Korean startups

Fabless startup FADU eyes unicorn status with $157 mn funding

The company may delay its IPO until after the first quarter of 2023 to become more profitable

By May 06, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

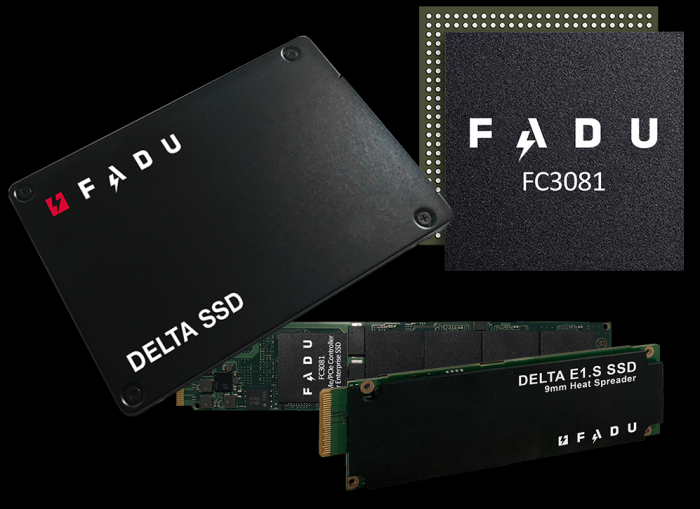

FADU Technology, a fabless startup that develops architecture for solid-state drive (SSD) controllers and storage products, is seeking to raise 200 billion won ($157 million) from global private equity firms for business expansion.

If successful, the company will likely join the ranks of unicorns, or private companies worth $1 billion or more, by becoming the first such startup company in Korea’s semiconductor sector.

FADU, headquartered in Seoul and runs offices in Silicon Valley, California, has hired a Korean financial advisor for the new funding round with an aim to put its enterprise value between 1.2 trillion won and 1.8 trillion won, according to investment banking sources on Friday.

The company plans to issue new shares for the fundraising, but doesn’t rule out selling existing equity stakes to interested parties, which will increase the total size of funding, the sources said.

FADU aims to complete the new fundraising by the end of the year, they said.

The estimated corporate value is up to twice that of 900 billion won, based on which FADU raised 30 billion won from existing shareholders last month. During a funding round in August last year, the company’s valuation stood at 450 billion won.

Industry watchers said FADU’s enterprise value could rise further as its business partner SK Hynix Inc. recently signed a deal to supply SSDs to Meta Platforms Inc., formerly Facebook Inc.

Among the company’s major stakeholders are venture capital firms such as Forest Partners, Reverent Partners and Capstone Partners.

Established in 2105, FADU is led by Chief Executive and co-founder Lee Ji-hyo, a former partner at Bain & Company; Chief Technology Officer and co-founder Nam Eyee-hyun (Peter Nam), a former SK Telecom Co. researcher; and Chief Operating Officer and co-founder Lee Dae-keun, previously an executive at Sapphire Technology.

IPO MAY BE DELAYED

Industry officials said that the 1.2 trillion-1.8 trillion won valuation FADU is seeking with the planned fundraising may be too high given that the company is still losing money.

FADU posted an operating loss of 33.7 billion won on revenue of 5.2 billion won in 2021. It targets 65 billion won in sales this year.

Some PEFs interested in the upcoming funding round have tapped into the possibility of acquiring the management rights of the company, according to the sources.

FADU may postpone its plan to go public in order to become more profitable and more attractive to investors, they said.

The company has said it plans to list its shares on the Korea Exchange in the first quarter of 2023 after completing an IPO review by the regulator in the second half of 2022.

FADU specializes in designing and developing advanced flash storage technology called non-volatile memory express, or NVMe, controller.

SK Hynix’s corporate SSD products, to be supplied to Meta and other clients, will use FADU’s NVMe controller, industry officials said.

Write to Chae-Yeon Kim at Why29@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSK Hynix, Solidigm unveil SSD for data centers

Korean chipmakersSK Hynix, Solidigm unveil SSD for data centersApr 05, 2022 (Gmt+09:00)

2 Min read -

Korean fabless startups take center stage, attracts VCs

Korean fabless startups take center stage, attracts VCsAug 12, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersFadu, Mobilint emerge as S.Korea's system chip startup dark horses

Korean chipmakersFadu, Mobilint emerge as S.Korea's system chip startup dark horsesNov 24, 2020 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix starts mass production of high-performance SSDs

Korean chipmakersSK Hynix starts mass production of high-performance SSDsApr 15, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN