Mergers & Acquisitions

Cash-rich Nongshim pursues first-ever sizeable acquisition

Its bid for a domestic food supplement brand signals an end to its 57-year organic growth strategy

By Sep 06, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Nongshim Co., South Korea’s No. 1 instant noodle brand, is looking to buy a domestic food supplement maker for up to $50 million, which would mark its first-ever sizeable acquisition, according to people with knowledge of the matter on Tuesday.

The move also signals a shift in the company's 57-year-long organic growth and conservative corporate culture since Chairman and CEO Shin Dong-won took over in July last year.

Nongshim, which means “farmers’ heart” in Korean, is among the shortlisted bidders of Chunho Food Co., a small-sized company based in the port city of Busan. Seoul-based KAMUR Private Equity has put its 76.8% stake in the firm up for sale.

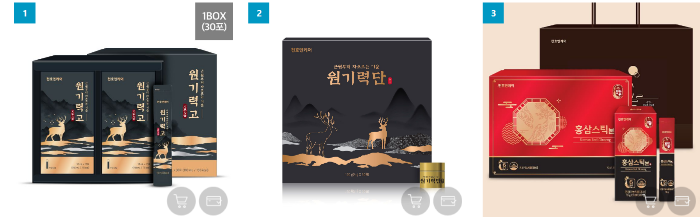

The food and beverage giant is believed as the strongest candidate for the producer of extracts of black goats, black garlic and red ginseng.

Chairman Shin is directly spearheading its bid for Chunho, in a deal estimated at 60 billion to 70 billion won ($45 million-$50 million).

Nongshim, a household name for food and beverages, is among the country’s cash-rich business groups.

Whenever food companies are put on the market, it has been speculated as a potential candidate. But it has never made an acquisition offer, nor sat down at the M&A negotiating table.

Established in 1965, the purchase of a local professional gaming group Team Dynamics marked the only acquisition in its history, which was executed in a proprietary deal in 2020.

However, since the 64-year-old CEO took the helm of the company in mid-2021, it has been diversifying into health products and alternative meats.

Instant noodles made up 79% of its first-half sales of 1.5 trillion won. Its heavy reliance on noodles leaves it highly vulnerable to fluctuations in raw material prices. In the second quarter of this year, it reported a 3 billion won operating loss.

Nongshim commands 56% of South Korea’s instant noodle market as of end-2021. It managed to enter the food supplements market in 2020 but produces them as an original equipment manufacturer.

Chunho Food operates production lines of dietary supplements and sells them directly on its sales platform, which drew Nongshim's interest.

It also exports the supplements under its own brand name to some 10 countries, including the US, China and Australia. Its operating profit came to 1.5 billion won on sales of 42.7 billion won in 2021.

Nongshim’s bid for the dietary supplement company comes as its archrival Lotte Group has been aggressively pushing into various business areas from alternative food to biotechnology, urban air mobility and the senior housing market.

Write to Si-Eun Park at seeker@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Corporate restructuringLotte Confectionery to merge with Lotte Food

Corporate restructuringLotte Confectionery to merge with Lotte FoodMar 24, 2022 (Gmt+09:00)

3 Min read -

Food & BeverageLotte invests in Canada's edible insect food company

Food & BeverageLotte invests in Canada's edible insect food companyMar 11, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsLotte acquires Ministop Korea for $260 mn from Aeon

Mergers & AcquisitionsLotte acquires Ministop Korea for $260 mn from AeonJan 23, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN