Korea Zinc, Bain Capital offer $2.4 bn share buyback vs MBK

Korea Zinc's family owners seek to buy shares in Young Poong Precision with a casting vote in the battle

By Oct 02, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korea Zinc Inc. said on Wednesday it will buy back shares for 3.1 trillion won ($2.4 billion) with the backing of Bain Capital to counter MBK Partners’ attempt to take control of the world’s largest lead and zinc smelter.

Its buyback price of 830,000 won per share is 10.7% higher than MBK's offer of 750,000 won.

But Korea Zinc's market share price being below MBK's bid price, two days before the latter's tender offer expires, may lower the odds of Korea Zinc winning the battle against a consortium of MBK and Young Poong Corp., said industry watchers. Korea Zinc gained 3.63% to close at 713,000 won on Wednesday.

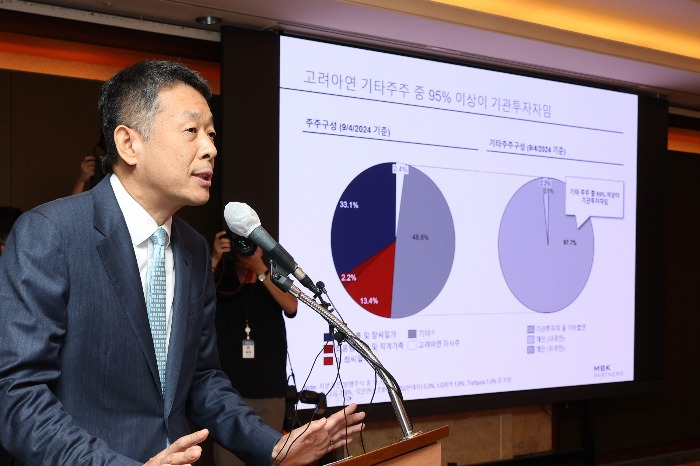

The South Korean company plans to buy an additional 5.87%-15.5% of its outstanding shares and retire all of them, its Chairman Choi Yun-birm said in a press conference on Wednesday.

Bain Capital will join Korea Zinc's buyback program as a financial investor, injecting 429.5 billion won to secure a 2.5% stake in the zinc smelting company, he said.

Its share buyback will take place between Oct. 4 and 23, after the MBK-led consortium wraps up its three-week tender offer.

"With the share buyback, we will protect our company from hostile and predatory attacks, while improving corporate and shareholder value," Choi told reporters.

Young Poong is Korea Zinc's largest shareholder with a 25.4% stake. It is vying for the management rights of the latter in cooperation with MBK.

Early in the day, the Seoul Central District Court rejected MBK and Young Poong's request to block Korea Zinc from buying back shares.

In response to the court decision, MBK said in a statement that Korea Zinc's share buyback, if carried out at a higher price than its fair value, represents a breach of trust and therefore should be banned.

The buyback plan comes less than a week after a consortium of MBK and Young Poong bumped up its takeover bid to 750,000 won a share from the initial 660,000 won.

MBK and Young Poong aim to buy up to 14.6% stake in Korea Zinc through a tender offer, estimated to cost up to 2.3 trillion won ($1.7 billion) in the largest takeover bid for a domestic company.

The takeover attempt comes as Korea Zinc is stepping up its efforts to terminate its decades-long business relations with parent Young Poong Group.

To win over shareholders, Korea Zinc on Wednesday presented its aggressive goals: achieving operating profit margins of more than 12% over the medium to long term and expanding new businesses to 50% of its sales. It is pursuing an average 9% return on investment over the next three years.

YOUNG POONG PRECISION WITH A CASTING VOTE

Simultaneously, Korea Zinc’s three family members led by Chair Choi plan together to spend 118.1 billion won to buy shares in Young Poong Precision Corp. at 30,000 won per share to secure an additional 25% stake, according to the latter’s regulatory filing on Wednesday.

They will be buying back the shares from Oct. 2 to Oct. 21 at a price about 20% higher than the MBK-led consortium’s offer of 25,000 won. The announcement drove its share price to a record high of 28,100 won on Wednesday morning.

Young Poong Precision Chairman Choi Chang-gyu and Korea Zinc honorary Chairman Choi Chang-young formed a three-way consortium with Korea Zinc's current chairman for a share repurchase to lift their combined stake to 60.45%.

Young Poong Precision, an industrial pump and chemical plant valve maker, can give a casting vote with a 1.85% stake in Korea Zinc in the management battle against the MBK-led consortium.

Korea Zinc is speculated to use its retained earnings for the buyback, which industry observers said could lead to allegations of breach of trust and market manipulation against its Chairman Choi even if the company wins against the MBK-led consortium.

(Updated with Korea Zinc Chairman Choi Yun-birm's press conference comments and MBK's official response)

Write to Woo-Sub Kim and Ji-Eun Ha at duter@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsMBK ups Korea Zinc bid price as management feud intensifies

Mergers & AcquisitionsMBK ups Korea Zinc bid price as management feud intensifiesSep 26, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea Zinc to sell $301 mn in CPs amid management feud with MBK

Mergers & AcquisitionsKorea Zinc to sell $301 mn in CPs amid management feud with MBKSep 25, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsHanwha, LG to support Korea Zinc in battle against MBK

Mergers & AcquisitionsHanwha, LG to support Korea Zinc in battle against MBKSep 23, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea Zinc teams up with brokerage firm to counter MBK

Mergers & AcquisitionsKorea Zinc teams up with brokerage firm to counter MBKSep 19, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK not to sell Korea Zinc to China after tender offer

Mergers & AcquisitionsMBK not to sell Korea Zinc to China after tender offerSep 19, 2024 (Gmt+09:00)

4 Min read -

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea Zinc

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea ZincSep 13, 2024 (Gmt+09:00)

4 Min read -

Leadership & ManagementKorea Zinc speeds up separation from Young Poong in management feud

Leadership & ManagementKorea Zinc speeds up separation from Young Poong in management feudJun 21, 2024 (Gmt+09:00)

2 Min read -

Waste managementKorea Zinc buys US Kataman for $55 mn for recycling business

Waste managementKorea Zinc buys US Kataman for $55 mn for recycling businessApr 01, 2024 (Gmt+09:00)

1 Min read -

Hydrogen economyKorea Zinc to up sales to $19 billion by 2033 with green energy

Hydrogen economyKorea Zinc to up sales to $19 billion by 2033 with green energyDec 07, 2023 (Gmt+09:00)

3 Min read -

Private equityYoung Poong Precision to increase control over Korea Zinc

Private equityYoung Poong Precision to increase control over Korea ZincDec 28, 2022 (Gmt+09:00)

1 Min read -

Leadership & ManagementYoung Poong Precision emerges as key to Korea Zinc control; shares surge

Leadership & ManagementYoung Poong Precision emerges as key to Korea Zinc control; shares surgeNov 27, 2022 (Gmt+09:00)

1 Min read -

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materials

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materialsAug 09, 2022 (Gmt+09:00)

2 Min read