Mergers & Acquisitions

KDB girds up for Korean Air-Asiana deal collapse with Plan B

Under pressure to recover taxpayer money, the state-run bank is scrambling to wrap up the prolonged Asiana Airlines sale

By Aug 07, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

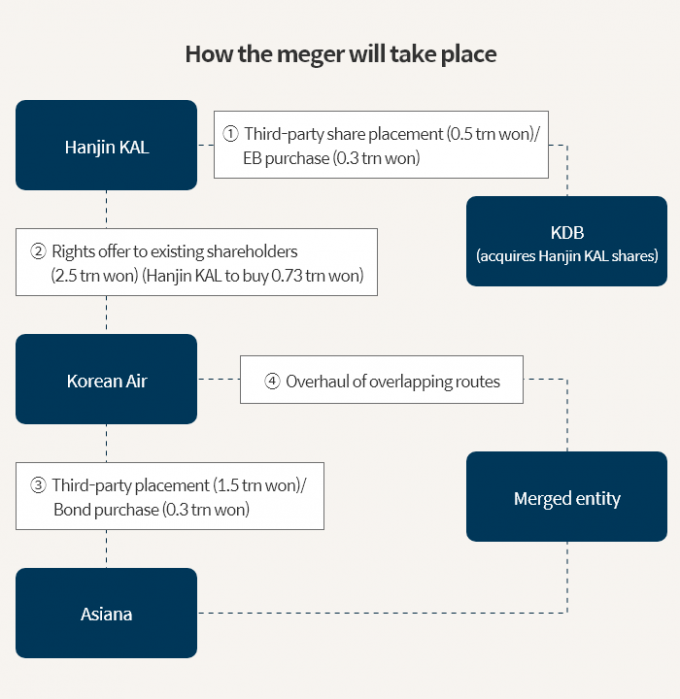

The state-run Korea Development Bank (KDB) is looking for alternative options to sell Asiana Airlines Inc. to prepare against a possible collapse of Korean Air Lines Co.'s 1.8-trillion-won ($1.4 billion) purchase of its smaller domestic rival as the deal has been stalled for almost three years.

The KDB recently hired Samil PwC accounting to explore ways to sell debt-ridden Asiana Airlines in case its combination with Korean Air fails, as well as measures to bolster Asiana’s competitiveness, according to people with knowledge of the matter on Monday.

The consulting request comes after the US raised a hurdle for the approval of the proposed combination of the two South Korean carriers in May and the European Commission rejected the deal after a preliminary review due to monopoly concerns the same month.

Asked by Market Insight, the capital market news outlet of The Korea Economic Daily, about Samil PwC’s involvement, the KDB said: “The consulting assignment is to assess Asiana’s future business plans and financial conditions in case its merger with Korean Air is delayed and its business environment changes.”

“We’re not looking for a third-party buyer (for Asiana),” the bank said, reiterating its previous comment.

In June, the state-run lender had made public that it was not considering a Plan B to prepare against a collapse of the Korean Air-Asiana merger.

But industry observers said the consulting assignment to PwC seems to indicate a shift in KDB’s stance on the Korean Air-Asiana transaction.

They said the US and the EU seemed to have already decided to object to the Korean Air-Asiana deal, even though their anti-trust bodies have not make it clear.

Given that, the delayed sale of Asiana will worsen its financial condition and make it harder to retrieve taxpayer money.

The KDB and other creditor banks had injected a combined 1.2 trillion won into Korean Air and 2.4 trillion won into Asiana in emergency funds in 2020 after they took a hit from COVID-19.

A STRING OF ANTI-MONOPOLY PROPOSALS

To clear the hurdle to the transaction, Korean Air earlier this year suggested it sell Asiana’s cargo lines to domestic budget carriers such as T’way Air Co., in addition to the proposing to give some of the combined entity’s landing and takeoff slots to them.

Cargo business accounted for 72.5% of Asiana’s air transport business in sales in 2021 and generated profits during the pandemic period.

Also, Korean Air is considering transferring some of the US and European routes of itself and Asiana to other domestic carriers. A combined entity is expected to take more than 70% of the Korean aviation industry’s international passenger routes and cargo lines.

But KDB gave the cold shoulder to those proposals, which it believes would split up Asiana operations, looking rather to normalize its operations and create synergy for South Korea’s aviation industry.

Another reason for KDB to turn down Korean Air’s offers to resolve monopoly issues is that there is no guarantee that antitrust bodies of Europe, the US and other countries will clear the way for the deal even after Korean Air executes those suggested measures.

“Anti-trust regulators are demanding that (Korean Air) take anti-trust steps before they deliver final results of their review of the deal,” said an aviation industry official.

“But it may not get the green light even after implementing those measures.”

Industry observers had said the conditions attached by other countries to the approval of the Korean Air-Asiana transaction are hard for Korean Air to accept.

Those requirements are raising skepticism within the KDB. It seems unsure whether the US and Europe will give the go-ahead to the deal, whatever anti-monopoly measures Korean Air takes, they said.

In May, the US Department of Justice (DOJ), reviewing the Korean Air-Asiana merger, said it would reject Korean Air’s purchase of Asiana if the deal leads to the creation of a dominant player with no formidable rival in South Korea's aviation industry.

It denied Korean Air’s proposal of handing some of its international routes to Korea's low-cost carrier Air Premia Inc., saying Air Premia wouldn't be competitive enough to challenge the combined entity of Korean Air and Asiana.

With the deal's delays, Asiana has accumulated debt amounting to 12.8 trillion won as of end-March. Its debt-to-equity ratio surpassed 2,000%.

It has frozen hiring since January 2020. During the period, Korean Air has solidified its No. 1 position in the domestic aviation market.

The alternative to the Korean Air-Asiana merger will likely be unveiled after the US and Europe finalized their decisions on the deal.

A collapse of the Korean Air-Asiana deal would leave KDB under criticism as was the case for the failure in selling Daewoo Shipbuilding & Marine Engineering Co., renamed Hanwha Ocean Co., to Hyundai Heavy Industries Co., the country’s top shipbuilder, after the deal failed to win approval from other countries.

But there are still chances for KDB to contact new candidates behind the scenes to buy Asiana to prepare against a deal collapse with Korean Air, as it did for Daewoo Shipbuilding last year.

It sealed the sale of Daewoo Shipbuilding to South Korea’s defense-to-chemical conglomerate Hanwha Group, less than a year after the European Commission vetoed the shipbuilder’s sale to Hyundai Heavy.

Write to Jun-Ho Cha and Jong-Kwan Park at chacha@hankyung.com

Yeonhee kim edited this article.

More to Read

-

AirlinesKorean Air’s operating profit falls to $360 mn in Q2 2023

AirlinesKorean Air’s operating profit falls to $360 mn in Q2 2023Aug 03, 2023 (Gmt+09:00)

1 Min read -

-

AirlinesKorean Air says it can conclude Asiana takeover via big concessions

AirlinesKorean Air says it can conclude Asiana takeover via big concessionsJun 07, 2023 (Gmt+09:00)

1 Min read -

AirlinesUS antitrust body blocks $1.4 bn Korean Air-Asiana deal

AirlinesUS antitrust body blocks $1.4 bn Korean Air-Asiana dealMay 22, 2023 (Gmt+09:00)

4 Min read -

-

AirlinesUK grants de facto approval of Korean Air's Asiana takeover

AirlinesUK grants de facto approval of Korean Air's Asiana takeoverNov 29, 2022 (Gmt+09:00)

1 Min read -

AirlinesKorean Air to buy rival Asiana in $1.6 bn deal to emerge as world’s 7th airline

AirlinesKorean Air to buy rival Asiana in $1.6 bn deal to emerge as world’s 7th airlineNov 16, 2020 (Gmt+09:00)

5 Min read

Comment 0

LOG IN