SK E&S eyes business split-up to raise up to $1. 5 bn

Renewables and low-carbon energy are likely to be spun off in the stake deal

By Jun 29, 2023 (Gmt+09:00)

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

Korea's Lotte Insurance put on market for around $1.5 bn

South KoreaŌĆÖs SK E&S Co. is seeking to split up its business to raise up to 2 trillion won ($1.5 billion), according to people with knowledge of the matter on Thursday.

Its parent company SK Inc. is in negotiations with global private equity firms and infrastructure investment companies, including Macquarie Infrastructure and Brookfield Asset Management, to sell a stake in the spun-off unit, which will likely include renewables and other low-carbon energy businesses.

The holding company of the countryŌĆÖs No. 2 conglomerate will put up about a 40% stake in the spin-off for sale, including new shares to be issued.

SK Inc. owns 90% of the natural gas subsidiary. It hopes the stake sale will bring in between 1 trillion and 2 trillion won ($760 million-$1.5 billion) in proceeds by the end of this year, the sources told Market Insight, the capital market news outlet of The Korea Economic Daily.

The SK Group previously contacted homegrown PE firms for the stake deal, but talks with them went awry.

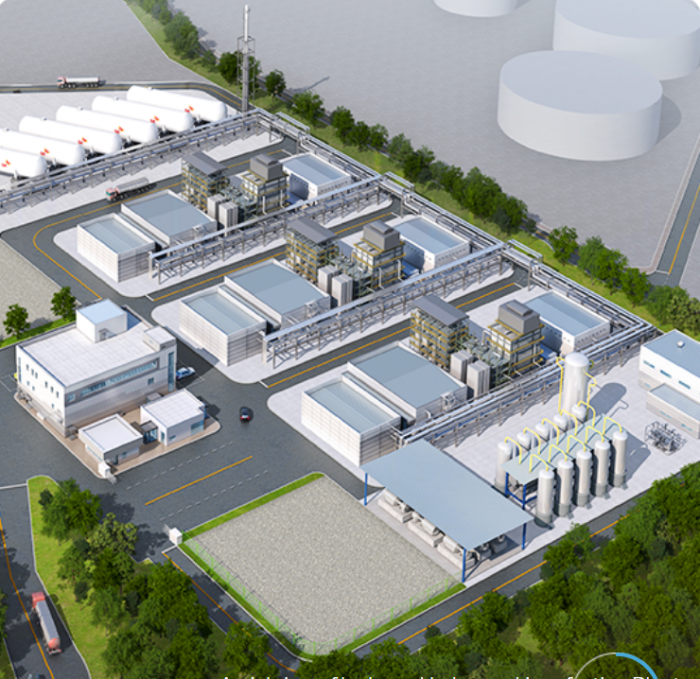

A stake in SK E&SŌĆÖ renewables and energy solutions divisions, spanning energy storage systems, hydrogen and low-carbon LNG, are speculated to be up for sale. Details about which divisions will be split up will likely be specified next month.

Renewables and low-carbon energy such as energy storage systems, LNG and hydrogen account for less than 5% of SK E&SŌĆÖ revenue. City gas and power generation from natural gas and combined heat & power plants take the lion's share of 95%. Last year, its consolidated operating profit came to 1.4 trillion won on sales of 11.2 trillion won.

Despite their negligible contribution to the earnings, the low-carbon businesses to be split up are touted as a future cash cow for SK Group with high growth potential.

Further, SK E&S has built its footprint in the US renewable energy market through the purchases of three US energy companies in 2021.

It invested $400 million in the US-based Rev Renewables to take an undisclosed stake. It secured 95% of Key Capture Energy, a US energy storage systems provider, for $600 million.

SK also acquired a controlling stake in US hydrogen fuel cell maker Plug Power Inc. for $1.5 billion, jointly with the groupŌĆÖs holding company.

The stake sale is seen as the best scenario for SK to prop up its financial health, market watchers said.

SK Inc. is expected to earn dividend income from SK E&SŌĆÖ remaining business, which takes a big chunk of its revenue, while raising fresh money through a minority stake sale of the growth area for a decent sum.

The stake deal will slash SKŌĆÖs debt, which amounted to 10.3 trillion won as of end-March. The figure was a 6% increase from three months before.

It has securitized some of the city gas operations. It raised a total of 3.1 trillion won from the sale of redeemable convertible preferred shares to KKR & Co. in two tranches between 2021 and 2022. They are convertible into shares of an SK E&S subsidiary.

Last year, SK E&S also sold the Busan City Gas headquarters building and some land owned by the subsidiary to a consortium of South Korean companies.

Mirae Asset Securities Co. is the second-largest shareholder in SK E&S with a 5.9% stake. The city gas supplier paid dividends of 754.7 billion won, 385.7 billion won and 630.8 billion won in 2020, 2021 and 2022, respectively.

In regards to the business split-up, SK Group said nothing has been determined yet.

Write to Ji-Eun Ha and Jun-Ho Cha at hazzys@hankyung.com

Yeonhee Kim edited this article.

-

Rights offeringsS.Korean firms' rights issues swell 10-fold in June

Rights offeringsS.Korean firms' rights issues swell 10-fold in JuneJun 27, 2023 (Gmt+09:00)

2 Min read -

Private equityKoreaŌĆÖs SK Square sells off entire stake in Grab as shares tumble

Private equityKoreaŌĆÖs SK Square sells off entire stake in Grab as shares tumbleJun 22, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSKC to sell unit to Glenwood PE at $390 mn for future biz

Mergers & AcquisitionsSKC to sell unit to Glenwood PE at $390 mn for future bizJun 13, 2023 (Gmt+09:00)

1 Min read -

BatteriesSK On wins $909 mn from BlackRock, QIA, MBK consortium

BatteriesSK On wins $909 mn from BlackRock, QIA, MBK consortiumMay 24, 2023 (Gmt+09:00)

1 Min read -

Leadership & ManagementSK Group chairmanŌĆÖs eldest son to play key role at US unit PassKey

Leadership & ManagementSK Group chairmanŌĆÖs eldest son to play key role at US unit PassKeyApr 16, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKKR to buy 100% stake in SK E&S' Busan City Gas for $561 mn

Mergers & AcquisitionsKKR to buy 100% stake in SK E&S' Busan City Gas for $561 mnDec 20, 2022 (Gmt+09:00)

2 Min read -

Private equitySK Group's PE-funded transformation in the spotlight

Private equitySK Group's PE-funded transformation in the spotlightMar 07, 2022 (Gmt+09:00)

5 Min read