[Survey] Korean LPs tilt to infrastructure on dull 2019 economic outlook

Oct 30, 2018 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

A majority of leading South Korean institutional investors are planning to boost overseas infrastructure investment next year with focus on developed markets, while maintaining or lowering the proportion of cross-border real estate portfolios, a survey of 23 chief investment officers shows.

Eighteen respondents to the poll, conducted by the Korea Economic Daily in October 2018, saw an increase in overseas infrastructure investment in 2019 from this year in search of better-yielding and safe-haven assets, as trade disputes between the US and China raise global economic uncertainties and financial market volatility. The other five CIOs expected no change in the proportion of 2019 infrastructure assets.

For cross-border property investment, only nine respondents to a separate question expected an increase in 2019, saying that global real estate portfolios have already reached their target proportions, amid caution about elevated valuations.

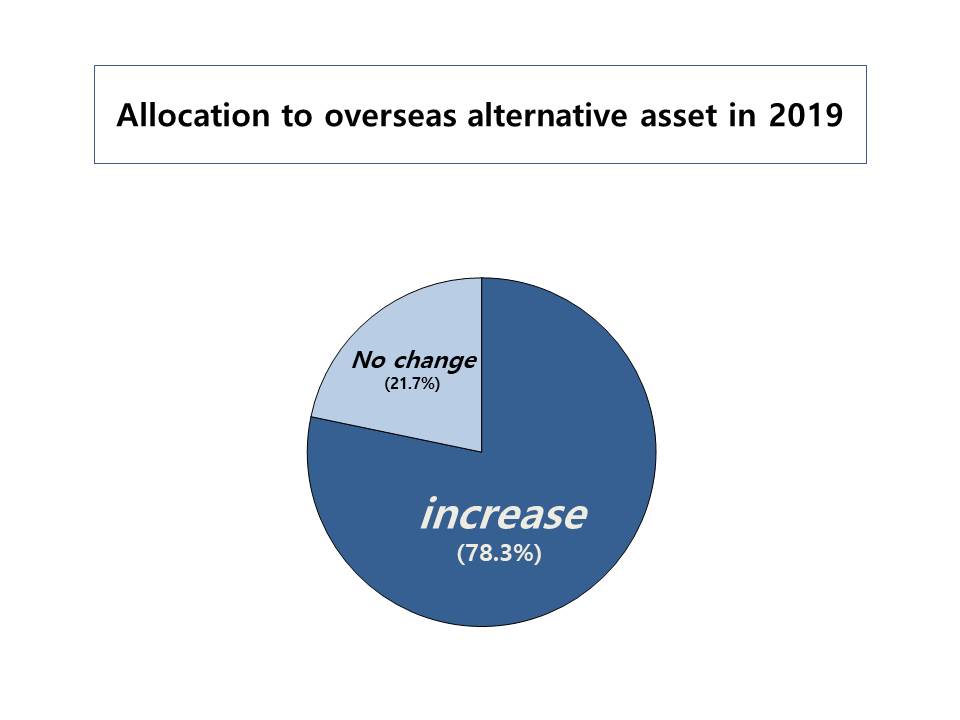

Overall, 80% of the 23 CIOs plan to ramp up global alternative investments in 2019, shying away from volatile stock and fixed-income markets and expensive domestic alternative assets.

“Compared with the domestic market, there are plenty of investment opportunities for prime assets abroad and competition is not as fierce as in the domestic market,” said Korean Teachers’ Credit Union in a written answer to the questionnaire.

The poll was undertaken ahead of the ASK 2018 Global Real Estate & Infrastructure Summit held in Seoul on Oct. 23, 2018.

INFRASTRUCTURE

By asset type, social overhead capital projects such as roads, airports and harbors (82.6%) were picked as their most favorite in a two-choice question for infrastructure, followed by new and renewable energy projects (34.8%) and hospitals, correction facilities and nursing homes (21.7%).

By asset type, social overhead capital projects such as roads, airports and harbors (82.6%) were picked as their most favorite in a two-choice question for infrastructure, followed by new and renewable energy projects (34.8%) and hospitals, correction facilities and nursing homes (21.7%).

By region, Europe (73.9%) came first, tracked by the US (69.6%), Australia (13.0%) and Canada (4.3%).

“By and large, the US and Europe relatively have higher-level maturity of regulations and market for infrastructure assets,” Yellow Umbrella Mutual Aid Fund said.

“Thus, we will improve investment stability by investing in the US and Europe which have high sovereign credit ratings and mature markets along with the steady economic environment.”

By tranche, equity (52.2%) was the most preferred type, followed by senior loans (43.5%), mezzanine (34.8%) and subordinated notes (26.1%) in a two-choice question.

Teachers’ Pension, Korea Post and Samsung Fire & Marine Insurance Co. Ltd. will seek both profitability and stability by appropriately adjusting the proportions of equity and mezzanine tranches.

In comparison, Meritz Fire & Marine Insurance Co. Ltd. is cautious about equity tranches, saying: “There is a growing risk of equities being traded at high premiums relative to fundamentals and intrinsic values. We need to approach them conservatively.”

REAL ESTATE

Those saying no change (43.5%) or decrease (17.4%) in 2019 overseas real estate outweighed the number of respondents for an increase (39.1%).

“Higher property prices and rising rents increase the vacancy risk. Hence, expected yields from real estate investments are being lowered. We are planning to decrease the proportion,” according to Shinhan Life Insurance Co. Ltd.

“Higher property prices and rising rents increase the vacancy risk. Hence, expected yields from real estate investments are being lowered. We are planning to decrease the proportion,” according to Shinhan Life Insurance Co. Ltd.

By contrast, the Korean Teachers’ Credit Union (KTCU) expects that gateway and second-tier cities in the US and other developed countries will continue to benefit from economic expansion and create investment opportunities.

“We will invest selectively in high-growth regions and sectors, in cooperation with credible partners (local managers and developers),” KTCU added.

Storage facilities (78.3%) were the most preferred asset type, followed by office buildings (43.5%) and housing properties (34.8%).

As for a favorite region for real estate investment, Europe (82.6%) beat the US (52.2%). Australia and Japan were picked by two and one respondents, respectively.

“Real estates in Europe are attractive in terms of price, because they have not risen as sharply as in the US,” said Korea Post.

“Real estates in Europe are attractive in terms of price, because they have not risen as sharply as in the US,” said Korea Post.

“When investing in European real estate, we can earn currency hedging premiums,” said Local Finance Association.

By tranche, equity (39.1%) came ahead of subordinated loans (34.8%), mezzanine (34.8%) and senior loans (30.4%).

Most of pension and retirement funds saw a mix of equities and mezzanine tranches in real estate portfolios to pursue both profitability and stability.

By contrast, insurance companies indicated a shift towards senior loans away from equities because of price concerns.

MACRO ECONOMY

Most of the CIOs participating in the survey expected the US economy to slow down from next year and saw a flattening US yield curve.

Almost all the respondents (95.7%) predicted the 10-year US treasury yield to come to 3~4% by the end of the first half of 2019. None of them expected a rise in the yield to above 4% in the same period of time.

Despite the widely-expected base rate hikes by the US Federal Reserve next year, US-China trade conflicts are likely to slow the US economic expansion, limiting yield increases in long-term bonds, according to their comments.

The CIOs were wary of the possible impact of the US-China trade disputes on the global economy.

The CIOs were wary of the possible impact of the US-China trade disputes on the global economy.

On the question about what would be the trigger of a global economic crisis in 2019, a majority of them (65.2%) picked the US-China trade disputes, before rapid US rate increases (47.8%) and a bubble burst after a decade of quantitative easing (30.4%).

[download id="5306" template="Survey Result"]

Participants in the survey are as follows:

1. National Pension Service

2. Korea Investment Corporation

3. Korea Post

4. Government Employees Pension Service

5. Korean Teachers’ Credit Union

6. Teachers’ Pension

7. Public Officials Benefit Association

8. Military Mutual Aid Association

9. Police Mutual Aid Association

10. Korea Scientists and Engineers Mutual-aid Association

11. Construction Workers Mutual Aid Association

12. Yellow Umbrella Mutual Aid Fund

13. Korea Fire Officials Credit Union,

14. Local Finance Association

15. Meritz Fire & Marine Insurance

16. Kyobo Life Insurance

17. Hanwha Life Insurance

18. Nonghyup Life Insurance

19. Hyundai Marine & Fire Insurance

20. ABL Life Insurance

21. Samsung Fire & Marine Insurance

22. Samsung Life Insurance

23. Shinhan Life Insurance

By Chang Jae Yoo and Daehun Kim

yoocool@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)