Future Unicorns

Future Unicorns

iCore is a component and module maker in the machine vision industry. It develops technology and manufactures products for imaging-based automatic inspection and analysis. Think of it as an eye that scans for flaws that the human eye cannot notice, thanks to advanced lenses, lighting and more.

- Story

- Data

Machine vision technology for faster, more accurate detection of flaws

A one-stop shop for high-end components and modules

With the rapid sophistication and soaring demand for semiconductor chips, advanced machine vision is becoming increasingly important, particularly in the microchip industry.

The South Korean startup aspires to manufacture the full gamut of components needed in a module, thus making purchasing and customer service easier for end-users. The idea is to beat the industry trend of relying on specific parts from companies that specialize in them.

iCore has five categories of products, namely iPulse, iFocus, iLight, iPlus and iVision.

In an industry dominated by German and Japanese giants, the company hopes to become a dark horse player and go public by 2026.

Contents

-

[How it began] Eye of machine vision

Machine vision startup iCore Co. is not a stereotypical tech startup founded by recent graduates nor is its description peppered with buzzwords like AI and metaverse.

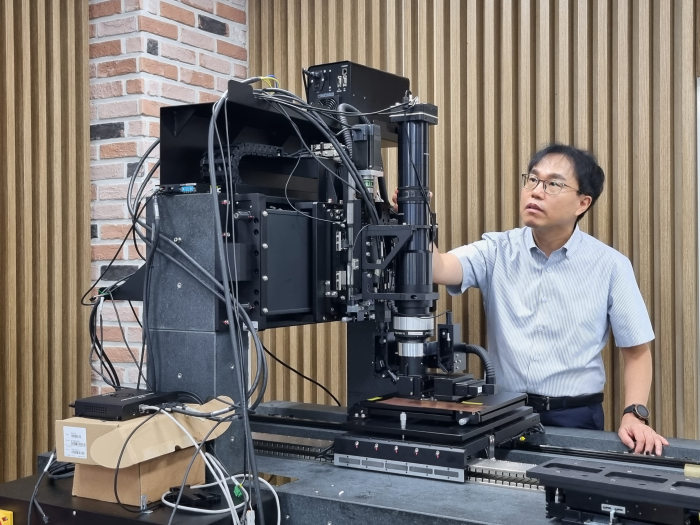

This manufacturer of key components for machine vision is headed by veteran researcher Park Choul-woo, who has more than three decades of experience in mechanical engineering.

“I was taking it easy after leaving Vieworks when two previous co-workers from there approached me asking me to be the CEO of a company they'd recently started,” Park told The Korea Economic Daily. “I declined immediately.”

CEO Park Choul-woo was invited to lead iCore by former colleagues he had worked with at Vieworks

Vieworks Co. is a leading manufacturer of imaging systems and solutions, based in Anyang, South Korea.

Unlike most other startups that began with the idea of serving a market that did not previously exist, iCore, short for “innovation to the core,” was born with the concept of innovating an existing business sector with a high entry barrier.

Machine vision refers to the technology and methods used to provide imaging-based automatic inspection and analysis. Think of it as the eyes that scan for flaws the human eye cannot catch, thanks to advanced lenses, lighting and more.

Few companies dare to enter this sector, deterred by the high level of technological sophistication needed to compete against the industry's existing heavyweights.

Developing new machine vision products is hard and it takes at least two to three years to generate any revenue after successful development. This partly explains why many companies in the industrial materials, parts and equipment sectors are struggling.

But, drawn by the opportunity to work with a team he believed to be the crème de la crème of Korea’s machine vision component manufacturing sector, Park decided to re-enter the race to develop and commercialize a faster, more accurate “eye” to detect and analyze manufacturing flaws.

iCore was founded on March 27, 2019, and Park joined the company two months later. -

[Technological forte] Five main components for machine vision

iCore received an award for its technological advancement at SPLASH 2022, a Korea-based startup event

Advanced machine vision is increasingly important alongside the rapid sophistication and demand for semiconductor chips, as well as other industries that require fine-tuned inspection.

iCore has five categories of products, namely iPulse, iFocus, iLight, iPlus and iVision.

The company has succeeded in developing and commercializing products in the first two categories, strobe controllers and autofocus modules, and is working to commercialize the latter three.

A strobe, or pulsed lighting, controller enables high-speed current control of lighting in different modes, while the autofocus module uses the principles of triangulation.

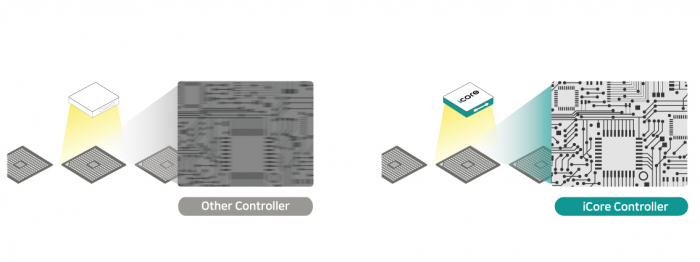

What matters most in imaging-based automatic inspection is the speed at which lighting can be turned on and off. The high-speed format is called multi-strobing, also known as flying, named after the style in which the lights flash.

iCore claims to have developed the world’s first high-efficiency power circuit that generates ultra-precise current pulses of less than 0.5㎲ even under conditions of 200A or higher.

The autofocus module dubbed iFocus is the field programmable gate array (FPGA)-based real-time autofocus model using the principle of optical trigonometry.

It is applied to the automatic optical inspection (AOI) of a high magnification optical system, which measures the target object’s position in real-time and sets the optical image to quickly detect defects of 1μm or smaller in semiconductor and display inspection.

The lighting component is also on its way to becoming commercialized.

The company aims for iLight to compete against industry heavyweight Sugawara’s Xenon lamp, which uses gas.

Unlike the Xenon lamp, the iLight takes a hybrid approach of combining laser and LED technology to provide 10,000 hours of light with no fluctuation in brightness.

-

[Positioning and value proposition] One-stop shop for middle- to high-end components

In an industry dominated by Western and Japanese makers such as Britain's Gardasoft Vision Ltd., the US’s Cognex Corp., Germany’s Physik Instrumente, and Japan’s Mitutoyo, the startup founders wanted to position the budding firm as a high-end maker rather than aiming for economies of scale.

From the get-go, founders Park Kyoung-seok and Park Do-hyun did not even entertain the idea of pinching pennies by developing and manufacturing low-end products.

Instead, the team focuses on pushing out key components that are more compact and durable than existing machine vision products.

Perhaps owing to this strategy that focuses on quality over quantity, the company received orders from an OLED inspection machine maker that supplies to Samsung Display Co. in 2020, less than a year after its inception, and LG PRI, which supplies to LG Display, earlier this year.

The Taiwan Semiconductor Manufacturing Company (TSMC) Ltd. is currently conducting a proof-of-concept (PoC) on an iCore product.

Ultimately, iCore plans to offer the full gamut of key components involved in the machine vision sector.

A challenge for the sector is that because manufacturing requires a high level of sophistication, companies tend to focus on developing products they are familiar with rather than developing and providing a wide range of products.

This becomes an issue when there is a problem with a piece of machinery and the client cannot figure out which component is wreaking havoc.

“Earlier this month, a client based in Hanoi, Vietnam, was having trouble with a piece of machinery and even though the issue turned out to be unrelated to our product, we flew our technicians over there to fix it,” Park explained, adding that he forecasts more clients requesting such technological assistance down the line.

The team is confident that when it can complete the five-category lineup that encompasses all of the key components of machine vision, clients will save a lot of time and energy from having different parts manufacturers playing blame games on each other when there is a need to fix machinery — as most of the components will be made by iCore.

iCore manages four main product lines -

[Revenue model] B2B and direct sales, price point

iCore has two sales routes, one for business-to-business (B2B) and direct sales, and another for going through local distributors.

As a key component and module maker, the startup receives orders from machinery makers who deliver the finished machinery to the end user.

Oftentimes, the clients request customization for their specific machinery.

“There was an order for a top-of-the-line strobe controller two years ago, where the client requested the finished products in just two months,” Park said.

The CEO said that clients placing orders even before the product's development is a testament to the startup’s solid quality.

While the B2B and customized model works well domestically, the company is looking to expand its network of partners for overseas sales.

When the sales process goes through a distributor abroad, the product will be a commercial product rather than a customized one. The distributor will also provide technical support on behalf of iCore.

There are two distributors in Korea and one each in China, Taiwan, and Singapore. By year’s end, iCore plans to have distributors in Japan and Germany as well.

Presently, the revenue from direct sales and overseas sales accounts are more or less equally split.

But as iCore strengthens its foothold in the overseas market, the ratio of revenue coming from commercial sales abroad will trump that of customized domestic sales.

The company's revenue has doubled annually.

Its operating revenue reached 600 million won ($418,483) in 2020, nearly doubled to 1 billion won ($697,277) in 2021, and is poised to hover above 2 billion won ($1,464,281) this year.

While R&D, production, and PoC can take time in the manufacturing sector, Director of Strategy William Ju said that the system of immediate payment is a plus.

iCore requires 100% upfront payment for overseas orders and full payment within two months for direct sales and sales to machinery makers in Korea.

The materials cost is only a fraction of the company’s production costs.

Let’s take a look at how the bigger players are faring in terms of profitability.

Osaka-based Keyence Corp. raked in $4.9 billion in sales revenue last year while Massachusetts-based Cognex Corp. notched $1 billion. This year’s profit margin for Keyence is 40.6% while that of Cognex is 23.8%.

iCore is aiming for a 30% profit margin.

Thanks to the founders' expansive network of clients prior to launching iCore, the startup ventured abroad, first to mainland China, the same year it was founded.

The most expensive commercial product they have available now is the autofocus module. Including the strobe lighting, iCore products range in price from $1,000 to $20,000. -

[Scalability] Local distributors

Recognizing the importance of exploring the market beyond Korea, iCore is working on expanding its presence abroad.

It currently has 14 employees, with two partners in Korea and three in China and Southeast Asia combined.

The goal is to find new partners in Germany during VISION 2022, the world's leading machine vision trade fair, held for three days from October 4 in Stuttgart.

The machine vision market is projected to grow to reach $18.2 billion, and the figure for Korea is expected to hover around 2 trillion won ($1.4 billion).

But out of the entire machine vision ecosystem, iCore is focusing on the high-performance inspection system market, which is forecast to grow to $2.2 billion, with the number for Korea alone at about 520 billion won ($365.8 million).

The demand for sophisticated vision machines is especially high in display-making, agricultural inspection detection drones and pharmaceuticals.

ICore's three regional partners are located in China, Taiwan and Singapore -

[Team building] Making mechanical engineering attractive to young people

Two former colleagues of Vieworks Co. founded iCore in March 2019.

Electrical engineer Park Do-hyun, who specializes in high-resolution sensor and camera development, and computer science major-turned-sales director Park Kyung-seok joined forces to launch it.

Vieworks is a leading manufacturer of imaging systems and solutions, offering X-ray detectors and image processing technologies for medical use, industrial inspection instruments and other applications.

The company was founded as Raysis Co. in 1999 and is also based in Anyang, where iCore's headquarters is also located.

iCore hopes to recruit more early- to mid-career engineers who are interested in electronics engineering

There are currently six core members, including the CEO and other directors, all in their 40s and 50s.

CEO Park is a two-time winner (2003 and 2016) of the IR52 Jang Young-sil Award, a prestigious honor named after a Joseon Dynasty scientist and inventor who served King Sejong. Co-founder Park Do-hyun also received the award in 2016.

In addition to the core members, several new employees, all in their 20s and 30s, have joined the company since its founding.

The younger employees are office managers and engineers.

-

[Challenge] Human resources, supply bottleneck, and branding

Human resources is one of the three main challenges faced by iCore.

“Because it is not run-of-the-mill type manufacturing, we have difficulties recruiting engineers with the certain skillset level we are looking for,” CEO Park said.

With a sigh and a smile, the mechanical engineer by training said that many engineers are now into software engineering, especially in the fields of artificial intelligence, as opposed to hardware.

Park explained that a major incentive for fundraising is to be able to pay workers well in order to retain them.

iCore has an AI engineer working on deep-learning algorithms for developing its industrial smart camera but it still needs to hire entry- and mid-level mechanical engineers.

The difficulty of recruiting and retaining skilled engineers is an industry-wide issue across borders.

iCore plans to focus on its technological sophistication to break into the machine vision sector, notorious for its high barrier to entry

The second challenge is also a worldwide issue affecting many industries — the supply bottleneck.

Part of the fundraising will be for placing bulk orders on necessary parts for key components so that the company will not have issues of missing or having to delay order deadlines to wait for certain parts.

“It’s not that the parts cost a lot but even 50-cent parts, if they are missing, force us to have to wait or look for an alternative, which delays our production time,” explained Park, adding that the fresh injection of funds will allow for more stockpiling.

A parts shortage can delay production by up to a year and a half.

Unfortunately, nationalism also peeks its head into business in times of difficulty such as supply shortages.

For example, if the parts are made in China and most companies around the globe are seeking those parts, Beijing could incentivize the parts makers to prioritize supplying the desired products to Chinese parts manufacturers over those in other countries.

Park added that 'Made in Korea' products still do not enjoy the same status as those made in Germany or Japan in Asia, and that’s something to be overcome through a distinct competitive edge in quality and technological advancements. -

[Funding] Aiming for IPO by 2026

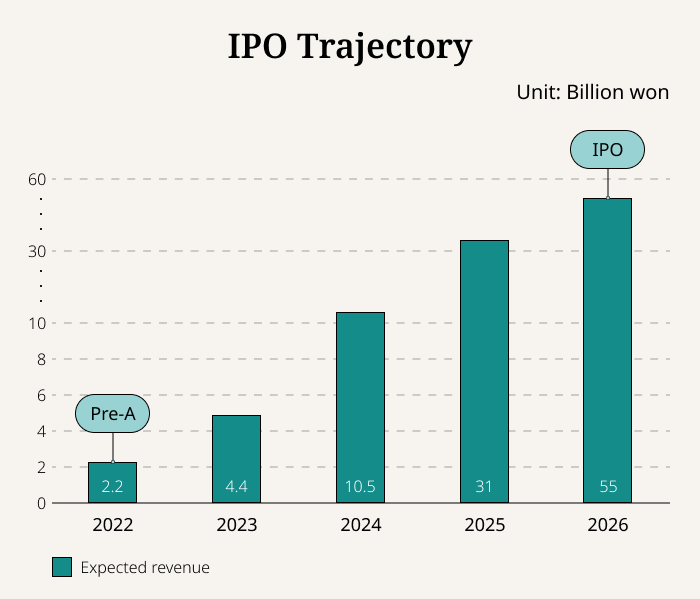

Postech (Pohang University of Science and Technology) Holdings was was the first company to inject capital into iCore: 5.5 billion won ($3.8 million) in August 2020.

The Korea Credit Guarantee Fund was the second and the most recent investor, contributing 5 billion won in January 2022.

While the company was initially preparing for a pre-A fundraising round later this year, it is now leaning toward delaying it to next year, given the doubling sales revenue trend each year.

The company is currently valued at $20 million to $25 million.

iCore's initial public offering is slated for 2026 on the Kosdaq.

By Jee Abbey Lee (jal@hankyung.com)