Future Unicorns

Future Unicorns

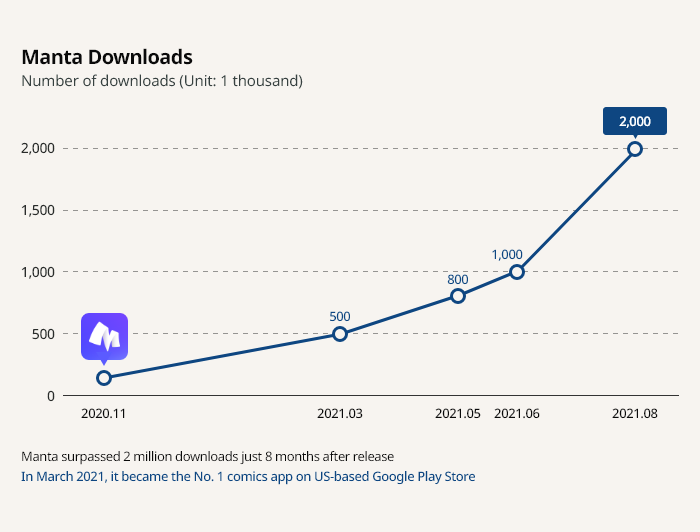

RIDI is a comprehensive content platform, offering e-books, webtoons, web novels and animation based on its rich intellectual property portfolio. The company boasts over 230,000 types of content materials from over 111,000 creators. RIDI is credited with having pioneered the e-book scene in South Korea. Following its success as an e-book giant, the company has continued to branch out its content IP business by acquiring content companies and launching a global webtoon service, Manta. In August 2021, Manta topped over 2 million downloads just 8 months after its release and became the No. 1 comics app on Google Play Store. So far, the company has raised over 70 billion won.

- Story

- Data

Korea's Kindle evolves into a content IP provider

Encompassing e-books, web novels, webtoons and more

Until 2017, RIDI Corp. was often referred to as Korea’s Kindle. Founded in 2008, the company pioneered the country’s e-book market, holding the No. 1 position even as competitors entered the segment. In 2018, after enjoying a decade of great success as an e-book platform, RIDI introduced a new service on its platform – web novels.

RIDI created original web novels in collaboration with authors who had already worked with the company. Instead of releasing the original content as complete e-books, RIDI opted for an episode format: a new episode would be uploaded every week. The company also adopted a mobile-exclusive format and structured web novel plots that moved at a faster pace, which were a huge hit. In the first half of 2018, RIDI’s numbers of new subscribers jumped by 195% compared to the year-earlier period.

Industry watchers were floored by RIDI’s transformation. But it was the expected course of events for Bae Ki-sik, the founder and chief executive of RIDI. From the very beginning, Bae had envisioned building a global content company backed by a rich intellectual property portfolio of content, rather than an e-book company.

And web novels only marked the beginning of Bae’s plan to expand the IP business. In 2020, while kicking off its global expansion plans, RIDI also forayed into the webtoon market.

“This is only the beginning of RIDI’s growth story,” said Bae.

Contents

-

[Market Trailblazer] Pioneering the domestic e-book market

After establishing RIDI in 2008, Bae was a bit anxious to stake a strong claim in the content market because Apple had just introduced the iPhone to the world and he had a strong hunch it was the dawning of a new mobile era. Bae had just recently left Samsung Electronics Co.’s venture investment team and was determined to be a first mover in the emerging industry.

Confident that the content market would experience vast growth amid the mobile era, Bae decided to launch a content business. He believed that he could foster a strong content business as long as he could secure valuable IPs.

RIDI’s first undertaking in the content market was comic books, but scanning printed comics and uploading them for mobile viewing was challenging due to their poor readability after scanning. The company had to either re-create all of the comics or produce new material. RIDI ended up hiring dozens of comic artists and produced over 100 webtoons.

However, at the same time smartphones were becoming widespread globally while RIDI wasn’t keeping up in accumulating content IPs.

In a move to secure an early lead in the market, Bae switched direction and focused on books. Unlike comics that involved drawings, books only required the text to be digitalized for mobile viewing. Also, the comics segment was already dominated by portal giants such as Naver Corp. and Kakao Corp. whereas the e-book sector had few, if any, rivals.

Securing book IPs wasn’t an easy task either. An e-book market didn’t exist at the time and publishers weren’t convinced by RIDI’s e-book idea, expressing doubt that anyone would actually read them. Bae made dozens of calls and sent countless emails only to hear back from just a couple of publishers. But he pressed on.

“I would visit publishers during the day and develop the service at night with our developers. That was my life at the time,” said Bae.

Fortunately, Bae’s efforts paid off. By 2011, he had secured contracts with around 200 publishers, fueling the company’s explosive growth.

CEO Bae Ki-sik

From early 2010, tablet PCs’ popularity was on the rise, which led to surging demand for e-books. The initial smartphones were relatively small, making it difficult to read e-books via mobile phone screens whereas tablet PC screens were larger than actual books and offered enhanced readability. In the meantime, the size of iPhone screens was also increasing with their follow-up series, improving readability on mobile phones.

In February 2012, RIDI saw the number of its subscribers surge by 578% compared to the year-earlier period.

“RIDI’s growth in 2012 made all of our efforts worthwhile. Our IP library, which we built up ahead of the e-book boom served as a strong foundation to provide an extensive e-book portfolio,” said Bae. -

[Competitive Edge] Data and software bring home a win

Following RIDI’s success, Korea’s major chain bookstores Kyobo Book Centre, Young Poong Book Store, Bandi & Lunis – similar to the US-based Barnes & Noble -- as well as online bookstores Yes24 and Aladdin Communications began to tap into the e-book market.

Immediately, the e-book industry became a red ocean market and RIDI saw the need to create an entry barrier that would be second to none – by making use of software and data. RIDI embarked on a tremendous push into software development and app feature upgrades.

“Our app was becoming faster and more innovative than our competitors, who received complaints from users due to slow speed and service errors,” Bae said.

RIDI also concentrated on beefing up its data portfolio. The company had been operating e-book services since end of the 2000s, meaning that it had accumulated a vast pool of user data, such as what type of people prefer certain genres as well as how much time they spend reading specific content. This gave RIDI a competitive edge because companies that sold printed books couldn’t acquire the same level of data.

Through this data portfolio, RIDI was able to advance its services to more precisely predict demand, secure IPs, plan promotions and map performance.

RIDI maximized the benefits of its data-rich resources by operating its team in a data-friendly manner. For example, the company offers educational programs across all divisions to boost employees’ data science capabilities. Moreover, the company doesn’t have a separate data science team, but rather a data analyst in each division to provide support for data-related tasks.

RIDI’s efforts have borne fruit, as it remains the unrivaled No. 1 e-book player in Korea with around a 50% market share while its rivals each hold around a 10% market share.

“We already have a strong lead in the e-book segment and we expect the gap to further widen thanks to our extensive data portfolio,” said Bae, adding that there will also be a noticeable gap in the quality of services. -

[Scalability] Going beyond e-books and transcending into IP business

Since 2018, RIDI has been expanding its content categories, going beyond its status as an e-book giant and venturing into other segments such as web novels, which tied in with the company’s existing operations.

Riding on its success from web novels, RIDI has evolved into a comprehensive IP content company under the principle of “one source, multiuse,” thereby reworking its e-book and web novel IPs to create webtoons, animated content and videos.

According to Bae, the IP business market is still in its early stages with immense potential, which is why many content companies are flocking to the IP scene. In 2020 Naver webtoon-based drama “Sweet Home” was adapted into a Netflix series and became the most-watched show across eight nations including South Korea, Malaysia, Singapore and Taiwan. Also, the Kakao Page IP-based movie “Space Sweepers” became the No. 1 film on Netflix upon its release. -

[Scalability 2] Going global with webtoon platform

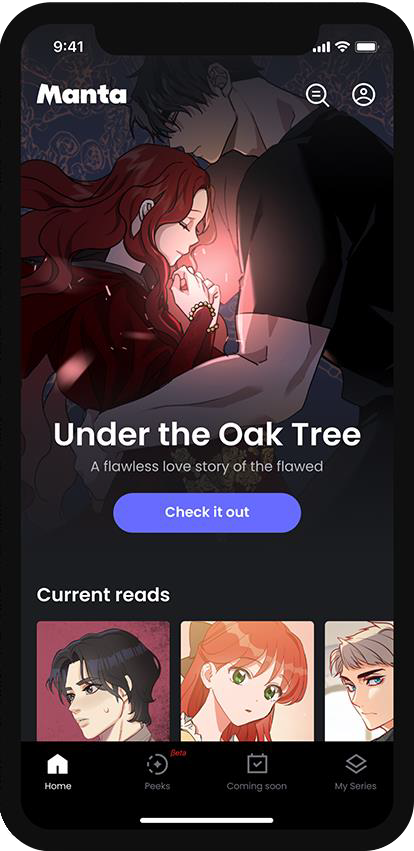

Global webtoon app, Manta

RIDI has been branching out its services into the global market while broadening its offering of IP-based content materials. At the end of 2020, RIDI rolled out a global webtoon platform, Manta, to ride on the worldwide webtoon hype brought on by the COVID-19 crisis, which triggered high demand for content due to the extended social distancing and contactless environment.

In the past, RIDI had logged some overseas revenue, mostly owing to Korean residents who were either studying or living abroad. The launch of Manta, positioned as a global platform, marked the official start of RIDI’s global ventures.

Manta experienced immediate success upon its release, emerging as the No. 1 app on Google Play Store’s comics category in 15 countries including the US, Singapore, Portugal, Canada, Sweden, Belgium and China.

Graphics by Jerry Lee

“Manta’s user acquisition speed is about 16 to 17 times faster than RIDI’s e-book service, growing at a pace that we’ve not experienced over the past 12 years,” said Bae, adding that RIDI’s content portfolio, rich in both quantity and quality, is the driving force behind Manta’s success.

In fact, Manta has been receiving positive feedback for its quality. As of August 2021, Manta’s average rating on Google Play Store and Apple’s App Store stood at 4.55 and 4.77, respectively.

As RIDI continues to increase its global footprint, the company has also been ramping up the hiring of international talent. The company’s team comes from various backgrounds, made up of global employees from eight countries including South Korea, Taiwan, Spain, New Zealand and the US.

Going forward, RIDI will have to go up against large domestic content companies such as Naver and Kakao, which run the same business model. But the IP market, including webtoons, is destined to become a massive industry and the content sector is unique in the sense that market share is divided among companies that have winning content. And RIDI is positive that it can secure a loyal audience pool thanks to its original webtoons based on exclusive IPs.

“The thing about webtoon platforms is that there’s low loyalty among readers. Content materials have far-reaching influence and readers will choose a platform based on the content – not vice versa,” Bae said, explaining that this is different from other sectors such as shopping platforms or search engine platforms where there are high entry barriers for latecomers.

According to Bae, both a coexistence between platforms as well as a dominant player being overturned are possible scenarios in this rapidly growing market. -

[Revenue Model] Securing loyal users willing to pay for high-quality content

From RIDI’s early days, CEO Bae stressed the principle of creating content that people would pay for. He wasn’t keen on using advertisements as a revenue model to provide free content since it would dampen the user experience with their mobile screens bombarded with ads.

Instead, Bae believed in a virtuous cycle, where providing high-quality content would lead to a positive user experience, thereby driving platform inflow. CEO Bae’s strategy was very different from other platforms that chose to offer free content to boost traffic instead of concentrating on profit.

RIDI’s push for paid content may have made it difficult to attract users in the beginning, but Bae was adamant on offering a consistent user experience without any interruptions or distractions. And just as Bae predicted, RIDI began to acquire loyal users who did not hesitate to pay for good content, and the company’s revenue soon began to increase steadily.

Graphics by Jerry Lee

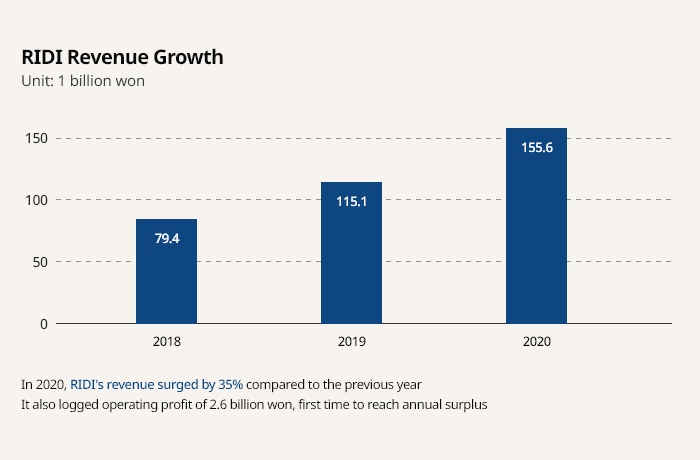

In 2010, RIDI’s sales hovered around 200 million won ($172,930), which rose to 153.7 billion won in just a decade. Although it may not appear as a dramatic growth curve, the company has logged consecutive growth for 43 straight quarters thanks to readers who willingly pay for content.

“My goal was to create a consistent business, which made it essential to offer high-quality content that would secure loyal readers,” said Bae, explaining that it was how RIDI built the foundation to continues its business.

RIDI’s philosophy of building loyal readership was also applied to its webtoon platform Manta by adopting a subscription-based business model, unlike other webtoon platforms where banner ads or single episode purchases accounted for a significant portion of their revenue models.

Also, the e-book giant was able to venture into the webtoon market despite facing bigger rivals such as Naver and Kakao because content readers tend not to be loyal to platforms, but rather to content quality — and RIDI saw this as an opportunity to win over users with consistently great quality. -

[Team Building] Rewarding top talents with competitive packages

Since the beginning of this year, major game companies such as Nexon, NCSoft and Netmarble have been upping their salaries for developers to attract top industry talent. Bae joined the fierce battle to secure seasoned developers by offering competitive packages – seen as an unusual move since RIDI is an e-book company -- but also a testament to how important data and software is to the company’s growth.

Earlier in March, RIDI increased the base salary for developers and proposed a 50 million won incentive for senior-level developers and project managers that transferred over to the company.

According to Bae, he didn’t want to lose talented employees over money or make future-based promises so he decided to offer competitive packages just like other large business groups.

“It wasn’t about recruiting skilled employees who were chasing money, but more about hiring strong talent who then wouldn’t need to worry about money,” Bae said. -

[Funding] Long-lasting investment partnerships

Consistency is RIDI’s key trait and it is demonstrated in the way the company fosters relationships with its investors. For example, Mirae Asset Venture Investment first invested in the e-book company in 2011. Since then, the investment firm has made a total of five investments into RIDI, which now accounts for a significant portion of Mirae Asset Venture Investment’s portfolio.

In 2013, Atinum Investment invested in RIDI via Series B funding round but ended up selling off its shareholdings due to the expiry of the fund. But a year later, Atinum made a larger investment into RIDI and now stands as the company’s second-biggest shareholder, having invested six times in total.

Meanwhile, Company K Partners, which first invested in RIDI in 2014 has invested five times in total without yet selling a single share in the company.

“We engage in a lot of conversations with investors who relate to our business and mission instead of just talking about numbers and performances. We also reach out to the company’s management team, which creates a bond that helps maintain a long-term partnership,” Bae said.

Recently RIDI has been actively seeking overseas investors as it plans to expand its global footprint. Aside from Manta, RIDI is looking to provide IPs to over-the-top (OTT) platforms such as Netflix and Disney Plus and in order to facilitate these plans, the company needs to set up overseas offices and establish business networks abroad.

The company is also pursuing an initial public offering, although it’s not a priority at the moment. RIDI swung to a profit last year and the company’s webtoon unit Manta has been performing well. There’s still ample funding so there’s no financial pressure to rush into an IPO. If anything, the company is looking to boost its valuation before kicking off the IPO process. -

By Min-ki Koo; Edited by Danbee Lee (kook@hankyung.com)