Mergers & Acquisitions

Kosdaq-listed Daebo Magnetic’s 46% stake up for sale, its shares swing

Daebo Magnetic, a major supplier to Samsung SDI and China’s BYD, seeks to sell its controlling stake estimated at 300 billion won

By Feb 21, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s leading secondary battery equipment player Daebo Magnetic Co. is set to sell its owner family’s controlling stake of about 46%, estimated at 300 billion won ($231.3 million) including management rights, according to an exclusive report by Market Insight, The Korea Economic Daily’s capital market news outlet, on Monday.

The report said after citing sources from the investment banking industry that Daebo Magnetic has started the sale process for its controlling stake after picking Samjong KPMG, a member firm of the KPMG global organization, as the lead financial advisor. The seller is in contact with potential buyers at home and abroad interested in the secondary battery production equipment business.

The stake up for grabs is about 46%, including its Founder and Co-Chief Executive Officer (CEO) Lee Jun-gak’s 22.26% holdings, his wife’s 16.70% and his daughter’s 6.37% stake, according to sources. Founder Lee is the largest shareholder.

Considering that the company’s total market capitalization is 516.4 billion won based on the current market price, the total stake up for sale is estimated at more than 300 billion won, including management rights. The company is listed on Korea’s secondary Kosdaq bourse.

The founder’s son Lee Sang-ick’s stake is not for sale. After the junior Lee stepped down from his position as vice president and co-CEO, as well as a board member, early this month, he sold his 878,763 holdings Feb. 8-9 in separate block trades to cash in a total of 56.7 billion won. He currently holds 1.51% in Daebo Magnetic.

Daebo Magnetic shares gained 2.7% to end at 67,800 won on Monday following Market Insight’s exclusive stake sale report. But on Tuesday they had tumbled about 6% in the morning session.

LEADING EMF PLAYER

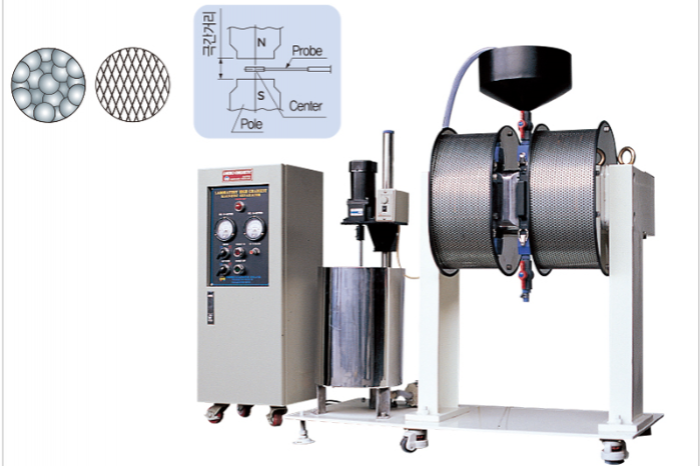

Initially founded in 1976 and incorporated in 1994, Daebo Magnetic went public in 2018. It manufactures electrical components, including suspended magnetic separators, magnetic drum separators and metal detectors.

It is the No. 1 producer of electromagnetic filter (EMF), which is used to reduce or eliminate electromagnetic interference in electronic devices. Its main customers are LG Chem Ltd., Samsung SDI Co., EcoPro BM Co. and China’s BYD Co.

Daebo Magnetic reported 26.6 billion won in operating profit on a consolidated basis in 2022 on sales of 107.1 billion won. In 2021, it posted 5.7 billion won in operating income and 42.9 billion won in sales on a separate basis.

Its operating profit and sales skyrocketed more than 362% and 149%, respectively, on-year last year thanks to brisk sales of EMF, a core device in EV battery production, in line with the burgeoning EV market.

It previously attracted investments from local private equity firm J& Private Equity. The PEF in 2019 issued convertible bonds worth 24 billion won and cashed out its holdings two years later in 2021 at an internal return rate (IRR) of 28.9%.

Write to Ji-Eun Ha at hazzys@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion22 HOURS AGO

-

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demand

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demandApr 30, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to Bunge

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to BungeApr 29, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 million

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 millionApr 28, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bank

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bankApr 24, 2025 (Gmt+09:00)

Comment 0

LOG IN