PI Advanced, NexFlex draw bids from foreign rivals, PE firms

Two Seoul-based PE firms put their entire stakes in the Korean materials companies up for sale

By May 27, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Two leading South Korean materials companies PI Advanced Materials Co. and NexFlex Co. have drawn final bids mainly from foreign rivals and private equity firms, including Belgium's Solvay S.A. and TPG, by their Friday deadline, according to sources with knowledge of the situation.

Both PI Advanced and NexFlex are expected to be among the country's highest-profile M&A deals in the first half of this year, worth about 1 trillion won ($800 million) and 700 billion won ($560 million), respectively.

Since the majority of the bidders are foreign companies and investment firms, they stand a good chance of winning the race for the two Korean materials producers, investment banking sources said.

PI Advanced, the world’s largest polyimide (PI) film manufacturer, received final bids for its 54% stake from Belgian chemicals giant Solvay S.A., French specialty materials company Arkema, Baring Private Equity and KCC Glass Corp.

KCC Glass is the only domestic contender for the majority stake in PI Advanced. But the glassmaker expressed its determination to acquire the materials company to secure a new growth driver, according to the sources.

Seoul-based Glenwood Private Equity put its entire 54% stake in PI Advanced up for sale, after the company logged its largest-ever earnings last year. Glenwood purchased the stake at 607 billion won in 2020.

PI films are used in flexible printed circuit boards (PCBs) for smartphones, computers and OLED displays. The films are now widely adopted in high-growth areas such as batteries and motors of EVs.

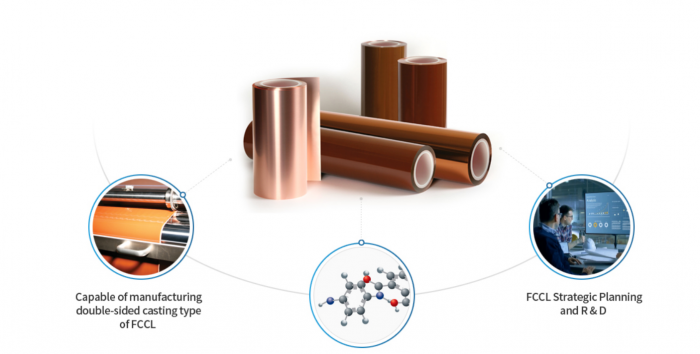

NexFlex, South Korea's largest manufacturer of flexible copper-clad laminates (FCCLs) used for smartphones, has attracted bids from three final candidates, including TPG and an unidentified global materials supplier.

The materials supplier for Samsung Electronics Co. and Apple Inc. has developed its own polyimide films, used for FCCLs and introduced the up-to-date manufacturing process using infrared rays to strengthen FCCLs.

SkyLake Investment Co., another Seoul-based PE firm, has offered to sell its 100% stake in NexFlex. The materials producer was established in 2018, shortly after SkyLake acquired the FCCL business from SK Innovation Co.

The increase in smartphone use and the sophistication of IT gadgets are expected to lead to higher demand for FCCLs.

Meanwhile, Iljin Materials Co., a Korean manufacturer of copper foils used for EV batteries, backed out of making a final offer for NexFlex. It did not participate in the competition for PI Advanced either, as its top shareholder-cum-CEO is understood to have put his entire stake up for sale.

Write to Chae-Yeon Kim at why29@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsCarlyle, Solvay show interest in Korea's PI Advanced

Mergers & AcquisitionsCarlyle, Solvay show interest in Korea's PI AdvancedApr 07, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSmartphone material maker NexFlex draws bidders

Mergers & AcquisitionsSmartphone material maker NexFlex draws biddersApr 01, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsPI Advanced up for sale in deal estimated at $1 bn

Mergers & AcquisitionsPI Advanced up for sale in deal estimated at $1 bnFeb 15, 2022 (Gmt+09:00)

1 Min read