Korean stock market

Korea Exchange seeks to extend derivatives trading hours

The move comes as S.Korea plans to lengthen forex trading hours by eight and a half hours to 2 am

By Jan 31, 2023 (Gmt+09:00)

1

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

UAE to invest up to $1 bn in S.Korean ventures

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

US multifamily market challenges create investment opportunities

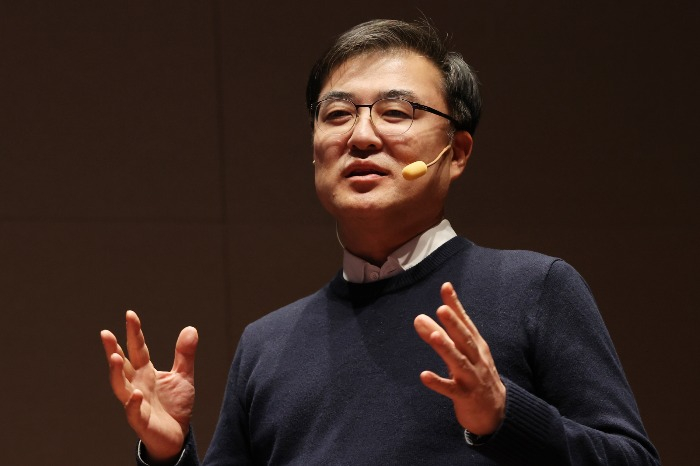

South KoreaŌĆÖs bourse operator is seeking to extend derivatives trading hours by opening the market 15 minutes earlier at 8:45 am and allow for nighttime trading, its Chairman Sohn Byung-doo said on Tuesday.

The moves are aimed at reducing spot market volatility and cushioning the impact of global market data and news, he said in a New YearŌĆÖs press conference.

Currently, both spot and derivatives markets open at 9 am simultaneously in South Korea. But global bourses start derivatives trading earlier than spot trading.

Extending derivatives trading hours is also expected to solve the Korea Discount, or lower valuations for South Korean companies than global peers.

The bourse operator is also considering several measures to improve market accessibility for foreign investors, said the former vice chairman of the regulatory Financial Services Commission.

They may include expanding the scope of companies subject to English disclosures and revising dividend policies so as to comply with global practices.

Within this year, it will abolish the pre-registration requirement for foreign investors when investing in listed Korean stocks as well.

Such moves come as South Korea is set to extend foreign exchange trading hours by eight and a half hours to close the market at 2 am from the current 3:30 pm.

Finance Minister Choo Kyung-ho said earlier this month that the government will lengthen trading hours of the local forex market as early as the second half of next year and allow foreign investors to directly participate in the market.

Write to Tae-Ung Bae and Gyo-Beom Gu at btu104@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Foreign exchangeS.Korea extends trading hours of local forex market

Foreign exchangeS.Korea extends trading hours of local forex marketJan 13, 2023 (Gmt+09:00)

2 Min read -

Foreign exchangeKorea eyes removal of pre-reporting for forex transactions

Foreign exchangeKorea eyes removal of pre-reporting for forex transactionsJan 16, 2023 (Gmt+09:00)

1 Min read -

Korean stock marketKRX opens German office to promote EU certification of Korean indices

Korean stock marketKRX opens German office to promote EU certification of Korean indicesDec 16, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN