Korean stock market

Defense, healthcare lure global funds in dull market

Global asset managers' raised bets are primarily on 10 listed S.Korean companies

By May 04, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Defense, healthcare and semiconductor materials companies have been the main investment targets of global funds such as Fidelity and Morgan Stanley over the past few months, despite fears of an economic downturn and the softening won currency.

Their buoyant exports and growth potential have lured foreign investors even in rangebound trade on the Korea Exchange. They also chased holding companies of Korean conglomerates, which they believed were undervalued.

Morgan Stanley said in a Tuesday filing that it has secured a 6.72% stake in Hyundai Rotem Co. as of April 28. It was the investment firm’s first disclosure about its shareholding in the armored vehicle and high-speed rail car manufacturer.

The filing was in line with the disclosure requirements for a shareholder with a 5% stake in a listed firm or above.

Fidelity Management has increased its stake in Korea Aerospace Industries Ltd. (KAI) by seven percentage points to 5.71% in the two weeks ahead of April 21. KAI is South Korea’s sole military aircraft manufacturer.

Both KAI and Hyundai Rotem had previously been regarded as domestic sales-oriented companies. But their string of recent export deals, including those with Poland and Australia, has drawn the eyes of foreign investors.

The weakening won against the US dollar and other major currencies has also boosted the appetite for exports-focused companies. The South Korean won fell to its weakest level in almost five months in late April.

For foreign shareholders, a rebound in the Korean currency later on could generate foreign exchange gains on top of investment returns.

MEDICAL EQUIPMENT, SEMICONDUCTOR MATERIALS

Templeton Investment has increased its stake in i-SENSE Inc. to 6.27% over the past two months, compared to 5.17% in early February. The Kosdaq-listed company specializes in blood sugar test kits.

An investment arm of Fidelity held a 5.18% stake in medical imaging device maker Vieworks Co. as of April 25.

The Fidelity unit has also continued to buy InBody Co. shares. Its shareholding in the body composition analyzer maker had climbed to 6.68% by March 31, versus 5.16% in mid-February.

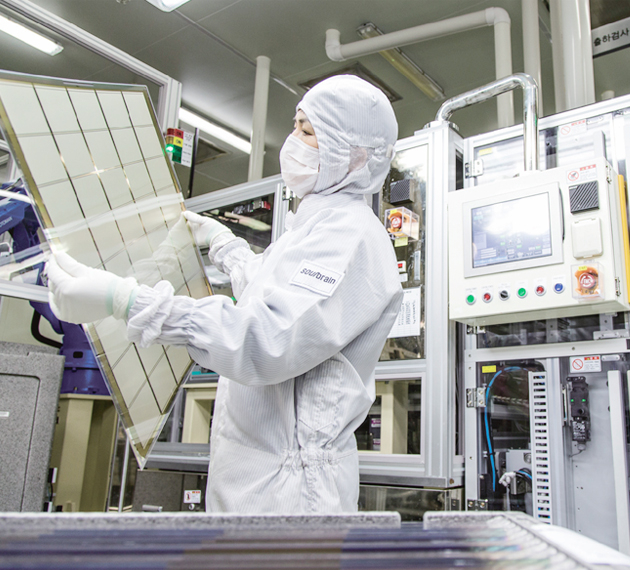

Additionally, Fidelity had raised its stake in Soulbrain Co. to 8.12% by the end of March from 6.56% in early January. Soulbrain supplies chemical materials to process semiconductor chips.

BlackRock bumped up its stake in Hansol Chemical Co. to 6.09% by the end of March from early February. Hansol produces hydrogen peroxide used in the manufacturing process of semiconductor chips.

Hansol and Soulbrain have drawn interest from foreign investors as both companies are expanding into the rechargeable battery materials market.

Hansol supplies electrode binders for secondary batteries to both Samsung SDI Co. and SK On Co. Its battery-related sales are forecast to shoot up 55% to 62 billion won ($47 million) in 2023.

HOLDING COMPANIES

Norges Bank, the central bank of Norway, made its first disclosure about SK Square Co. after it secured a 5.01% stake in the intermediary holding company as of early April.

SK Square controls SK Hynix Inc., the world’s No. 2 memory chipmaker and Tmap Mobility Co., a satellite-based navigation service provider.

Silchester International Investors, one of the largest UK-based boutique asset managers, now holds a 5.02% stake in LG Corp.

It has chased the holding company of South Korea’s No. 4 conglomerate over the past five years. This is the first time its ownership has exceeded the 5% threshold.

The aforementioned asset managers had purchased those stocks during market hours for financial investment, according to their disclosures made between April 4 and May 3.

Write to Eui-Myung Park at uimyung@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Shareholder activismKorean activist fund mired in controversy over SM stock deals

Shareholder activismKorean activist fund mired in controversy over SM stock dealsMay 02, 2023 (Gmt+09:00)

4 Min read -

Korean stock marketSocGen dumps Korean stocks, likely due to client margin calls

Korean stock marketSocGen dumps Korean stocks, likely due to client margin callsApr 24, 2023 (Gmt+09:00)

3 Min read -

Foreign exchangeKorean won near 5-month low despite weak dollar; outlook dark

Foreign exchangeKorean won near 5-month low despite weak dollar; outlook darkApr 21, 2023 (Gmt+09:00)

4 Min read -

Korean stock marketSuper-rich Koreans eye return to stocks despite weaker economy

Korean stock marketSuper-rich Koreans eye return to stocks despite weaker economyApr 10, 2023 (Gmt+09:00)

2 Min read -

Korean stock marketS.Korean stocks at 8-month high as foreigners chase Samsung

Korean stock marketS.Korean stocks at 8-month high as foreigners chase SamsungApr 10, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN