Korean startups

S.Korea's drone market set for takeoff, led by startups

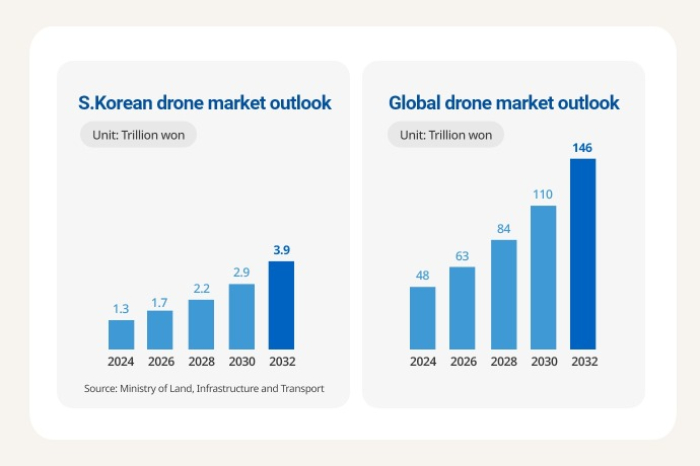

The Korean drone market is forecast to nearly quadruple to 3.9 trillion won in 2032 from 2024, taking 2% of the global market

By Mar 21, 2024 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Starting in May, drones, not boats, will deliver parcels and even fried chicken to residents living on some of South Korea's remote islands unreachable by motor vehicles, a major advancement in the country lagging far behind global leaders in the drone sector such as the US and China.

According to sources in the Korean drone industry on Wednesday, Pablo Air, a local drone delivery system-developing startup, will start to offer drone delivery service to residents on seven islands in Incheon on the coast just west of Seoul in partnership with a local logistics giant.

It will use the PA-H3 drone that can fly up to 36 kilometers per hour. It can fly for 25 minutes while carrying items weighing up to 5 kilograms.

Pablo Air will dispatch eight units of the PA-H3 for the service.

The Incheon Metropolitan City government plans to expand the list of items deliverable to the remote islands with drones, including not only parcels but also groceries, convenience store items and food including fried chicken.

Pablo Air, which raked in 8.1 billion won ($6.1 million) in sales in 2023, a tenfold jump from 2021, also plans to work with Korea Post to offer public parcel services.

This is one of many drone-related businesses readying to take off in Korea.

Mostly led by startups like Pablo Air, the drone industry of Asia’s fourth-largest economy is gearing up for a leap to catch up with global rivals in the US and China.

At the current pace, the Korean drone market is forecast to grow to 1.3 trillion won ($981 million) in 2024 and then to 3.9 trillion won in 2032, which will be translated into a 2% share of the global drone market, according to data from Korea’s Ministry of Land, Infrastructure and Transport.

The global drone market is projected to grow to 146 trillion won by 2032, led by the US with the biggest share of 16.3%, followed by China with 16.1% and Japan with 5%.

DIVERSIFYING DRONE APPLICATIONS

The drone industry is largely divided into drone manufacturing, which makes up 42%, and its application market making up the remainder.

Global leaders have rapidly shifted their focus to the expansion of drone application areas, mainly in delivery, aerial survey and tracking as well as monitoring -- segments set to spike in demand.

US big technology companies have already joined the drone delivery market, paving the way for a speedy growth of the segment in the country.

Korean companies, mostly startups, are also rolling up their sleeves to work to catch up to the frontrunners in the drone race.

Meissa offers drone services that manage golf course grass, using its digital mapping and visualizing technologies.

It uses a drone and attached cameras to capture spatial information and then digitalize real space information into quantitative data by using its 3D reconstruction and georeferencing technology.

“Thanks to the digitalized spatial data, the cost to manage (golf course grass) can drop significantly,” said Kim Young-hun, the chief executive office of Meissa.

Its drone services are also used in other areas of site management such as construction.

Another startup Angelswing also offers drone data services for construction sites, collecting spatial information and visualizing the real field in a virtual world with the processed spatial data. Its drones enable workers to monitor and detect changes in the construction fields in real-time.

Its already famous construction site safety management platform has been used by many engineering companies, including Korea’s household names Samsung C&T Corp. and Hyundai Engineering & Construction Co., at about 200 construction sites at home and abroad.

Angelswing's drones were dispatched to deadly earthquake-hit areas in Turkey, or Türkiye, for a reconstruction mission last year.

Another promising Korean drone startup Siera Base develops software for drones to enable drones’ Level 4 autonomous driving and inspection automation.

COMBAT OPERATION AND LAW ENFORCEMENT

Drones will also be actively used in combat operations and law enforcement sectors beyond commercial applications in Korea.

The Korean National Police Commission has recently amended unmanned aerial vehicle operation rules to allow drones to be used at protest sites to collect evidence of unlawful, offensive behavior and to monitor and detect traffic violations in real-time.

The Ministry of Land, Infrastructure and Transport and the Ministry of Science and ICT have recently opened anti-drone system drill fields to test counter-drone technologies, like jammers that force foreign flying objects such as drones to go off course or crash by interfering with radio waves.

Under current law, jamming is banned in Korea but to counter the growing risk of drone attacks by terrorists, the government has designated it lawful in certain areas for the test of anti-drone systems.

Nearthlab, a Korean startup boasting precise flight control technology for autonomous drones, has developed military drones, called drone grenades, that crash alien drones by colliding with them. They can fly up to 250 km/h at the point of collision.

The company uses vision AI technology to analyze the approaching drone’s flight trajectory in real-time.

To foster the local drone startup industry’s development, the Korean government has selected 17 cities and towns including Busan to facilitate drone delivery, as sites of battlefield resupply and for the drone and leisure drone businesses.

It has selected 14 startups to join the government-sponsored drone businesses.

However, the local startup industry said that is not enough, urging the government to simplify and shorten the approval process of new drone technologies developed by startups, which currently takes about five years.

“It takes only a year for a new technology to become outdated after its development in the drone industry,” said an official at a local drone startup.

Write to Kang-Ho Jang at callme@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Aerospace & DefenseHanwha wins S.Korean military anti-drone system deals

Aerospace & DefenseHanwha wins S.Korean military anti-drone system dealsDec 22, 2023 (Gmt+09:00)

2 Min read -

-

LogisticsKyochon, Pablo Air to collaborate for commercializing drone delivery

LogisticsKyochon, Pablo Air to collaborate for commercializing drone deliveryAug 23, 2023 (Gmt+09:00)

1 Min read -

Future mobilityKorea unveils autonomous driving, commercial drone service roadmap

Future mobilityKorea unveils autonomous driving, commercial drone service roadmapSep 19, 2022 (Gmt+09:00)

2 Min read -

Korean startupsSouth Korean startups team up with convenience stores for drone delivery

Korean startupsSouth Korean startups team up with convenience stores for drone deliveryJul 13, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN