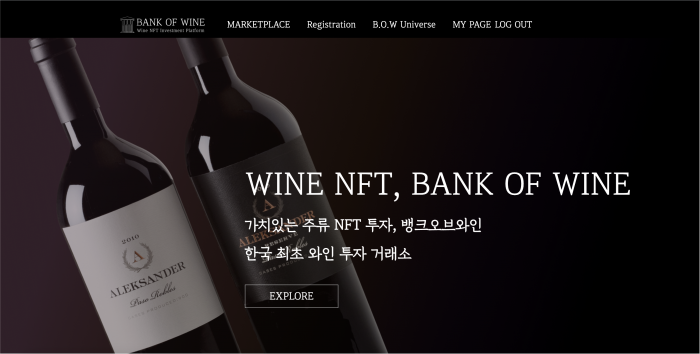

Bank of Wine: High-end wine investment in the form of digital assets

Demand for luxury wine in South Korea surged 700% on-year in 2021

By Mar 03, 2022 (Gmt+09:00)

Samsung shifts to emergency mode with 6-day work week for executives

CJ CheilJedang to sell feed, livestock unit for $1.4 bn

Samsung Electronics' key M&A man returns; big deals in the offing

Affinity to buy SK Rent-a-Car at $572 mn, more deals expected

Keppel REIT to sell Seoul-based prime office T Tower

South Korea is the worldŌĆÖs second-most attractive wine market, outranked by only the United States, according to London-based consumer research center Wine Intelligence Ltd.

In 2020, the country rose eight places to take second place and maintained the ranking in last year's Global Compass 2021 Report, an annual study that measures key economic and market factors to rank the beverage's attractiveness in 50 focus countries.

While US wine market growth has slowed in recent years, South KoreaŌĆÖs has grown 30% on-year in 2021. Experts say the stay-at-home measures during the pandemic have encouraged people to purchase higher-end alcoholic beverages to drink at home to compensate for not being able to dine out.┬Ā

Last week, startup accelerator D.Camp held its monthly demo event in the heart of Seoul. Out of the five startups that pitched their ideas to the venture capitalists, Bank of Wine won first place.┬Ā

Representatives from South KoreaŌĆÖs VC heavyweights and government officials were in attendance, including Financial Services CommissionŌĆÖs deputy director of financial innovation bureau Kim Min-ha.┬Ā

The VC bureau chiefs of banking institutions such as Hana Ventures, NH Digital Challenge+, KB Investment, and Fintech Center Korea also participated as judges.

REDEEMABLE COINS

Park Sang-wook is the founder and CEO of Blinkers, which operates Bank of Wine.

The 28 year-old studied data science for his master's at the Korea Advanced Institute of Science and Technology (KAIST.) Including Park, all nine members of the team are either graduates of KAIST or the Ulsan National Institute of Science and Technology (UNIST.)

Park is also a sommelier trained in the United Kingdom and wanted to continue sharing his passion in South Korea.┬Ā

The problem was, purchasing alcoholic beverages online or reselling them as an individual are not allowed in the country.

Bank of Wine aims to make access to wine easier by minting and issuing non-fungible tokens (NFTs) dubbed NFTCon ŌĆō benchmarking the uber-popular gifting options within the KakaoTalk messenger app Gifticon.┬Ā

A user can purchase and trade the wine token on the exchange platform in real time. When the user wants to receive the wine in person, he or she can redeem the wine with the NFTCon.┬Ā

In other words, the user will exchange the NFTCon with a new token, which will encompass information about the specific wine. If you are a sommelier or an industry insider, your experience on the blockchain can serve as a type of connoisseur commodity.┬Ā

Because a digital token is not an alcoholic beverage itself, the NFT can be traded online. Also, since the NFT can be redeemed for an actual bottle of wine at stores, it is not limited by the ban on the sale of alcoholic beverages online.┬Ā

But what about the legalities concerning digital assets?

ŌĆ£The NFTs minted and issued by Bank of Wine take the nature of a security for the right to claim delivery of a physical bottle of wine and thus not incur any violations to the South Korea law,ŌĆØ Park explained.

MARKET POTENTIAL

Inspired by the US liquor NFT platform BlockBar, the Bank of Wine team is confident that their product will be even more successful thanks to the rapidly expanding domestic wine market.

In 2020, the countryŌĆÖs wine market size was 1.23 trillion won ($1 billion) according to Korea Customs Service data. This was the first time ever the Korean wine market size has exceeded 1 trillion won.┬Ā

In particular, demand for very high-end wines, meaning bottles priced above 500,000 won ($414,) surged 700% on-year in 2021.

While the rising demand for luxury wine is especially pronounced on the peninsula, it reflects a worldwide trend among high net worth investors.┬Ā

As of 2020, ultra-high-net-worth investors, or those with a net worth of at least $30 million, had half of their assets in alternative investments, which include watches, diamonds, and rare alcoholic beverages, according to a report that year by Virginia-based financial advice company The Motley Fool. Among beverages, whiskey and wine were the investors' favorites.

Investors with over $1 billion in assets have more than half of their assets in alternative investments. That is because vintage wine purchased and sold two to three years later brings in three to four times more revenue on average.

While the growing appetite for luxury wine will likely continue, especially in South Korea, industry insiders say the changing regulations surrounding digital assets could negatively affect the NFT market down the road.┬Ā

The Bank of Wine platform is scheduled to launch on April 30.

Write to Jee Abbey Lee at jal@hankyung.com

-

Chief ExecutivesKurly CEO Sophie Kim on the road less traveled┬Ā

Chief ExecutivesKurly CEO Sophie Kim on the road less traveled┬ĀJan 19, 2022 (Gmt+09:00)

6 Min read -

Food & BeverageKoreaŌĆÖs F&B exports to surpass $4.5 billion in 2021

Food & BeverageKoreaŌĆÖs F&B exports to surpass $4.5 billion in 2021Jun 14, 2021 (Gmt+09:00)

2 Min read -