M&As

Affiliates merge to become Kakao Entertainment; aim global

By Jan 25, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s leading mobile app operator Kakao Corp.’s affiliates are set to merge to become a new entity, Kakao Entertainment, heralding the birth of a content platform giant with annual revenue near 1 trillion won ($907.5 million).

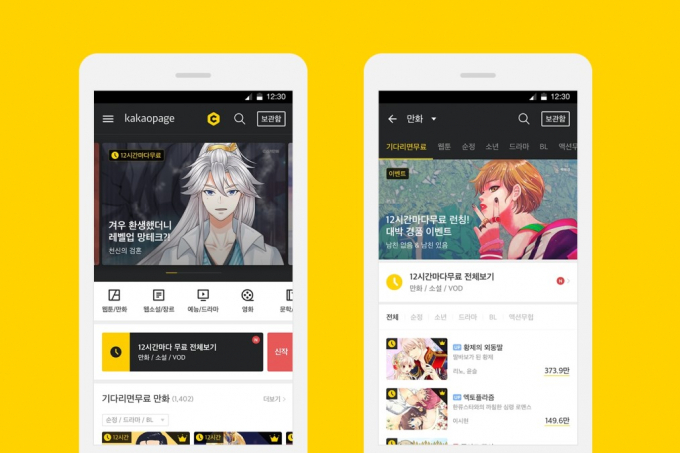

Kakao's entertainment platform Kakao M will merge with Kakao Page, a content platform for webtoons and web novels, the company announced in a regulatory filing on Jan. 25.

The exchange ratio will be 1:1.31 for Kakao Page and Kakao M, respectively, in which 1.31 shares of Kakao Page will be issued for a single share of Kakao M. The enterprise value has been set at 1:0.6 for Kakao Page and Kakao M, respectively.

The two companies will each hold general shareholders' meetings on Jan. 26 for final approval and complete the merger on Mar. 1. The combined revenue of Kakao Page and Kakao M will make it the largest merger of Kakao affiliates.

Kakao Page boasts a robust portfolio of intellectual property rights for almost 8,500 webtoons and web novels, alongside an extensive distribution network. Kakao M is an entertainment platform that manages music labels, singers and actors. It also specializes in content production for mobile, TV and live platforms.

The two companies' synergy is expected to lay the groundwork for the new entity's global expansion. Kakao Entertainment plans to roll out various businesses, including tie-ups between Kakao Page's IP portfolio with Kakao M's artists and production.

Kakao Page has already been ramping up its global content operations, with forays into Japan, Southeast Asia, the US and China.

"We're open to various possibilities as we brainstorm for new collaboration ideas, while still offering existing services such as adapting webtoons and web novel IPs into streaming content," said a Kakao Page official.

KAKAO PAGE IPO LIKELY TO BENEFIT FROM MERGER

The merger is deemed a strategic move to boost Kakao Page's valuation ahead of its planned initial public offering this year.

Last March, Kakao M's enterprise value was estimated to reach around 2 trillion won ($1.8 billion) after securing 209.8 billion won from private equity firm Anchor Equity Partners, which became the company's No. 2 shareholder.

By merging with the entertainment platform, Kakao Page is expected to receive a handsome valuation that is likely to increase by at least 2 trillion won, on top of its own increased revenue.

"Kakao Page has secured a solid ally through this merger, not to mention the expected financial gain," said an IT industry official.

The Kakao Group is expected to lend its full support to Kakao Entertainment, which may include additional investment and new talent hires, given that the merger reflects the will of group Chairman Kim Beom-su, according to a Kakao official.

There is a good possibility that Chairman Kim will be deeply involved in Kakao Entertainment's business based on his connection to the chief executives from both Kakao Page and Kakao M, whom he hired directly.

Write to Min-ki Koo at kook@hankyung.com

Danbee Lee edited this article.

More to Read

-

-

AI technologiesKakao Enterprise exceeds $920 mn in enterprise value

AI technologiesKakao Enterprise exceeds $920 mn in enterprise valueJan 06, 2021 (Gmt+09:00)

1 Min read -

Kakao, NCSoft likely to lead record-breaking earnings in 2021

Kakao, NCSoft likely to lead record-breaking earnings in 2021Jan 03, 2021 (Gmt+09:00)

3 Min read -

-

-

-

WebtoonsKakao webtoon platform Piccoma becomes No.1 grossing app worldwide

WebtoonsKakao webtoon platform Piccoma becomes No.1 grossing app worldwideNov 09, 2020 (Gmt+09:00)

2 Min read -

EarningsKakao’s Q3 sales, operating profit soar on e-commerce, online ad gains

EarningsKakao’s Q3 sales, operating profit soar on e-commerce, online ad gainsNov 05, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN