Korean chipmakers

South Korea sets sights on fostering EDA tech to win HBM chip war

While the Big Three — Synopsys, Cadence and Siemens — are leading the sector, Chinese firms are encroaching on Korean turf

By Jun 28, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

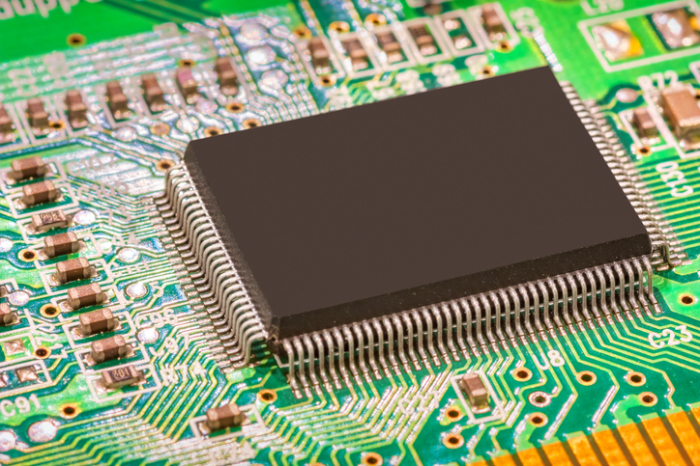

In an escalating war in the semiconductor industry, insiders know there’s one technology critical for gaining chip supremacy: Electronic design automation.

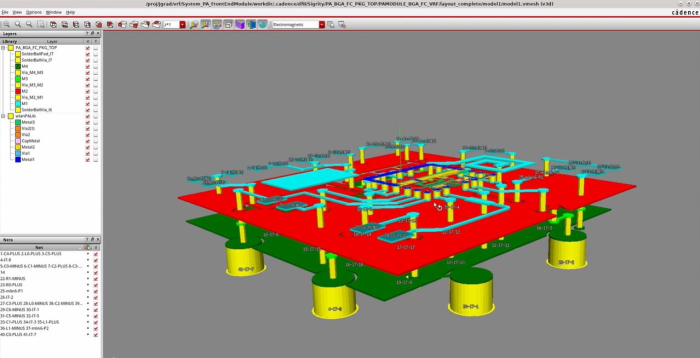

EDA tools design, validate and simulate the chip manufacturing process to ensure it delivers the required performance and density.

After the chip is made, such tools are also essential to ensuring that chip-studded devices continue to perform as expected throughout their lifetime.

Given that state-of-the-art devices can contain more than one billion circuit elements, it is impossible to design and manufacture semiconductor devices without EDA tools, industry officials say.

They said the cost of an error in a manufactured chip can be catastrophic as even a minor error cannot be “patched." The entire chip must be re-designed and re-manufactured.

“With the rise of high-bandwidth memory or AI chips, chip stacking without any mistake has become more important than ever,” said Lee Jun-hwan, chief executive of Baum Design Systems Co., a Seoul-based EDA tools provider.

He said the company has been developing EDA tools since 2013 but is struggling to hire EDA engineers in Korea.

“We’re struggling with hiring talent. Good engineers leave the country simply because there’s no EDA ecosystem here,” the CEO said.

TOP IN HBM BUT OBSCURE IN EDA

Korea is home to the world’s two largest memory chipmakers: Samsung Electronics Co. and SK Hynix Inc.

In recent years, the two memory giants and their overseas rivals have been ramping up the facilities to make high-bandwidth memory (HBM) chips to ride the AI boom.

HBM has become an essential part of the AI boom because it provides much faster processing speed than traditional memory chips.

SK Hynix is the dominant supplier of HBM chips to Nvidia Corp., the world’s top AI chip designer. Samsung also seeks to supply its HBM products to Nvidia.

“Although Korea is leading the global HBM market, I can say there’s no EDA technology here that can integrate AI and HBM,” said a Korean chip industry official.

With governments in China and Taiwan actively supporting EDA companies in their countries, Korea has also begun to take action.

The Ministry of Science and ICT, as directed by Minister Lee Jong-ho, recently began contacting domestic EDA companies for a reality check.

“Just three years ago, government officials did not even know the concept of EDA. The good news is that they now understand its importance,” said a Korean EDA company executive.

SYNOPSYS, CADENCE, SIEMENS EDA

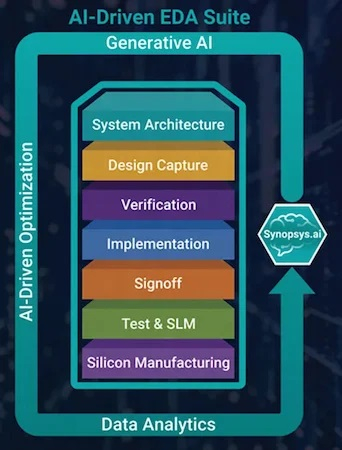

The global EDA tools market is dominated by US companies.

According to market tracker TrendForce, Synopsys Inc. is the top EDA technology provider, controlling 32% of the market, followed by Cadence Design Systems Inc. with a 30% share, and Siemens Digital Industries Software, also known as Siemens EDA, with a 13% market share.

Samsung and SK Hynix as well as major fabless chip design firms use EDA software developed by the three.

In Korea, there are only a handful of EDA companies, including Baum and Alsemy Co.

In China, there are about 300 EDA companies of which the top 10 are known to have secured advanced technology despite US sanctions, industry watchers said.

According to British market research firm EMIS, the global EDA market is forecast to grow from $10.8 billion in 2020 to $18.37 billion by 2026.

CHINA SEES OPPORTUNITY IN KOREA

The Shanghai government recently unveiled measures to support its EDA industry, including a 30% subsidy for EDA companies’ new investments.

Industry officials said Huawei Technologies Co. likely collaborated with Empyrean Technology Co., China's largest EDA company, in developing a 7-nanometer chip.

“These days, Chinese EDA companies are tapping into the Korean market by setting service prices at half the rates of US companies. They are very price-competitive,” said a Korean chip industry official.

China’s three leading EDA companies — Empyrean, Primarius Technologies Co. and Entasys Design Inc. — have been partners of Samsung Foundry since 2022.

“The time has come for the Korean government to pay more attention to the EDA sector from an economic security point of view,” said Kim Yong-suk, a professor of semiconductor convergence engineering at Sungkyunkwan University.

Write to Kyoung-Ju Kang at qurasoha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025

Korean chipmakersSK Hynix works on next-generation HBM chip supply plans for 2025May 30, 2024 (Gmt+09:00)

3 Min read -

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisis

Executive reshufflesSamsung Electronics replaces chip head amid HBM crisisMay 21, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growth

Korean chipmakersSK Hynix, Samsung set to benefit from explosive HBM sales growthMay 07, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEO

Korean chipmakersSK Hynix’s HBM chip orders fully booked; 12-layer HBM3E in Q3: CEOMay 02, 2024 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chips

Korean chipmakersSamsung shifts gears to focus on HBM, server memory chipsApr 30, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN