Why SM emerged as hot battlefield between HYBE, Kakao

A tie-up with SM is expected to bolster K-pop portfolios and the online fandom platform business

By Feb 10, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SM Entertainment Co., a South Korean music label widely credited as the pioneer of K-pop, has emerged as a new battlefield between HYBE Co., the agency behind BTS, and Kakao Corp., a dominant mobile platform.

Since SM founder and top shareholder Lee Soo-man offered his controlling stake, or about 20%, in the entertainment giant last year, it has whet the appetite of several entertainment powerhouses such as CJ ENM Co. and the country’s No. 1 online platform Naver Corp.

On Thursday, HYBE and SM’s Lee made a surprising announcement of their 422.8 billion won ($333 million) agreement, under which HYBE would buy a 14.8% stake in SM directly from its founder Lee. If the transaction goes through, Lee’s ownership will drop to 3.66%.

HYBE also announced a tender offer to buy an additional stake of up to 25% from minority shareholders at the same price, or 120,000 won per share. That represents a 22% premium to Thursday's closing price.

To purchase a 40% stake in SM, HYBE may have to spend a total of 1.1 trillion won.

Their agreement provoked a backlash from Kakao, which on Tuesday released a plan to secure a 9.05% stake in SM for 217 billion won to become the second-largest shareholder.

The planned share purchase will not involve shares held by SM’s Lee, who was not notified of the decision in advance. Kakao’s move also comes as SM has been under pressure from activist shareholders to improve business transparency.

“The war has just begun. There is no step back for either HYBE or Kakao,” said an entertainment industry official. “They will do whatever they can to take over SM or at least to block their competitor from buying it.”

Kakao, a latecomer to the entertainment scene, has been the most aggressive bidder for SM.

The country’s No. 1 mobile messenger app has rapidly sprawled into the ride-hailing service and mobile payments, as well as into webtoon, dramas, internet TV and music streaming services.

The takeover of SM would put Kakao on par with the country's two other entertainment giants: HYBE and YG Entertainment Co. of the girl group Blackpink.

SM controls 20% of the domestic entertainment management market, and boasts plenty of intellectual property portfolios.

From a broader perspective, controlling SM would not only shake up South Korea’s entertainment landscape from music to TV dramas and webtoons, but also the platform market, analysts said.

“Whoever wins the battle for SM will become the strongest player in both the content and platform markets,” said another entertainment industry official.

SM, with a market value of 2.7 trillion won, has led South Korea’s entertainment business since the 1990s. It is the label behind the first- and second-generation Korean idol groups, including H.O.T, S.E.S, Girls' Generation, Exo and Red Velvet.

Based on HYBE's market capitalization of 8.1 trillion won, their combination will create an entertainment juggernaut worth 11 trillion won.

SM’s Lee and HYBE Chairman Bang Si-hyuk said in a joint statement on Thursday that they were determined to grow both companies into “game changers” in the global pop music scene.

“We also share a vision of creating a lifestyle platform, while maximising K-pop’s global competitiveness,” they said.

FANDOM PLATFORM

In a business tie-up, they will likely collaborate to use the intellectual property for their artists, which analysts say will create economies of scale.

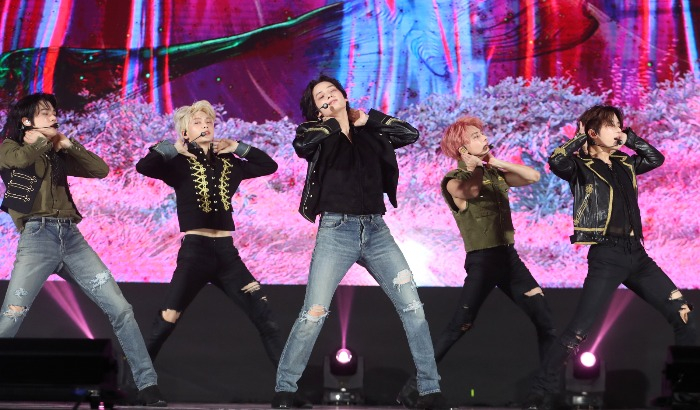

BTS successors, managed by HYBE, include boy bands – Tomorrow X Together, Seventeen and Enhypen – and girl groups NewJeans and Le Sserafim.

SM has managed boy bands – SM TVXQ, Super Junior, SHINee, EXO and NCT – as well as the girl group Aespa.

Both HYBE and SM plan to beef up their fandom-based business.

HYBE runs the Weverse K-pop fandom platform, where BTS, Blackpink and other K-pop stars hold online concerts, and their characters are featured in merchandise.

SM’s DearU bubble also serves as an online fan community. Therefore, a combination of the two fandom platforms will make it the dominant player with more than a 90% share in the K-pop fandom community worldwide.

In 2021, Naver's online fan community was merged into HYBE’s Weverse. In return, it obtained a 49% stake in a HYBE unit that operates Weverse.

Weverse then absorbed YG Entertainment's online fan platform.

Their three-way alliance has piled pressure on Kakao.

NO STEP BACK

Still, it remains uncertain whether the announced HYBE-SM share deal will force Kakao to give up its bid for SM.

A pullback from the competition would significantly weaken Kakao’s presence in the Korean platform market, where it is in fierce competitoin with Naver.

Industry watchers said Kakao seems to have room for a counterattack with an additional stake purchase.

“If Kakao loses to HYBE in the battle for SM, it will fall behind in the K-pop fandom platform market,” said one of the entertainment industry officials.

Kakao is also setting its sights on SM's vast IP portfolios, which would create synergy with its music and video streaming platforms, as well as its web novel and webtoon apps.

“SM’s content spanning music, drama, TV shows and advertisement will be able to expand through Kakao Entertainment’s platforms,” said EBest Investment & Securities analyst Ahn Jin-ah.

Furthermore, Kakao will likely emerge as a formidable rival against CJ ENM, the studio behind the Oscar-winning film "Parasite."

In 2021, Kakao Entertainment's revenue stood at 877.2 billion won, just one-fourth of CJ ENM’s 3.6 trillion won.

Write to Sun-A Lee at suna@hankyung.com

Yeonhee Kim edited this article.

-

K-popBTS label HYBE seeks takeover of K-pop pioneer SM Entertainment

K-popBTS label HYBE seeks takeover of K-pop pioneer SM EntertainmentFeb 10, 2023 (Gmt+09:00)

3 Min read -

-

Shareholder activismK-pop label SM taps activist investor as board member

Shareholder activismK-pop label SM taps activist investor as board memberJan 20, 2023 (Gmt+09:00)

2 Min read -

EntertainmentK-pop label SM to increase number of outside directors

EntertainmentK-pop label SM to increase number of outside directorsJan 16, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKakao closes in on $800 mn deal to buy SM Entertainment stake

Mergers & AcquisitionsKakao closes in on $800 mn deal to buy SM Entertainment stakeMar 11, 2022 (Gmt+09:00)

2 Min read