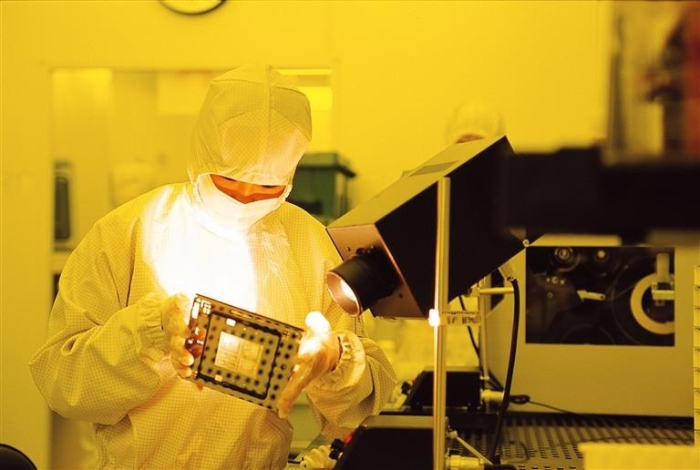

Korean chipmakers

Korea chip exports to rebound in Oct; car, cell exports to stay firm

S.Korea reports trade deficit of $2.3 bn for July 1-10 as exports fell 14.8% with overseas sales of semiconductors down 36.8%

By Jul 11, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea expected overseas sales of semiconductors, the country’s top export item, to rebound from October while the auto, secondary battery and shipbuilding industries are likely to maintain growth momentum, accelerating recovery in Asia’s fourth-largest economy.

The semiconductor industry is expected to benefit more from output cuts by major memory chipmakers from the third quarter, said the Ministry of Trade, Industry and Energy on Tuesday. The country is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

“If the improvement in the semiconductor sector and sales to China accelerates, the country is likely to maintain a trend of a trade surplus after September with monthly export growth in the fourth quarter,” the ministry said in its policy report for the second half.

South Korea reported its first trade surplus last month in 16 months as exports fell at the slowest pace since October 2022. Overseas sales of semiconductors dropped 28%, however.

Semiconductor exports in the first half skidded 37.4% to $43.2 billion from a year earlier, putting pressure on the country’s overall overseas sales.

TRADE DEFICITS EXPECTED IN JULY, AUGUST

The country is likely to log trade deficits in July and August due to fewer working days due to summer holidays, the ministry said.

It reported a shortfall of $2.3 billion in the first 10 days of July as exports fell 14.8% to $13.3 billion, according to separate data from the customs office. Overseas sales of semiconductors and petroleum products slumped 36.8% and 51.3%, respectively.

On the other hand, exports of automobiles and ships jumped 25.2% and 74%.

Carmakers, shipbuilders and battery makers are expected to maintain strong production and export momentum, the ministry said.

Automakers are likely to enjoy rising sales of high-priced models such as electric vehicles and sport utility vehicles, the ministry said. Hyundai Motor Co., the country’s top automaker, is set to launch a next-generation model of its steady-seller Santa Fe in the second half, which is expected to revive an SUV boom in the country.

Shipbuilders including the country’s three major players – HD Hyundai Heavy Industries Co., Hanwha Ocean Co. and Samsung Heavy Industries Co. – are forecast to turn to the black as they were scheduled to export high-value vessels ordered in 2021, the ministry said.

EV battery manufacturers such as LG Energy Solution Ltd. are predicted to keep raising sales with their order backlogs at 775 trillion won ($598.9 billion) as of end-2022, more than 15 times their sales last year, according to the ministry.

Write to Sul-Gi Lee at surugi@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

AutomobilesHyundai’s restyled Santa Fe to revive SUV boom in S.Korea

AutomobilesHyundai’s restyled Santa Fe to revive SUV boom in S.KoreaJul 04, 2023 (Gmt+09:00)

3 Min read -

-

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyed

Korean chipmakersDRAM prices rebound on Samsung output cut; earlier recovery eyedApr 12, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN