Korean chipmakers

AI-driven GPU, advanced chip shortage: Boon for Samsung, SK Hynix

Amid tighter GPU, CPU and AP chip supplies, demand for high-capacity memory chips for servers is also on the rise

By May 31, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The global chip industry, which has been reeling from elevated inventory levels due to weak demand, is seeing a silver lining: Inventories of advanced chips, graphic chips in particular, are depleting rapidly.

The shortage triggered by the artificial intelligence revolution and subsequent capacity expansion by big data and server operators will be a boon for not just graphic chipmaker Nvidia Corp. but also high-capacity DRAM chipmakers such as Samsung Electronics Co. and SK Hynix Inc.

Industry data showed the value of Nvidia’s graphics processing unit (GPU) inventory stood at $4.61 billion at the end of March, down 10.6% from the end of December – the company’s first inventory decline since the fourth quarter of 2019.

Graphic chips, used for AI, are almost all made by the Santa Clara, California-based company.

But the boom in demand for them has far outpaced supply with the takeoff of ChatGPT, a generative AI chatbot that responds to questions in humanlike ways.

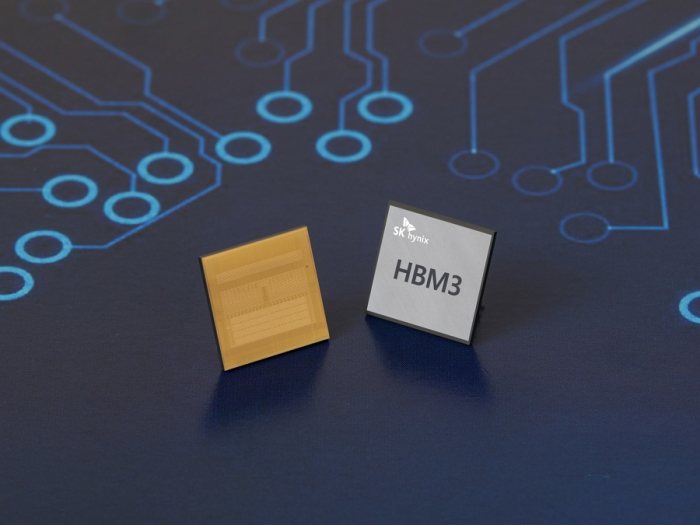

GPUs and high bandwidth memory (HBM) DRAM chips are particularly in short supply.

AI BOOM SET OFF RACE FOR MORE CHIPS

A shortage of advanced chips that are the lifeblood of new generative AI systems has set off a race to secure spare capacity and lock down computing power, industry officials said.

The advanced chip shortage is becoming so dire that a US startup that helps companies build AI models like chatbots said: “It’s like toilet paper during the pandemic,” according to a recent Wall Street Journal report.

Elon Musk, chief executive of Tesla and SpaceX, said at the WSJ CEO Council Summit on May 23 that “GPUs at this point are considerably harder to get than drugs.”

According to market tracker TrendForce, AI server shipments are expected to rise to 1.18 million units by the end of the year, up 38.4% from last year. AI chip demand is forecast to increase by 46%.

The demand for Nvidia’s products has driven the company’s stock sharply higher in recent weeks – up 39% over the past month – to $401.11 on Tuesday. Nvidia’s market capitalization has risen above $1 trillion, the first chipmaker to reach that level.

The system chip shortage isn’t limited to GPU makers such as Nvidia.

Central processing unit (CPU) maker Intel and application processor (AP) chip manufacturer Qualcomm saw their inventories also decline rapidly.

Intel’s CPU and Qualcomm’s AP chip inventory assets stood at $13 billion and $68.6 million, respectively, at the end of the first quarter, down 1.7% and 1.1% each from the end of 2022, which represent their first decline since the fourth quarter of 2020.

SHORTAGE TO PERSIST

Many AI companies expect the shortage to persist until at least next year.

Server manufacturers and their customers also say they have to wait for more than six months to get Nvidia’s latest graphics chips.

Alongside the increasingly tighter supply of GPUs, CPUs and AP chips, demand for high-capacity memory chips for servers is also rising, boding well for Samsung and SK Hynix – the world’s two largest memory chipmakers.

SK, the world’s No. 2 memory maker, supplies high-performance HBM3 DRAM chips to Nvidia for its graphic processor unit H100.

Major tech companies have been working to process surging data more quickly amid the rapid development of AI and big data. The trend is expected to raise demand for HBM chips, which vertically interconnect multiple DRAM chips and dramatically increase data processing speed compared to traditional DRAM products.

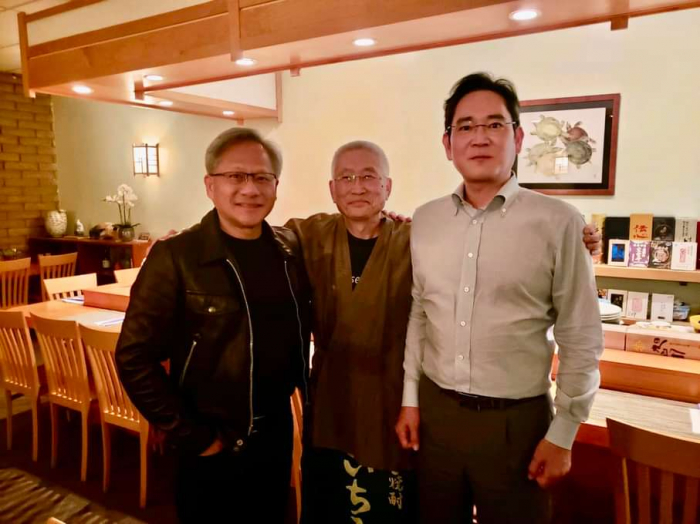

Samsung, which also supplies its advanced chips to Nvidia, expects to get more orders from the GPU maker.

Samsung Chairman Jay Y. Lee, during his US trip in May, met with Nvidia Chief Executive Jensen Huang to discuss ways to expand their business partnership, particularly in AP and GPU chips.

"Nvidia's major GPUs are produced by TSMC under foundry contracts. But Samsung is emerging as a strong candidate to divide work with TSMC for Nvidia,” said an industry official.

Write to Ik-Hwan Kim at lovepen@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Samsung GroupSamsung's Lee to redefine growth roadmap with focus on new drivers

Samsung GroupSamsung's Lee to redefine growth roadmap with focus on new driversMay 12, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to make 3 nm chips for Nvidia, Qualcomm, IBM, Baidu

Korean chipmakersSamsung to make 3 nm chips for Nvidia, Qualcomm, IBM, BaiduNov 22, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix to supply industry’s best-performing DRAM to Nvidia

Korean chipmakersSK Hynix to supply industry’s best-performing DRAM to NvidiaJun 09, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung clinches 2nd deal to make Nvidia’s latest gaming chips

Korean chipmakersSamsung clinches 2nd deal to make Nvidia’s latest gaming chipsDec 17, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN