Korean startups

Disgruntled investors accuse Fadu of blowing smoke

The S.Korean chip unicorn’s shares slid more than 40% from their August IPO price after reporting an earnings shock last week

By Nov 14, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Fadu Inc., the first unicorn in the South Korean semiconductor sector, which had a triumphant market debut three months ago, is facing the backlash of angry investors after its first public earnings disclosure shocked the market with poor results -- in stark contrast to its earlier rosy projections.

Fadu on Monday released a statement to assuage investors, blaming its disappointing third-quarter earnings on the unexpected suspension of its customers’ chip orders due to the longer-than-anticipated downturn in the global NAND flash memory and solid-state drive (SSD) markets.

“It was really difficult to anticipate that our customers would suddenly suspend their orders,” the company said in its letter to shareholders on its website on Monday. “There were no negative intentions or plans in the process … the (IPO) process was carried out in accordance with legal procedures.”

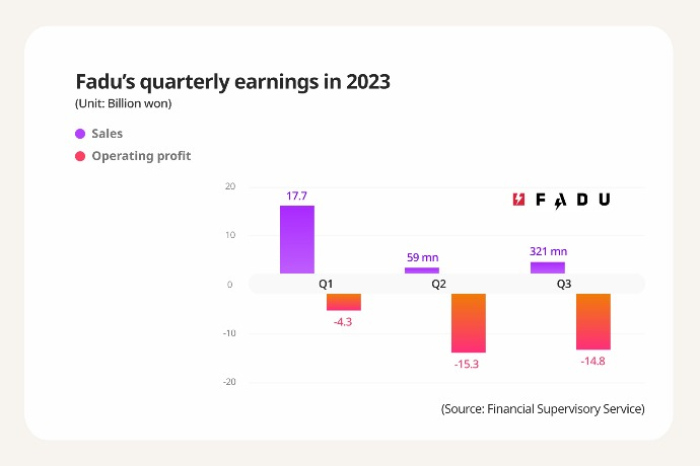

The company sent out the letter after its investors started dumping its shares in response to its earnings report on Wednesday last week that it logged an operating loss of 14.8 billion won ($11.1 million) in the third quarter ended September, stretching this year’s cumulative operating losses to 34.4 billion won.

The company earned 1.5 billion won in operating profit last year.

Its sales also fell far short of last year’s 56.4 billion won after reporting 18 billion won in the first three quarters of this year. Its sales in the third quarter alone shrank nearly 100% from the same period of last year to 320 million won.

Fadu projected before its initial public offering that its annual sales for this year would reach 120 billion won.

Worse yet, Fadu’s second-quarter sales plunged 98% on-year to 59 million won, according to the Financial Supervisory Service on Monday.

VALUATION CONTROVERSY

Fadu is a Korean fabless chip startup, which develops and produces SSD controllers for data centers. SSD controller is a core component of SSDs.

It became the country’s first semiconductor unicorn with a valuation of over $1 billion during its pre-IPO share sales in February.

It debuted on Korea’s tech and bio-heavy junior Kosdaq market on Aug. 7 with an IPO price of 31,000 won per share. But shares finished the first trading day below the IPO price on concerns about its high valuation

Its first public earnings disclosure with such poor results last week further fanned its valuation concerns, triggering investors to rush to throw out its shares.

At the end of June, Fadu released the first-quarter earnings only and failed to include second-quarter results during its amended stock registration statement filed with the Korea Exchange in mid-July.

Based on the first-quarter sales growth rate, its IPO price was decided at 31,000 won, the upper end of the indicative IPO price range, which allowed its market capitalization to reach 1.5 trillion won.

Following the release of the disappointing earnings, investors have raised issues with Fadu’s IPO process, accusing the startup of intentionally hiding its dismal results. They said the company must have aware of the second-quarter results during its investor relations (IR) sessions for its IPO in July and should have notified investors.

While denying any wrongdoing during its IPO process, the company said in the letter to shareholders that it expects its sales would improve in the final quarter of this year.

“The company’s recent performance has been derived from these challenging market conditions and concerns that existing customers have replaced Fadu products with others are completely untrue,” the letter read.

“We clearly state that orders from existing customers have already resumed in the fourth quarter of 2023 ... The global competitiveness of our products remains intact.”

It added the company is currently in discussions with new customers for potential new orders.

But the company’s efforts to calm its investors seem to have failed.

Investors continued dumping Fadu shares on Tuesday, with its shares losing more than 9% to hover around 17,000 won in the morning session. They closed down 7% at 17,710 won.

From Wednesday last week to Monday, its shares tanked more than 45%.

DIM OUTLOOK

Its share price outlook looks grim, given that retail investors were also furious upon the news that Fadu’s early-stage venture capital investor Forest Partners Ltd. had exited before the company’s announcement of its third-quarter earnings.

The Seoul-based private equity firm sold its shares in Fadu from Nov. 2 to Nov. 8 to completely cash out.

Some investors blame the country’s sole stock exchange operator KRX and Fadu’s lead IPO underwriter NH Investment & Securities Co. for the current Fadu IPO fiasco, saying they failed to detect red flags with the startup’s business beforehand.

Write to Jeong-Cheol Bae at bjc@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Upcoming IPOsFabless FADU taps institutional demand to raise about $151 mn

Upcoming IPOsFabless FADU taps institutional demand to raise about $151 mnJul 24, 2023 (Gmt+09:00)

2 Min read -

Korean startupsFADU joins ranks of unicorns as S.Korea’s first fabless chip firm

Korean startupsFADU joins ranks of unicorns as S.Korea’s first fabless chip firmFeb 28, 2023 (Gmt+09:00)

3 Min read -

Korean startupsFabless startup FADU eyes unicorn status with $157 mn funding

Korean startupsFabless startup FADU eyes unicorn status with $157 mn fundingMay 06, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersFadu, Mobilint emerge as S.Korea's system chip startup dark horses

Korean chipmakersFadu, Mobilint emerge as S.Korea's system chip startup dark horsesNov 24, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN