Korean chipmakers

Samsung's chip stockpile declines in Q4 2023

It's the result of a recovery in DRAM demand starting in H2 2023 and the effects of reduced semiconductor production

By Mar 13, 2024 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

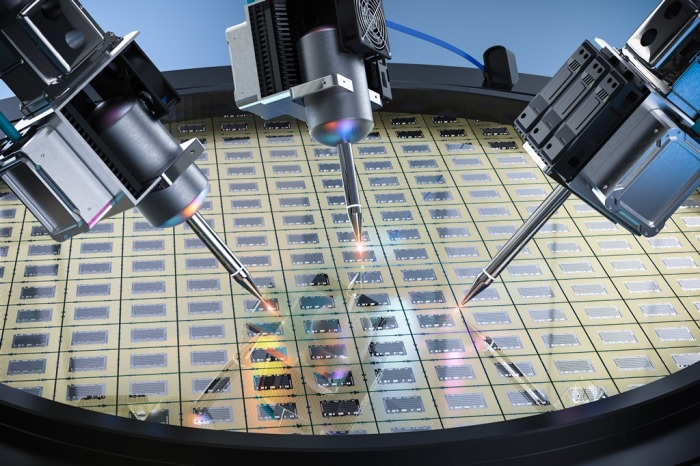

Samsung Electronics Co. has reported a decrease in its semiconductor inventory for the first time in 10 quarters, signaling a rebound in the memory chip sector.

The South Korean tech giant, in its 2023 business report released on Tuesday, disclosed that its Device Solutions (DS) division, which oversees its semiconductor operations, had inventory assets valued at 30.9987 trillion won ($23.63 billion) at the end of the last quarter of the previous year.

This figure marks an 8.1% decline from the 33.7306 trillion won recorded at the end of the third quarter, marking the first inventory reduction since the booming market of the second quarter of 2021.

During the peak of the semiconductor market in the second quarter of 2021, the DS division's inventory assets stood at 14.6025 trillion won.

However, following a downturn in market conditions, inventory levels surged, exceeding 29 trillion won by the end of the fourth quarter of 2022 and reaching 33.6896 trillion won by the second quarter of last year.

Analysts attribute the recent inventory decline to a resurgence in demand for DRAM and the impact of Samsung Electronics' production scale-downs.

Despite recording a loss of 14.88 trillion won in its semiconductor business last year, Samsung ramped up its investment in research and development (R&D) to 28.34 trillion won, up by 3.5 trillion won from the previous year and setting a new record for the company.

The ratio of R&D spending to sales also hit a milestone, reaching 10.9% and marking the first instance of double-digit investment.

Meanwhile, capital expenditures remained at a high, comparable to 2022's record investment of 53.1 trillion won.

Write to Eui-Myung Park at uimyung@hankyung.com

More to Read

-

Korean chipmakersSamsung to use recycled neon gas in chip manufacturing

Korean chipmakersSamsung to use recycled neon gas in chip manufacturingMar 07, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, Arm reinforce alliance on future AI chips

Korean chipmakersSamsung, Arm reinforce alliance on future AI chipsFeb 21, 2024 (Gmt+09:00)

4 Min read -

Comment 0

LOG IN