[Survey] Direct lending, mezzanine at top of Korean LPs’ private debt strategies

May 25, 2017 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s leading asset owners are planning to expand private debt investment this year in pursuit of medium risks and medium returns, setting their eyes on direct lending and mezzanine notes.

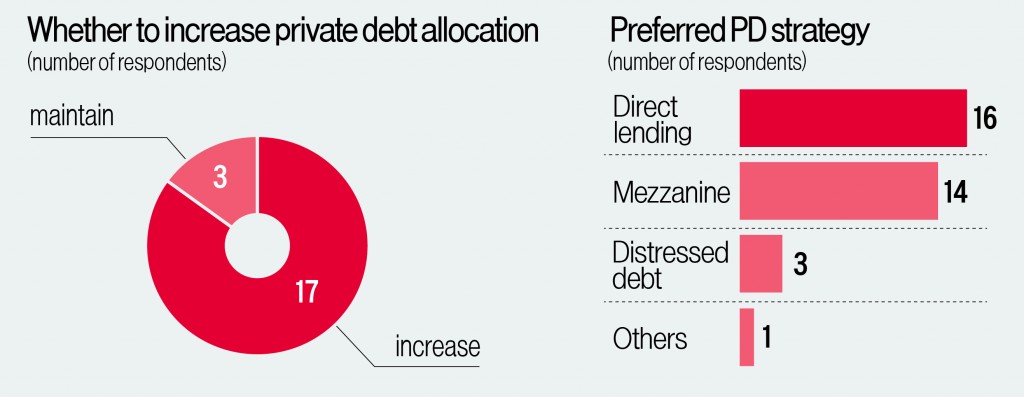

In a recent poll of the country’s 20 institutional investors by the Korean Investors, 17 institutions said they will scale up private debt investment, while three others saw no change to their private debt portions this year.

The survey was conducted just ahead of the ASK 2017 Summit of Private Debt & Equity and Hedge Fund & Multi-Asset held in Seoul on May 17 and 18.

Among private debt strategies, direct lending won 16 votes, followed by mezzanine for 14 votes. Three unidentified institutions picked distressed debt as a favored strategy.

They were requested to choose up to two of the four stated strategies, including venture debt, or state other than the four.

Higher interest rates bode well for private debt holders because private debt offer floating rate returns.

For insurers, in particular, private debt becomes a necessary asset to create a steady stream of returns, as well as an alternative to equity investment.

“In light of tightening RBC (risk-based capital) regulations, we are looking closely at private debt as an alternative to equities which are disadvantageous to RBC,” said an insurance company official.

PRIVATE EQUITY, HEDGE FUNDS

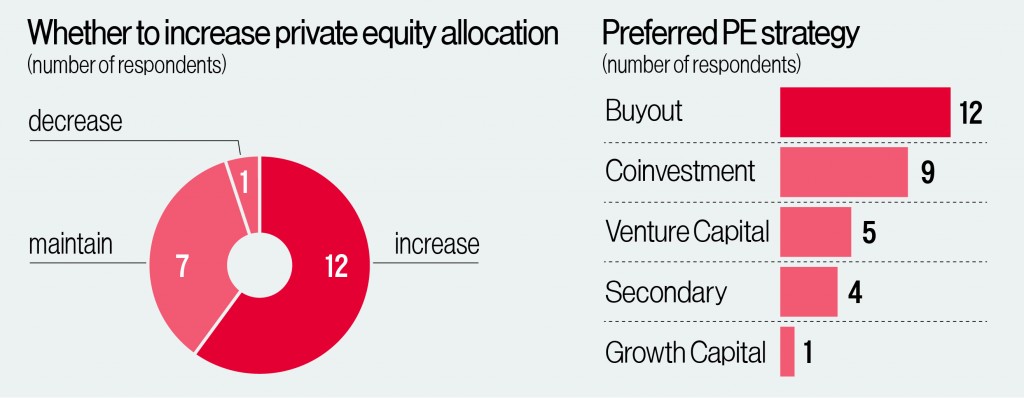

On private equity, 12 institutions plan to boost investment in search of higher returns, and seven others will maintain their PE portions. Only one institution said “decrease.”

Buyout and co-investment are the most preferred strategies, winning 12 and 9 votes, respectively.

“With the rise of redundant liquidity globally and the market consensus that prices in target assets have soared, we decided to maintain the current portion of private equity,” said a savings fund official.

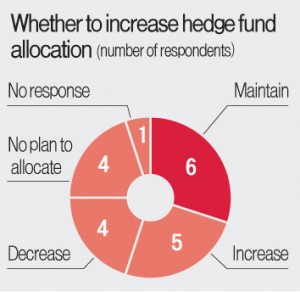

On hedge funds, South Korean asset owners remain wary of poor performance and high fees. Only five respondents, including Korea Post’s insurance arm, said they will expand hedge fund portfolios, while six others said “maintain.”

Global macro strategy was the most favored by the Korean institutional investors, receiving six votes. Equity long/short came next with four votes.

When asked about naming other attractive alternative asset classes, Korean Teachers’ Credit Union picked waste disposal facilities. National Pension Service and Public Officials Benefit Association named farm and timber land. Korea Post’s insurance unit and Local Finance Association are interested in vessel funds.

Meanwhile, an insurance firm participating in the poll expressed concerns about foreign currency risks.

“There has been no significant change in the environment since late last year, but we are now more concerned about hedging costs for overseas investment,” he noted, in reply to a question about any change since they drew up asset allocation plans late last year.

The following is the list of the participants in the survey:

1. National Pension Service

2. Korea Investment Corporation

3. Korea Post (Insurance Unit)

4. Korea Post (Savings Unit)

5. Korean Teachers’ Credit Union

6. Teachers’ Pension

7. Military Mutual Aid Association

8. Public Officials Benefit Association

9. Police Mutual Aid Association

10. Yellow Umbrella Mutual Aid Fund

11. Korea Fire Officials Credit Union

12. Local Finance Association

13. ING Life Insurance

14. Kyobo Life Insurance

15. Dongbu Insurance

16. Hyundai Marine & Fire Insurance

17. Samsung Life Insurance

18. Samsung Fire & Marine Insurance

19. NongHyup Life Insurance

20. NH Bank

By Daehun Kim

daepun@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)