Korean stock market

Global X to liquidate China-exposed ETFs on poor returns

Mirae Asset’s EFT provider will cease the trading of badly performing 19 ETFs, 11 of which are exposed to Chinese stocks

By Jan 23, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Global X ETFs, the New York-based provider of exchange-traded funds, will liquidate 19 ETFs, including 11 China-exposed funds, next month to stop the bleeding amid no sign of an imminent recovery in the Chinese economy.

The ETF provider under South Korea-based Mirae Asset Global Investments Co. announced in a news release on Friday last week that it will dissolve 19 ETFs trading in the US stock market “in the best interests of the funds and their shareholders.”

Their trading will be terminated at the end of the trading day on Feb. 16, and the funds are expected to liquidate on or around Feb. 23, according to the statement.

The funds’ shareholders are advised to either sell their holdings before the last trading day or receive a cash distribution equal to the net asset value of their shares as of the liquidation date, the company said.

Of the 19 ETFs due to leave the market, 11 funds are exposed to Chinese companies in a wide array of sectors, encompassing communications, biotech, real estate, materials, utilities, information technology (IT), energy and consumer staples.

Those China-exposed funds have been suffering from snowballing losses amid China’s stalling economy. Worse yet, there is no sign of imminent recovery in the world’s No. 2 economy, keeping investors wary of Chinese assets.

Global X said it has decided to liquidate the funds “based on an ongoing review process of its product lineup to ensure it meets the evolving needs of its clients.”

Reflecting the growing concern about China’s economy amid the ongoing property crisis largely stemming from the default risk of China’s top three private real estate developers such as Country Garden and Evergrande, the net asset value of Global X Real Estate ETF plunged 34.2% over a year.

Chinese wealth manager Zhongzhi Enterprise Group grappling with a deepening property market downturn also filed for bankruptcy liquidation after failing to repay debt earlier this month, fueling fears that the country’s property crisis could spill over into the country’s financial sector.

Global X ETFs holding China’s industrials and materials stocks also lost 17.5% and 16.3%, respectively, over the same period.

CHINA-EXPOSED FUNDS ARE WORST PERFORMERS

Global X is not the only fund provider suffering huge losses from their investments in Chinese stocks.

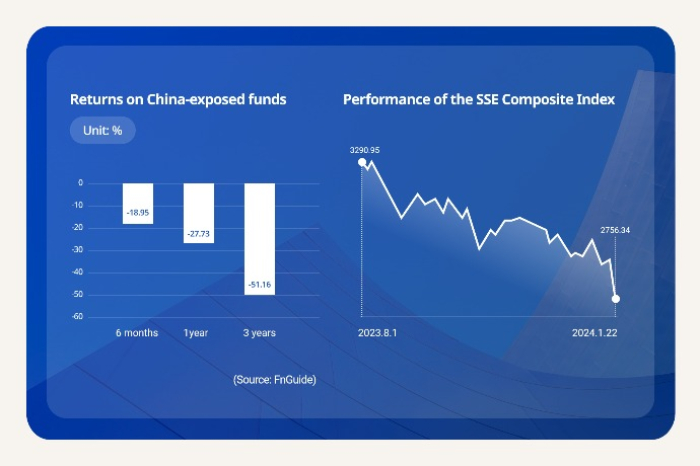

According to Seoul-based fund tracker FnGuide, funds holding Chinese stocks lost 27.7% over a year on average, performing the worst among international funds traded in Korea.

This is worse than a 22.34% loss recorded by funds exposed to stocks listed in Russia amid the war with Ukraine.

KB Asset Management’s KBSTAR China Mainland Large Cap Stock CSI100 Securities ETF and Samsung Asset Management's KODEX China H Leverage (H) lost 20.1% and 57%, respectively, over the same period.

Their dire performance is mainly due to the freefalling SSE Composite Index and Hang Seng China Enterprises Index (HSCEI), which have slid 15.5% and 31.1%, respectively.

Mirae Asset Global Investments’ TIGER China Electric Vehicle Solactive ETF, the largest China-exposed fund in Korea incepted in December 2020, lost 38.5% over the past year following the tumble of Chinese EV-related stocks such as CATL and BYD.

The fund’s net asset value plummeted to 1.9 trillion won ($1.4 billion) from more than 4 trillion won recorded in June 2023.

Korean investors are also exposed to massive losses from their investments in the HSCEI-tied equity-linked securities (ELS). Their losses already reached 229.6 billion won in the first three weeks of this year.

If the index stays at the current low 5,000 level, Korean investors are expected to suffer from a total loss of more than 6 trillion won by the end of June this year.

Write to Man-Su Choe at bebop@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELS

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELSJan 22, 2024 (Gmt+09:00)

3 Min read -

Pension fundsNPS fills basket with China reopening, cosmetics shares; tech firms sold

Pension fundsNPS fills basket with China reopening, cosmetics shares; tech firms soldOct 06, 2023 (Gmt+09:00)

3 Min read -

BatteriesBattery cell prices plummet amid supply glut in China, weak EV demand

BatteriesBattery cell prices plummet amid supply glut in China, weak EV demandSep 15, 2023 (Gmt+09:00)

2 Min read -

Korean stock marketKorean exodus from China funds amid deepening property crisis

Korean stock marketKorean exodus from China funds amid deepening property crisisAug 23, 2023 (Gmt+09:00)

3 Min read -

Asset managementMirae Asset’s global ETFs exceed $100 bn in net asset value

Asset managementMirae Asset’s global ETFs exceed $100 bn in net asset valueJul 18, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN