Surging freight rates, bulker shortages squeeze Korean importers

By Jan 21, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Surging sea freight rates, coupled with a shortage of bulk carriers and container ships, are putting South Korean exporters and importers in a bind as a recovering global economy drives up demand for ships worldwide.

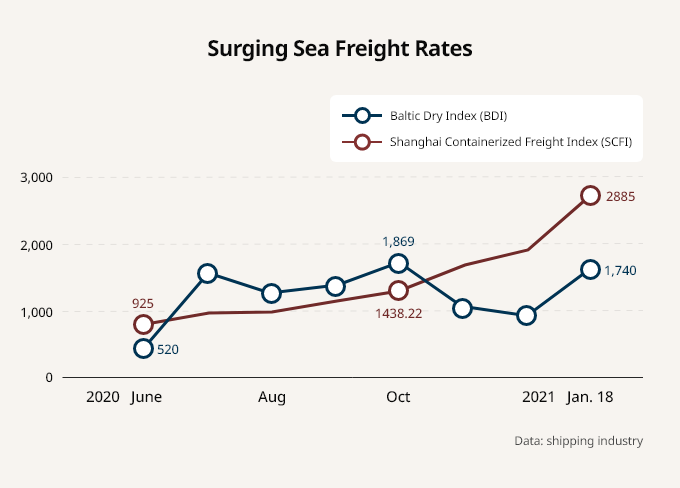

The quick resumption of business activities is sending global shipping costs soaring, with the Baltic Dry Index (BDI) hitting 1,740 as of Jan. 18, up 27% from the start of the year.

Rates for LNG carriers and air freight are also rising. According to global shipping intelligence provider Clarksons Research, LNG ship short-term charter rates are currently at $195,000 a day, up more than sevenfold from about $27,500 in July 2020. For the popular US-Japan and US-Europe routes, rates hover around $300,000.

Increasing bulk carrier rates are owing to the restart of business activities in North America and Europe, but the problem has been aggravated by China’s increasing imports of iron ore and coal to fuel its economic recovery.

The recent sharp gains in bulker carrier rates were partly affected by container freight rates, which started escalating in the second half of 2020 to hit fresh record highs every week since early November. The Shanghai Containerized Freight Index (SCFI) reached an all-time high of 2,885 in the second week of January.

DEMAND OUTPACES CAPACITY

As demand outpaces the capacity of the global shipping industry, Korean companies are paying sharply higher rates and struggling to find container ships and bulk carriers for their goods.

“During the second half of last year, we had difficulty exporting goods amid the lack of container ships. And now, we are struggling to find bulkers to import raw materials,” said a local chemical company official.

The global shortage of container vessels was trigged by China as container ship owners rushed to the Asian country to meet rising demand as Chinese exporters emerged from the COVID-19 impact earlier than their global peers.

Chinese firms snatch up not just container ships but also bulkers and LNG carriers given their need to import raw materials.

According to Bloomberg News, China’s iron ore port stockpiles have dropped to 120 million tons from 130 million tons in December as the country’s steel mills are churning out products.

China’s power plants, largely dependent on coal for electricity generation, have heavily borrowed vessels to import fossil fuels during the cold spell in the winter. They are diversifying the source of imports to Southeast Asian countries, including Indonesia, pushing global shipping costs higher.

They are using bulk carriers under long-term contracts, leaving fewer vessels available in the spot market.

TIGHTER REGULATIONS

Tighter environmental regulations by the International Maritime Organization (IMO) are also posing logistic challenges.

Starting January 2020, the global upper limit on the sulfur content of ships' fuel oil was lowered to 0.50% from 3.50%. Known as "IMO 2020", the reduced limit is mandatory for all ships operating outside certain designated emission control areas.

Shipping companies started installing desulfurization equipment on old vessels but it takes several months to finish the work, prompting companies around the world to compete for cargo ships.

STEELMAKERS, CHEMICAL FIRMS BEAR THE BRUNT

The shortage of vessels amid rising freight rates is hitting steelmakers and petrochemical companies particularly hard.

“The bulker freight rate on the Korea-India route has quadrupled from the second half of last year,” said an official at a Korean steelmaker. “We’re trying to send products in one package if possible to cut shipping costs. Nevertheless, we find it harder to secure ships even at higher rates.”

Smaller exporters and importers are bearing the brunt of the impact, with hefty logistics costs eroding their profit margins.

Lee Suk-woo, chief executive of a local wallpaper fabric maker, said logistics costs now account for 30% of product prices, up from less than 10% six months earlier.

“Sometimes, we lose contracts just because we can’t send goods at the right time. It’s very frustrating,” he said.

Write to Jae-Kwang Ahn and Man-Su Choe at ahnjk@hankyung.com

In-Soo Nam edited this article.

-

Shipping industryFreight crunch pushes S.Korean export firms into crisis

Shipping industryFreight crunch pushes S.Korean export firms into crisisApr 25, 2021 (Gmt+09:00)

3 Min read -

-

Shipbuilding ordersSamsung Heavy sets new global record with $2.5 bn order

Shipbuilding ordersSamsung Heavy sets new global record with $2.5 bn orderMar 26, 2021 (Gmt+09:00)

2 Min read -

LogisticsHyundai Glovis, Changjiu team up to boost China-Europe rail transport

LogisticsHyundai Glovis, Changjiu team up to boost China-Europe rail transportMar 03, 2021 (Gmt+09:00)

1 Min read -

-

Shipbuilding ordersKorean shipbuilders kick off 2021 with $1 bn container ship, LNG carrier orders

Shipbuilding ordersKorean shipbuilders kick off 2021 with $1 bn container ship, LNG carrier ordersJan 05, 2021 (Gmt+09:00)

2 Min read -

M&AsHyundai-Daewoo shipbuilding merger wins China approval, awaiting EU

M&AsHyundai-Daewoo shipbuilding merger wins China approval, awaiting EUDec 28, 2020 (Gmt+09:00)

3 Min read -

Shipbuilding industryS.Korea maintains global lead in shipbuilding industry

Shipbuilding industryS.Korea maintains global lead in shipbuilding industryDec 27, 2020 (Gmt+09:00)

3 Min read -

Shipbuilding outlookKorean shipbuilders sailing toward order target; shares on uptick

Shipbuilding outlookKorean shipbuilders sailing toward order target; shares on uptickDec 22, 2020 (Gmt+09:00)

2 Min read -

Shipbuilding industrySamsung Heavy, Daewoo Shipbuilding fetch over $4 bn in orders

Shipbuilding industrySamsung Heavy, Daewoo Shipbuilding fetch over $4 bn in ordersNov 23, 2020 (Gmt+09:00)

2 Min read