Korean stock market

Hyundai Department stocks down on cheap dividend policy

Hyundai Department Group companies announced mid- to long-term dividend payout plans to level up stocks

By Feb 08, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Hyundai Department Store Group, a South Korean major retail conglomerate, has unveiled the group companies’ dividend payout plans for the mid to long term to improve their stock value, but investors scoffed at them.

The group announced on Thursday that its listed affiliates introduced their new minimum dividend payout plans for the 2024-2026 period as well as share retirement policies.

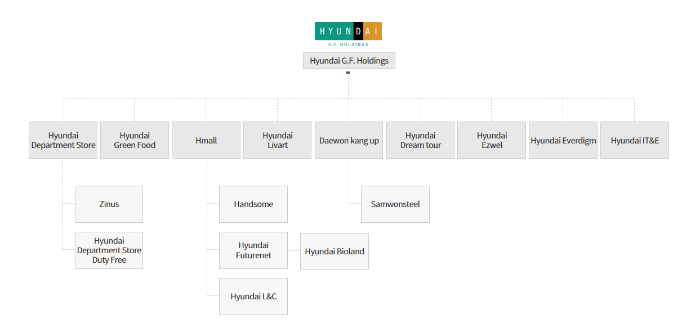

The new plan comes two months after the group was transformed into a single holding company Hyundai GF Holdings Co. in November, controlling 25 affiliates, which include nine Kospi-listed units, three Kosdaq-listed firms and 13 unlisted companies in the retail, food, healthcare, lifestyle and information technology sectors.

Korea’s major department store operator Hyundai Department Store Co. has set its minimum dividend payment for the 2024-2026 period at 1,300 won ($1) per share versus the previous 1,000 won.

Hyundai Home Shopping Network Corp. will pay at least 2,500 won per share in dividends over the same period, while Hyundai Green Food Co. and Hyundai GF Holdings’ minimum dividend payment is set at 325 won and 150 won under their dividend payout plans announced in January last year.

Handsome Corp., Hyundai Livart Furniture Co., Hyundai Ezwel Co., Daewon Kangup Co. and Hyundai Everdigm Corp. also announced their mid and long-term dividend payout plans for the first time.

However, their shareholder-friendly policies were deemed unfriendly as investors unloaded most of their shares after the announcement.

Hyundai GF Holdings stock fell 6% to end at 4,965 won on Thursday, while Hyundai Department Store and Hyundai Green Food lost 4.1% to 56,700 won and 7.6% to 11,650 won, respectively.

Hyundai Home Shopping and Handsome stocks also closed down 1% and 2.8% at 46,450 won and 20,950 won, respectively.

Other Hyundai Department Store Group’s listed affiliates underperformed the broad Kospi market, which added 0.4% on the same day.

VALUE-UP PROGRAM

The group’s official said the companies have come up with their new dividend payout plans in response to the growing call to upgrade the value of a corporation with a low price-to-book value ratio (PBR) and to enhance the shareholder-friendly policy and corporate value.

PBR is one of the metrics investors use in deciding whether to buy a stock. A PBR below 1 suggests that the firm’s stock is undervalued or cheap to buy.

The Korean government recently unveiled a “value-up” program designed to bolster underperformers in the local stock market.

More than 500 Korean stocks’ PBR has remained below 1 for a decade, and many of them are in the finance, automotive and retail sectors. Following the government’s announcement of the program, those stocks have attracted capital from investors.

“Considering that Hyundai Department Store stock has recently climbed on its low PBR and expectations for the company’s better shareholder-friendly policy, it (the new dividend policy) falls short (of expectations),” said Joo Young-hoon, an analyst at NH Investment & Securities Co.

But he pins hope on an improvement in the company’s PBR as the company said it would reflect changes in its business circumstances when deciding annual dividends later.

The analyst also noted that the dividend rate is the minimum rate, meaning that it could rise depending on earnings results.

“We plan to take diverse opinions in the market to introduce more enhanced shareholder-friendly policy,” said an official of Hyundai GF Holdings.

A Hyundai Department store official also projected the company’s dividend payments for this year would increase from last year’s thanks to the new dividend policy although it hinges on affiliates’ earnings results.

Hyundai Department Store Group companies paid 166.9 billion won dividends in total in 2023, up 16.4% from 2022.

Hyundai GF Holdings also canceled all of its treasure shares, 4% of the company’s total issued shares, in December.

Write to Ji-Yoon Yang at yang@hankyung.com

Sookyung Seo edited this article.

More to Read

-

RetailNewJeans selected as models for Hyundai Dept. Store Duty Free

RetailNewJeans selected as models for Hyundai Dept. Store Duty FreeAug 14, 2023 (Gmt+09:00)

1 Min read -

Shareholder activismKorea’s Hyundai Dept. Store drops holding company plan

Shareholder activismKorea’s Hyundai Dept. Store drops holding company planFeb 10, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsHyundai Dept. Store to buy Zinus for $735 mn

Mergers & AcquisitionsHyundai Dept. Store to buy Zinus for $735 mnMar 22, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN