Mergers & Acquisitions

MBK to acquire KoreaŌĆÖs top FCCL maker NexFlex for $407 mn

SkyLake, NexFlexŌĆÖs top shareholder, is set to exit with a profit estimated at about five times its initial investment

By Mar 17, 2023 (Gmt+09:00)

1

Min read

Most Read

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

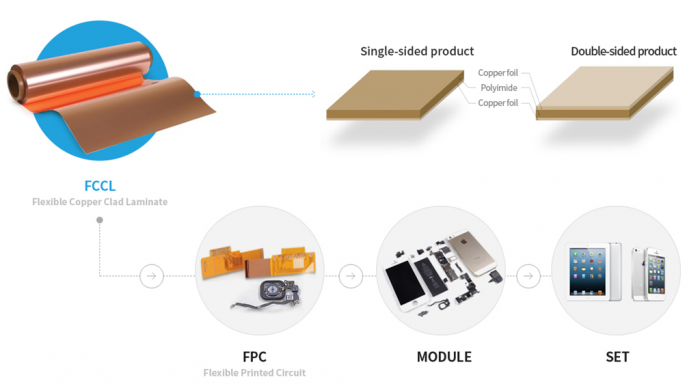

MBK Partners agreed to buy NexFlex Co., South KoreaŌĆÖs top flexible copper-clad laminates (FCCL) producer, as the leading Northeast Asian private equity firm saw high growth potential in the industry, given the strong consumption of smartphone materials and rising 5G demand.

MBK on March 16 signed a stock purchase agreement with SkyLake Equity Partners, NexFlexŌĆÖs top shareholder based in Seoul, to purchase a 100% stake in the company for 530 billion won ($407.2 million), according to banking industry sources on Friday.

SkyLake had inked deals to sell NexFlex to other PE firms before but failed to raise money for the acquisitions on surging interest rates last year.

JC Growth Investment, Korean PE firm JC Partner Co.ŌĆÖs subsidiary, was initially selected as a preferred bidder, but it did not succeed in securing funds for the takeover. Well to Sea Investment Co. and Woori Private Equity Asset Management Co. signed an MOU to buy the 100% stake for about 630 billion won, but that deal also fell through.

MBK has been in talks with SkyLake to acquire NexFlex since late last year.

EXIT WITH HUGE PROFIT BASED ON HEALTHY EARNINGS

SkyLake is set to exit from NexFlex with a huge profit in about five years as it spent some 100 billion won to buy the FCCL unit from SK Innovation Co. in 2018.

NexFlex is the countryŌĆÖs top producer by sales of FCCLs, which are used for flexible printed circuit boards, a key component in IT devices such as smartphones.

The companyŌĆÖs earnings have markedly improved since SkyLakeŌĆÖs takeover. The FCCL makerŌĆÖs operating profit surged to 45.8 billion won last year from 1 billion won in 2019, with sales more than doubling to 154.7 billion won from 68.2 billion won. Its earnings in 2022 were estimated to have nearly doubled from the previous year.

MBK has been investing billions of dollars in acquisitions since late last year. It bought Medit Corp. the worldŌĆÖs third-largest 3D dental scanner maker, for 2.45 trillion won from Unison Capital Korea. MBK and Unison took control of Osstem Implant Co., the worldŌĆÖs fourth-largest dental implant maker, through a tender offer.

Write to Chae-Yeon Kim at why29@hankyung.com

┬Ā

Jongwoo Cheon edited this article.

More to Read

-

Mergers & AcquisitionsMBK, Unison agree on tender offer for KoreaŌĆÖs Osstem Implant

Mergers & AcquisitionsMBK, Unison agree on tender offer for KoreaŌĆÖs Osstem ImplantJan 25, 2023 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK signs $2 bn deal to acquire 3D dental scanner firm Medit

Mergers & AcquisitionsMBK signs $2 bn deal to acquire 3D dental scanner firm MeditDec 29, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea PE firms to buy FCCL maker NexFlex at $463 mn

Mergers & AcquisitionsKorea PE firms to buy FCCL maker NexFlex at $463 mnSep 02, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN