Investors ready their return to Korean stock market but with bet on declines

Investor deposits hit a 5-month high on battery-related stocks’ rally; net buying of Kosdaq inverse ETFs up to 200.1 bn won

By Apr 06, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Investors are readying their return to the stock market in South Korea, encouraged by the rosy outlook for secondary battery stocks, but more retail investors are betting on the fall of the country’s junior Kosdaq stock market crowded by secondary battery and related stocks after their recent rallies.

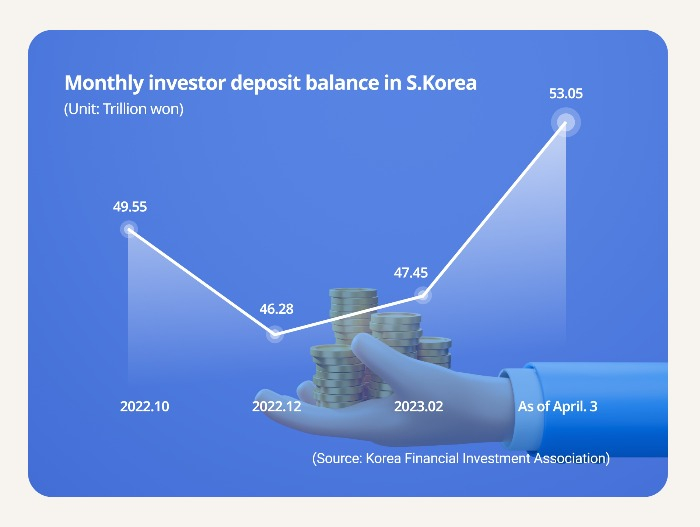

According to data released by the Korea Financial Investment Association on Wednesday, investor deposits as of April 3 amounted to 53.05 trillion won ($40.3 billion), the biggest amount since October last year with 49.55 trillion won.

Investment deposits are funds parked by investors in brokerages’ investment accounts, considered money ready to invest in stocks. An increase in investor deposits indicates improved stock investor sentiment.

The rise in investor deposits comes after secondary battery and related stocks mostly listed on the Kosdaq index have recently rallied on their bright outlook.

The monthly turnover in the Kosdaq market more than doubled to 12.73 trillion won in March from January. The main Kospi market also saw a rise in turnover to 8.93 trillion won from 6.97 trillion won over the same period.

But more retail investors seem to be bracing for a decline in the Kosdaq index on expectations of profit-taking in secondary battery stocks after their recent rallies.

RISING BETS ON BATTERY STOCKS' DECLINE

Individual investors’ net buying of KODEX KOSDAQ150 Inverse ETF funds over 10 sessions from March 22 to April 4 hit 200.1 billion won, versus 106.0 billion won in net selling of KODEX KOSDAQ150 Leverage ETF funds.

Inverse ETFs bet on declines in the underlying assets, whereas leverage ETFs bet on increases.

Investors are turning their back on secondary battery stocks on a surge in the short balances for these stocks, hinting at massive profit-taking ahead, said market analysts.

Short positions on EcoPro BM Co., a leading Korean battery material producer, piled up to 777.7 billion won as of March 31, up 68.8% from March 1, according to the Korea Exchange (KRX). This is much more than the short positions for LG Energy Solution Ltd., the most heavily shorted stock on the Kospi, estimated at 728.4 billion won.

Other secondary battery-related stocks on the Kosdaq market are also facing growing short-selling pressure, with L&F Co.'s and EcoPro Co.’s short positions reaching 339.3 billion won and 221.0 billion won, respectively.

Samsung Securities Co. recently revised down EcoPro’s target rating to Neutral from Buy after its shares skyrocketed.

EcoPro and EcoPro BM shares have soared 368% and 151%, respectively, since the first trading day of the year.

Write to Tae-Ung Bae at btu104@hankyung.com

Sookyung Seo edited this article.

-

-

Korean stock marketEV materials maker EcoPro tops the buy list of Korean stocks

Korean stock marketEV materials maker EcoPro tops the buy list of Korean stocksSep 14, 2022 (Gmt+09:00)

2 Min read -

Korean stock marketEcoPro BM beats Kosdaq's top market cap Celltrion

Korean stock marketEcoPro BM beats Kosdaq's top market cap CelltrionJan 19, 2022 (Gmt+09:00)

2 Min read