Korean chipmakers

Samsung Electronics stock likely to climb in Q2, analysts say

The company is expected to boost its earnings on rising memory chip prices alongside a market recovery

By Apr 08, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean analysts have recommended investors buy Samsung Electronics Co. stocks as the world’s top memory chipmaker, which reported higher-than-expected preliminary first-quarter earnings last Friday, is expected to continue to improve its performance.

Samsung’s first-quarter operating profit skyrocketed 931.3% on-year to 6.6 trillion won ($4.9 billion), according to its preliminary report on April 5. That compares with brokerage firms’ previous forecast of 3 trillion to 4 trillion won in profit.

Local analysts predicted Samsung’s earnings will improve in the second quarter as memory chip prices continue to rise, and that the company will start supplying high-bandwidth memory (HBM) to artificial intelligence semiconductor producers.

In its report on Monday, IBK Investment & Securities Co. kept its buy rating for Samsung and adjusted the target price to 110,000 won from 900,000 won.

“As semiconductor profitability enhances due to the price rebound, Samsung’s quarterly profitability will continue to improve. The company’s HBM sales are also expected to enter the market of high-performance semiconductors,” wrote IBK’s analyst Kim Un-ho on April 8.

Mirae Asset Securities Co. said on Monday that the first-quarter earnings have lifted the company’s performance recovery to the growth stage. It maintained its buy rating and target price of 105,000 won.

“A significant portion of the strong earnings seems driven by memory chip price hikes. The average selling prices for DRAM and NAND chips have jumped 22% and 25%, respectively,” wrote Mirae Asset analyst Kim Young-gun.

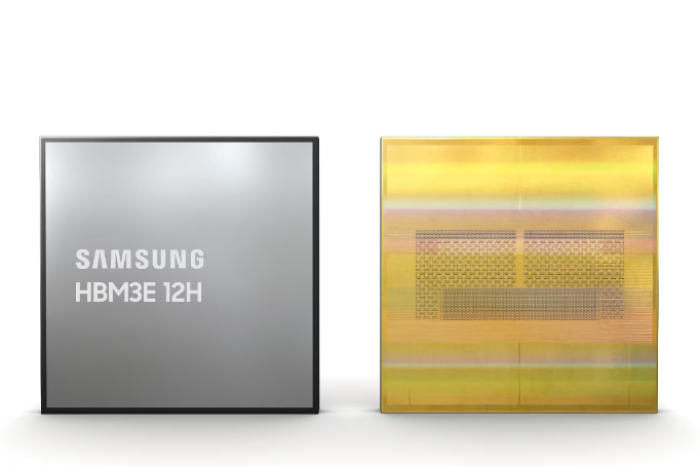

Kim expected Samsung to close the gap with its competitors in HBM3E, the best-performing DRAM chip for AI applications, in the second half. Samsung’s cost competitiveness will stand out amid a boom in the NAND market, and the chipmaker’s foundry business may swing to the black thanks to the highest-ever order backlog, Kim added.

Hi Investment & Securities Co. forecast Samsung will post 8.1 trillion won in operating profit and 71 trillion won in revenue for the second quarter.

Samsung’s earnings improvement in memory chip production due to average selling price hikes will more than offset the slowdown in the company’s mobile and network business, wrote the brokerage firm’s analyst Song Myung-seop.

Samsung may start providing HBM chips to Nvidia Corp. in the second quarter, Song added.

The Korean chipmaker will complete the performance verification of 12-layer HBM3E for Nvidia this year, and the success in the verification will be a key for Samsung’s stock rise in the near term, Song said. He kept a buy rating with a 99,000 won target price.

Samsung stock on the main Kospi finished flat at 84,500 won on Monday.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Korean chipmakersSamsung to more than double chip investment in Texas

Korean chipmakersSamsung to more than double chip investment in TexasApr 07, 2024 (Gmt+09:00)

2 Min read -

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demand

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demandApr 05, 2024 (Gmt+09:00)

3 Min read -

ElectronicsBespoke Samsung home devices make chores easier, smarter

ElectronicsBespoke Samsung home devices make chores easier, smarterApr 04, 2024 (Gmt+09:00)

2 Min read -

ElectronicsSamsung ups smaller OLED workforce to fend off Chinese rivals

ElectronicsSamsung ups smaller OLED workforce to fend off Chinese rivalsApr 04, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung gains upper hand vs Netlist in $303 million patent dispute

Korean chipmakersSamsung gains upper hand vs Netlist in $303 million patent disputeApr 03, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN