Kakao to launch takeover bid for SM to counter HYBE

The mobile platform plans to secure a 35% stake in SM in a tender offer at $115 per share, 25% above HYBE's bid price

By Mar 07, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

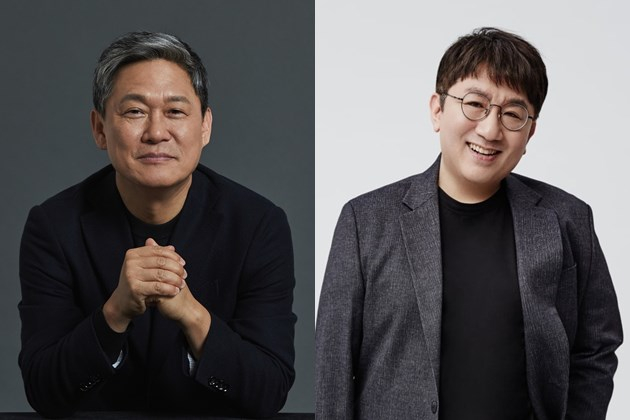

Kakao Corp., South Korea’s dominant mobile platform, will launch a takeover bid for SM Entertainment Co., according to people with knowledge of the matter on Tuesday, a move that could thwart HYBE Co.’s efforts to gain control of the K-pop pioneer.

The bid, estimated to cost 1.25 trillion won ($960 million), will be a new twist to the ongoing battle over the control of SM against HYBE Co., which is now its largest shareholder with a 15.78% stake.

To make a winning bid, Kakao will offer 150,000 won ($115) per share to secure a 35% stake in the producer of a string of Korean idols, including the girl group aespa and boy band NCT.

The bid price is 25% above the 120,000 won offered by HYBE and represents a 15% premium to SM's closing price on Monday. The tender offer will take place from March 7 to 26.

Kakao Corp. and Kakao Entertainment each will bear half of the cost, managed by Korea Investment & Securities Co.

The move comes after Kakao’s deal to buy a stake in the entertainment titan was blocked after a Seoul district court ruled against SM’s decision to sell new shares and bonds equivalent to a 9.05% stake in the latter.

It also followed HYBE’s announcement on Monday that it had secured a 15.78% stake in SM through a direct stake purchase from SM Founder Lee Soo-man and in a tender offer, despite failing to boost its ownership to 40% as planned.

For the stake purchases, it has spent 450.8 billion won. Its ownership of SM will increase to 19.43% if Lee exercises a put option granted by HYBE.

The confrontation between Kakao and HYBE, the label behind the boy band BTS and girl group NewJeans, has been escalating ahead of the March 31 general meeting of SM.

They are striving to persuade minority shareholders to vote in their favor so that they can dominate SM’s board.

Kakao had been widely speculated to launch its own takeover bid for SM. Last Monday, it pledged to thwart HYBE’s scheme to gain control of SM in a tender offer and would mobilize all possible countermeasures to do so.

Eventually, HYBE managed to raise its SM stake by merely 0.98%, buying from minority shareholders.

MOTIVATIONS BEHIND KAKAO’S AGGRESSIVE BID

Kakao’s takeover attempt for SM could end up as a winner’s curse because of the estimated cost, industry observers warn.

But it seems determined to acquire SM to gain a foothold in the global entertainment scene so that it can go public on the Nasdaq in the US.

Until 2015, Kakao Entertainment had remained an underdog with only webtoon and web novel businesses.

But it has since gobbled up drama and movie studios, entertainment companies and music labels at home and abroad. Now it has 41 companies under its wing.

Its third-quarter revenue reached 1.38 trillion won, more than the 1.24 trillion won for HYBE and 1.18 trillion won of CJ ENM Co., the studio behind the Oscar-winning film “Parasite,” in the same quarter.

But its rapid expansion has not yet created as much synergy as expected given no clear business focus.

Kakao is seeking to go public on the Nasdaq around the end of this year. A failure in the IPO could lead to the departure of core employees. It has granted stock options to key staff of companies it took over to retain the personnel.

It also received a combined 1.2 trillion won in pre-IPO funding from Saudi Arabia’s Public Investment Fund (PIF) and Singapore’s sovereign wealth fund GIC last month.

SM, with annual operating profits of close to 100 billion won, is regarded as the last puzzle piece to perfect Kakao’s business.

Now that Kakao is stepping up its confrontation with HYBE, all eyes are on what the company behind the BTS label would come up with in a counterattack.

HYBE is seeking to raise up to 1 trillion won from entertainment companies, as well as from financial investors.

For now, it faces an uphill battle against Kakao at the March 31 general meeting to win shareholder support for its proposal to replace all SM board members with its candidates.

(Updated with the tender offer period and details about who will bear the cost)

Write to Jun-Ho Cha and Ji-Eun Ha at chacha@hankyung.com

Yeonhee Kim edited this article

-

Mergers & AcquisitionsHYBE barely ups SM stake in tender offer amid tensions with Kakao

Mergers & AcquisitionsHYBE barely ups SM stake in tender offer amid tensions with KakaoMar 06, 2023 (Gmt+09:00)

5 Min read -

Mergers & AcquisitionsHYBE to raise up to $769 mn, new twist on battle with Kakao for SM

Mergers & AcquisitionsHYBE to raise up to $769 mn, new twist on battle with Kakao for SMMar 05, 2023 (Gmt+09:00)

5 Min read -

Mergers & AcquisitionsHYBE wins 2nd battle against Kakao over SM Entertainment

Mergers & AcquisitionsHYBE wins 2nd battle against Kakao over SM EntertainmentMar 03, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHYBE loses 1st battle against Kakao for SM Entertainment

Mergers & AcquisitionsHYBE loses 1st battle against Kakao for SM EntertainmentFeb 28, 2023 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsKakao vows to thwart HYBE scheme for SM control

Mergers & AcquisitionsKakao vows to thwart HYBE scheme for SM controlFeb 27, 2023 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsHYBE cries foul over SM, Kakao’s undisclosed deal

Mergers & AcquisitionsHYBE cries foul over SM, Kakao’s undisclosed dealFeb 23, 2023 (Gmt+09:00)

5 Min read -

Mergers & AcquisitionsHYBE not to raise tender offer price for SM Entertainment

Mergers & AcquisitionsHYBE not to raise tender offer price for SM EntertainmentFeb 20, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsWhy SM emerged as hot battlefield between HYBE, Kakao

Mergers & AcquisitionsWhy SM emerged as hot battlefield between HYBE, KakaoFeb 10, 2023 (Gmt+09:00)

5 Min read