Korean startups

Despite liquidity crunch, 5 verticals rake in venture capital investment

But experts say startups that succeeded in getting funded during the economic downturn are not necessarily immune to the liquidity crunch

By Oct 13, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The global venture capital ecosystem has been contracting since the second quarter of last year, hit by rising inflation and rate hikes.

New venture capital investment in the first quarter of 2021 was 6.83 trillion won ($4.79 billion), which shrunk to 4.61 trillion won in the second quarter last year and even further to just 3.11 trillion won in the third, according to The VC industry website.

This year’s data compiled by the Ministry of SMEs and Startups fell from the first quarter’s 2.18 trillion won to 1.83 trillion won in the second quarter of 2022.

Despite the plummeting overall investment amount, some 72 investments during the third quarter were worth more than 10 billion won each. That is a whopping 19% of the 372 total new investments in the quarter.

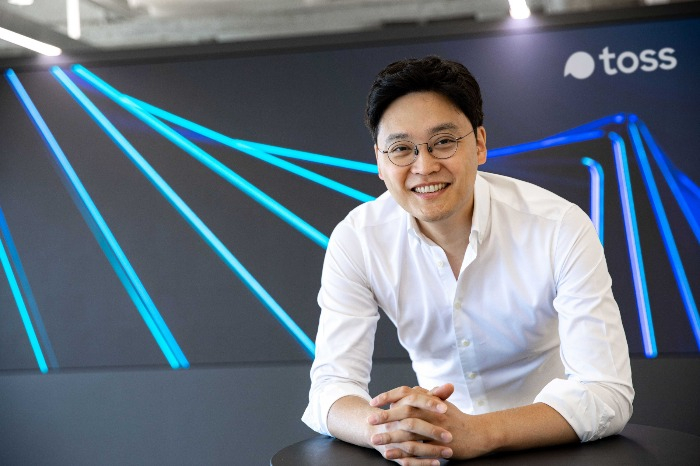

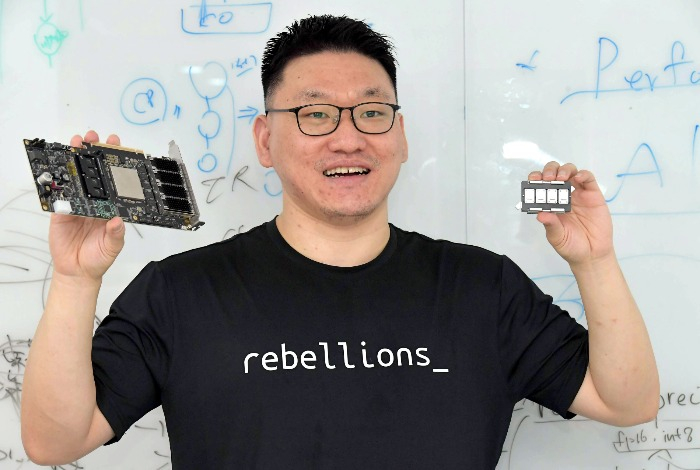

The successful funding cases range from the Series A round for Rebellions to Viva Republica’s Series G.

PAYING FOR CONVENIENCE

Startups that bring convenience to everyday life were popular among investors.

Caring Co., which finds and links elderly caregivers with clients, raised 30 billion won while childcare app Tictoccroc Inc. raised 16 billion won. The latter matches parents with teachers for children as young as a year old up to elementary school students.

Software as a service (SaaS) operator CLASSUM, CashNote operator Korea Credit Data, and Apartmentary all raised more than 10 billion won.

Operators of accommodation or rental car services were also popular among investors for providing services that make day-to-day tasks easier.

Even though mistrust regarding the profitability of many startups in the e-commerce sector persists, the industry heavyweights are widely expected to maintain their lead.

Fashion commerce platform Brandi Inc. raised 29 billion won in August while in the same month luxury commerce platform Trenbe Inc. garnered even more with 35 billion won.

VC behemoths such as Atinum Investment and Mirae Asset Venture Investment Co. were bullish on the e-commerce sector.

FUTURE MOBILITY & BLOCKCHAIN

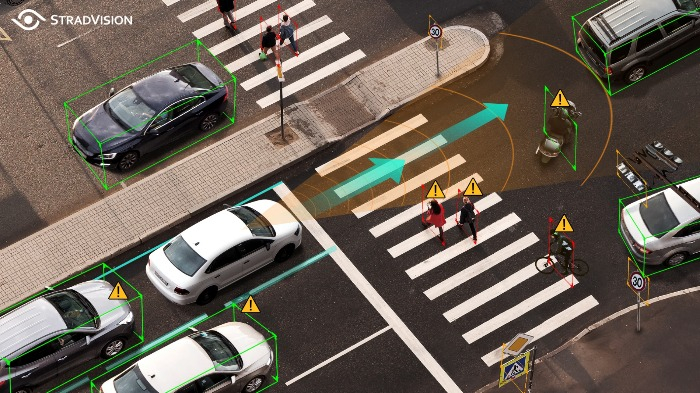

Startups possessing technology for autonomous driving raked in the heftiest investment.

Stradvision, Inc., which develops AI-based camera recognition software, raised 107.6 billion won in Series C funding.

LiDAR software developer Seoul Robotics raised 30.8 billion won in Series B from KB Investment Co., Future Play, and more.

Other LiDAR developers SOS Lab and AutoL raised more than 10 billion won each.

Blockchain startups, especially those in the gaming industry, were also successful in fundraising.

ESG & BIOTECH

Investors were also keen on startups leading the environment, sustainability, and government (ESG) trend.

Mushroom-based biomaterials developer Mycel raised 13 billion won in a pre-Series A round. The startup was the first destination for GS Ventures, a CVC within the GS Group.

Biotech and healthcare startups enjoy continued investment per usual.

Breast cancer and cervical cancer drug developer Enhanced Bio Inc. raised 12.5 billion won in a Series B round from Mirae Asset Venture Investment, HB Investment, and more.

But experts say the startups that have succeeded in raising funds during the economic downturn are not entirely immune to the liquidity crunch.

Luxury shopping platform operator Balan, which sought Series C funding with an estimated corporate value of 800 billion won, halved the figure.

“While the liquidity crunch is palpable, startups with a clear track record of revenue growth and potential for global expansion are continuing to whet investors’ appetite,” a venture capitalist told The Korea Economic Daily.

Write to Jong Woo Kim at jongwoo@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

Artificial intelligenceAI-powered translation startups tackle niche marketplaces

Artificial intelligenceAI-powered translation startups tackle niche marketplacesOct 11, 2022 (Gmt+09:00)

3 Min read -

Korean startupsKorea's data solution provider for small biz becomes unicorn

Korean startupsKorea's data solution provider for small biz becomes unicornOct 06, 2022 (Gmt+09:00)

1 Min read -

Cloud computingNaver Cloud seeks win-win strategy with K-startups in overseas market

Cloud computingNaver Cloud seeks win-win strategy with K-startups in overseas marketOct 04, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN