowest level in seven years in terms of value in 2024, according to a study by Market Insight, the capital market news outlet of The Korea Economic Daily.

Buyouts and minority stake investments by the 20 business groups amounted to 4.82 trillion won ($3.3 billion) in 2024, notching their lowest level since 3.64 trillion won in 2017, the study found.

The 2024 figure is down 21.9% from the year prior, bucking the trend of the global M&A market, which logged a 10% rise to $1.6 trillion in the first nine months of this year, according to Boston Consulting Group.

On the buy side, the sharp decline of the Korean currency and lackluster domestic stock market challenged fundraising plans, discouraging them from chasing acquisitions and massive investments.

Investments in semiconductor, rechargeable battery and bio companies — deemed as next-generation growth drivers for Korean companies — nearly halted this year, said investment bankers.

“As business dynamics have declined (in Korea), it has become difficult to even narrow down investment candidates,” said a private equity firm official.

Hyundai Motor Group was the only Korean conglomerate to spend at the billion-dollar-level on an overseas company this year. It injected 1.3 trillion won into Motional, its loss-generating self-driving joint venture with Aptiv PLC, to raise its stake.

Nine of the 20 largest business groups, as classified by Korea Fair Trade, did not conduct an M&A deal this year.

Lotte Group, facing a liquidity shortage, focused on selling assets, including its car leasing unit Lotte Rental Co., making an about-face from its buyout spree over the past few years.

In search of better returns, MBK Partners, one of the most active buyout firms in North Asia, targeted Korea Zinc Inc. with the aim of boosting its enterprise value through improved governance.

“The deal drought is expected to continue next year. Along with the economic slowing, the impeachment (of President Yoon Suk Yeol) and the beginning of Donald Trump’s second term added to the uncertainty,” said an investment banker.

Write to Ji-Eun Ha and Jong-Gwan Park at Hazzys@hankyung.com

Yeonhee Kim edited this article.

-

Food & BeverageHanwha seeks acquisition of sibling feud-mired Korean catering firm Ourhome

Food & BeverageHanwha seeks acquisition of sibling feud-mired Korean catering firm OurhomeDec 20, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHanwha completes acquisition $100 mn Philly Shipyard

Shipping & ShipbuildingHanwha completes acquisition $100 mn Philly ShipyardDec 20, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsMBK, Young Poong close in on majority of Korea Zinc

Mergers & AcquisitionsMBK, Young Poong close in on majority of Korea ZincDec 19, 2024 (Gmt+09:00)

2 Min read -

Real estateGIC drops Seoul landmark building sale on Korea’s political woes

Real estateGIC drops Seoul landmark building sale on Korea’s political woesDec 19, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHyosung TNC acquires Hyosung Chemical’s specialty gas unit for $642 mn

Mergers & AcquisitionsHyosung TNC acquires Hyosung Chemical’s specialty gas unit for $642 mnDec 12, 2024 (Gmt+09:00)

2 Min read -

Private equityHong Kong-based PEF Affinity Equity to acquire control of Lotte Rental

Private equityHong Kong-based PEF Affinity Equity to acquire control of Lotte RentalDec 06, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHyosung Chemical scraps specialty gas unit sale to IMM, STIC

Mergers & AcquisitionsHyosung Chemical scraps specialty gas unit sale to IMM, STICNov 21, 2024 (Gmt+09:00)

1 Min read -

Corporate restructuringLotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Corporate restructuringLotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bnOct 25, 2024 (Gmt+09:00)

2 Min read -

Artificial intelligenceKorea’s AI, robot startups shine despite funding drought

Artificial intelligenceKorea’s AI, robot startups shine despite funding droughtSep 10, 2024 (Gmt+09:00)

2 Min read -

Future mobilityHyundai to invest $923 million on self-driving JV Motional

Future mobilityHyundai to invest $923 million on self-driving JV MotionalMay 03, 2024 (Gmt+09:00)

2 Min read -

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read