Billion-dollar deals likely to flood Korea’s M&A market in H2

By Aug 18, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

In a survey of 10 M&A managers of private equity firms (PEFs) and investment banks by the Korean Investors on August 16, all the respondents said that M&A activities would accelerate in the second half of this year, compared to the first half.

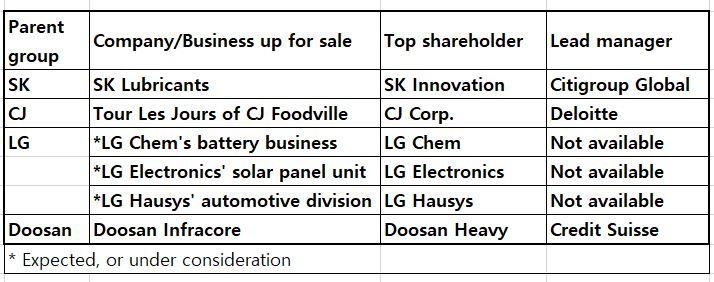

“Because of coronavirus-linked uncertainties, South Korea’s top business groups such as SK, LG, CJ and Lotte took a wait-and-see attitude during the first half,” said a global PEF source. “They will now put non-core assets up for sale in a preemptive action to restructure their businesses. In particular, carve-out deals, or sales of spun-off business units, will increase.”

CJ Foodville Corp., owned by the holding company CJ Corp., is seeking to carve out its bakery chain Tour Les Jour, in a deal estimated to be worth up to 200 billion won ($169 million), according to investment banking sources last week. The prospective sale is aimed at shedding non-core businesses.

Market sources said that LG Chem Ltd., South Korea’s top chemicals company, would hive off its battery business to attract fresh funding. LG Electronics Inc. appears to be considering selling a stake in its solar panel business, while LG Hausys Ltd., a building materials supplier, could sell its automotive materials division.

The LG Group's businesses have been expected to be up for sale as Koo Kwang-mo, the conglomerate’s chairman and CEO, is saddled with heavy taxes after he inherited the shares of his late father in 2018.

Plenty of market liquidity is encouraging Korean conglomerates to divest of non-core assets and push into new businesses such as autonomous driving, renewable energy and information technology.

Dry powder for South Korean buyout deals is estimated to reach 60 trillion won ($51 billion). South Korea-based buyout funds have raised around 22 trillion won ($19 billion) in aggregate, according to Market Insight, a capital market news outlet from the Korea Economic Daily. Global PEFs have secured about 38 trillion won in Asia buyout funds.

“Now, top management of conglomerates, who had previously been difficult to reach by phone, contact us first to offer deals. It is difficult to look at all of the accumulated offers,” said a global PEF source.

Daniel Yoo, a senior partner at Samil PricewaterhouseCoopers' cross-border M&A team, said that M&A transactions have been bouncing back globally since July. He noted that companies were seeking to secure cash to brace for coronavirus-like risk and focus on key businesses.

SK Innovation Co. Ltd. has recently put a stake in SK Lubricants Co. Ltd, a lube base oil supplier, in efforts to seek new funding to expand its rechargeable EV battery business.

"More than 10 large deals worth over 1 trillion won each are likely to hit the market in the coming months," said another investment banking source. This points to the busiest year for the M&A market since the 2008 global financial crisis.

MANUFACTURING, TMT

A rising number of manufacturing companies hit by poor sales in the first half would fall into financial difficulty and enter the M&A market, said Soomin Kim, head of Unison Capital Korea, a middle market-focused private equity firm.

Secondary PEF deals will also continue to rise between new and maturing funds, given that private equity firms may feel it challenging to create synergy from the acquisition of a unit of a conglomerate, he added.

Another global PEF source said his company is focusing on technology, media and telecoms (TMT) deals, in line with the boom in non-contact and online services.

Valuation gaps, however, may remain wide between potential buyers and sellers. The selling side will insist the price tag not reflect first-half results, which they claim were abnormal, while the prospective buyer will want to price in COVID-19 effects in its valuation.

Write to Sang-eun Lucia Lee, Chaeyeon Kim and Ri-ahn Kim at selee@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)