Foreigners gobble up chip stocks in S.Korea, buoying overall Kospi

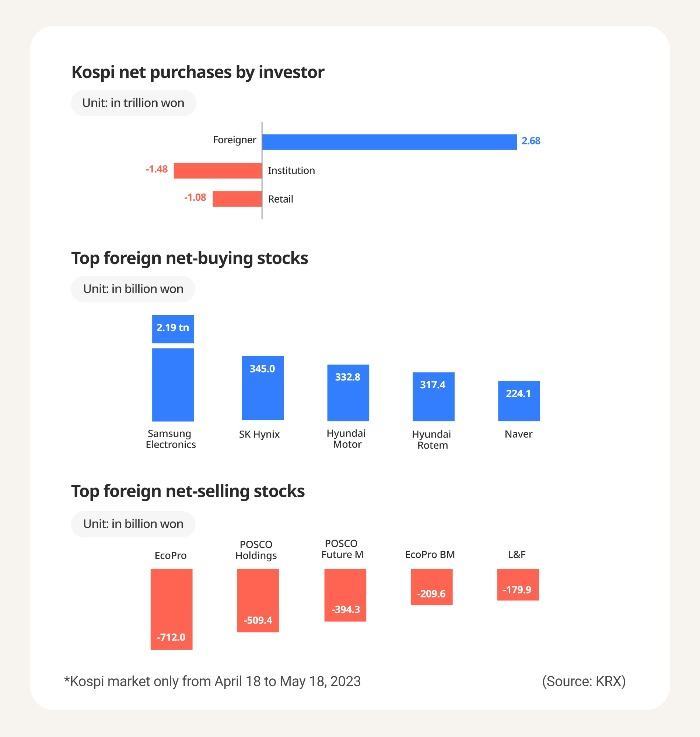

Offshore investors net bought over 2.6 trillion won ($1.9 billion) worth of stocks on Korea’s main Kospi bourse in the last four weeks

By May 19, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Foreign investors' appetite for South Korean stocks remains insatiable, mainly for semiconductor heavyweights, underscoring their high expectations for a recovery in the global chip industry despite lingering concerns about the economic downturn from rate hikes.

According to Korea’s sole stock market operator Korea Exchange (KRX), foreign investors on Friday net purchased 558.2 billion won ($420.5 million) worth of stocks on the Kospi, helping lift the Korean benchmark stock index by 0.9% from the previous session to end at 2,537.79.

Institutional investors net bought 558.9 billion won, a reverse from the previous day’s net selling, while retail investors net sold 1.1 trillion won, maintaining their selling spree.

It was overseas investors’ fourth consecutive net purchasing in the Kospi market.

They started showing resilient demand for Korean stocks in mid-March, and their appetite has grown stronger despite the weakening Korean won against the US dollar and the wider interest rate gap between Korea and the US, negative factors that typically keep foreigners from the Korean stock market due to foreign exchange rate loss concerns.

The Korean won this week weakened to around 1,330 against the US dollar due to the Asian country’s export slump, while the US-Korea rate gap widened to 1.75%.

CHIP STOCKS LEAD

But foreigners seem to have shrugged off such concerns and instead make a bigger bet on a recovery in the global semiconductor industry.

From April 18 to May 18, their cumulative net purchases of Kospi stocks amounted to 2.68 trillion won, of which 2.19 trillion won was spent to cherrypick Samsung Electronics Co., both common and preferred shares.

Including their net buying of 345 billion won worth of SK Hynix Inc. shares, 95% of their Kospi net purchases over the cited period were spent on semiconductor stocks.

Global investors have been actively raking in stocks in Taiwan since mid-May while slowing down their purchases of Chinese stocks after big spending on them on high expectations for the economic reopening early this year, said Park Sang-hyun, an analyst at HI Investment & Securities Co.

“The recent upswing in the Philadelphia semiconductor index and foreigners’ massive net buying of Taiwanese stocks reflect expectations that the semiconductor industry may soon bottom out,” said Park.

According to a recent report by SEMI, the semiconductor industry is expected to complete its inventory adjustment by mid-year, and chip demand is forecast to rebound in the second half.

He also noted improved risk appetite on eased concerns about the US Federal Reserve’s rate hiking pace, American mid-size banks’ domino collapses, stalled US debt ceiling negotiations and a possible recession in the world’s biggest economy.

Whether overseas investors would maintain net buying in Korea hinges on the recovery of the Chinese economy and the pace of global chip inventory reduction, Park said, adding that their strong demand for Korean stocks would prevent the Korean won from further weakening for a while.

FROM PASSIVE TO ACTIVE INVESTING

The latest foreign net buying in Korea suggests that more offshore investors are investing in Korean stocks via active funds, instead of passive funds, said Jung Sung-han, director of Alpha Investment Center at Shinhan Asset Management Co.

This means it is time to focus more on individual corporate earnings in stock investment, he added.

On top of chip stocks, offshore investors lately prefer entertainment stocks, pouring 119.5 billion won and 91.3 billion won into YG Entertainment Inc. and JYP Entertainment Corp., respectively, from April 18 to May 18.

But they dumbed most rechargeable battery-related stocks over the same period. Foreigners net sold 712.0 billion won worth of EcoPro Co. and 394.3 billion won worth of POSCO Future M Co., which rallied early this year.

Retail investors’ top choices were, however, those battery-related stocks in the last four weeks.

Write to Man-Su Choe at bebop@hankyung.com

Sookyung Seo edited this article.

-

EntertainmentYG’s new girl group lifts stock price to decade high

EntertainmentYG’s new girl group lifts stock price to decade highMay 12, 2023 (Gmt+09:00)

1 Min read -

Korean stock marketChina, India: Korean investors’ next stock investment targets

Korean stock marketChina, India: Korean investors’ next stock investment targetsApr 19, 2023 (Gmt+09:00)

3 Min read -

Korean stock marketS.Korean stocks at 8-month high as foreigners chase Samsung

Korean stock marketS.Korean stocks at 8-month high as foreigners chase SamsungApr 10, 2023 (Gmt+09:00)

2 Min read