Mergers & Acquisitions

Samsung materials suppliers Soulbrain, DNF to merge in $87 mn deal

Soulbrain is seeking to buy the biggest 19.70% stake in DNF, the second-largest shareholder of which is Samsung Electronics

By Aug 09, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Soulbrain Holdings Co., a South Korean high-tech materials supplier to Samsung Electronics Co., is in final talks to buy a controlling stake in another major Samsung supplier DNF Co. for 114 billion won ($87 million) to reinforce its semiconductor materials business, according to sources in the investment banking industry on Wednesday.

Soulbrain Holdings is said to be seeking to buy the biggest 19.70% stake in DNF from the latter’s founder and Chief Executive Kim Myung-woon and related parties at 50,000 won apiece, which would make the total purchase price about 114 billion won, according to the IB industry.

The buyer is expected to up its DNF stake via rights offering later, which also would help lower the overall acquisition cost.

DNF shares closed at 23,950 won apiece on Wednesday, down 8.8% from the previous session. Earlier this year, the stock hovered around 13,000 won.

Soulbrain Holdings shares ended up 1% at 25,150 won on the same day, while its high-tech materials-producing unit Soulbrain Co. shares added 1.8% to close at 260,000 won.

Both Soulbrain and DNF supply semiconductor materials to Samsung Electronics, and the Korean memory giant is also the second-biggest shareholder of DNF.

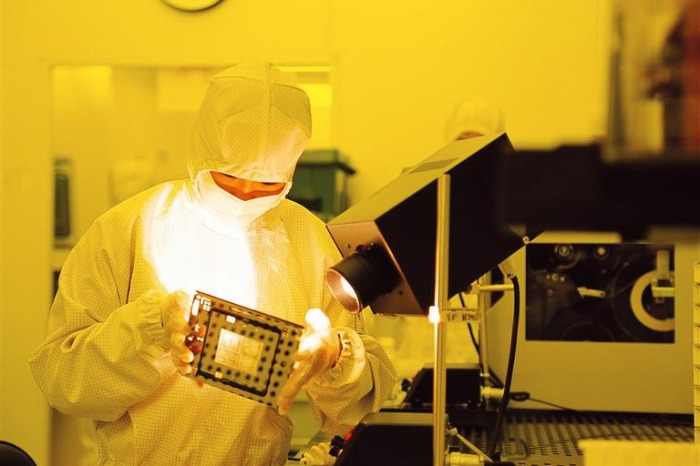

The world’s No. 1 memory chip seller and DNF joined hands in 2005 to develop precursors used in semiconductor wafer patterning process -- double patterning technology (DPT) and amorphous carbon layer (ACT) precursors -- with local technologies.

In a move to back DNF’s efforts to localize semiconductor materials, Samsung Electronics in 2021 invested 21 billion won in the chip materials supplier to acquire the latter’s 7% stake to become the second-largest shareholder.

As its two suppliers are due to be merged, Samsung Electronics is said to be considering the sale of its stake in DNF, according to sources in the high-tech materials industry.

TO REINFORCE SEMICONDUCTOR MATERIALS BUSINESS

With DNF, Soulbrain hopes to further enhance its semiconductor materials business.

Founded in 1986, Soulbrain Holdings owns various high-tech materials businesses including precursors. Soulbrain currently supplies a wide array of semiconductor and display materials to Samsung Electronics, SK Hynix Inc. LG Display Co. and Samsung Display Co.

Precursors are a core material used in wafer patterning, and DNF has rapidly expanded its share in the Korean precursor market since Japan’s export curbs on high-tech materials mainly used in manufacturing chips and displays to Korea in 2019.

Soulbrain raked in 207 billion won in operating profit in 2022 on sales of 1.1 trillion won, with semiconductor materials responsible for 77% of its entire sales. It earned 49 billion won in operating profit in the first quarter of this year with sales of 242.9 billion won.

DNF reaped an operating income of 16.3 billion won in 2022 with sales of 135.1 billion won. Its first-quarter operating income stood at 500 million won and sales came in at 28.7 billion won.

Soulbrain Holdings’ investment subsidiary NAU IB Capital Co. will lead the deal.

Write to Byung-Keun Kim at bk11@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean chipmakersKorea must nurture chip materials, parts, facilities: Jusung

Korean chipmakersKorea must nurture chip materials, parts, facilities: JusungApr 13, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN