Korean chipmakers

Samsung reclaims world's top spot in chip sales: Omdia

It achieved $67 billion in revenue last year; the overall semiconductor market shrank for four straight quarters in 2022

By Mar 07, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

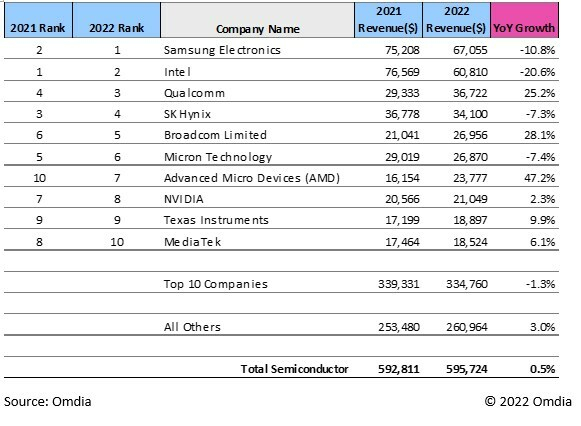

Samsung Electronics Co. topped the global chipmakers with $67.1 billion in revenue last year, according to London-based tech research firm Omdia earlier this month.

The South Korean semiconductor giant reclaimed the top spot beating Intel Corp., which achieved $60.8 billion in revenue last year. The US and Korean chip producers respectively ranked top and second in 2021 revenue.

Amid the slowdown in the semiconductor market, the two largest chipmakers saw a decline in their revenues compared with 2021. Samsung’s revenue fell 10.8% last year, while Intel’s dropped 20.6%.

Qualcomm ranked third with a $36.7 billion revenue last year, up 25.2% on-year. The US tech giant benefited from soaring demand for its application processors. SK Hynix Co., Samsung’s smaller rival, saw its revenue decline 7.3% to $36.8 billion last year.

The global semiconductor market posted a record-high $595.7 billion in revenue last year, surpassing $592.8 billion in 2021.

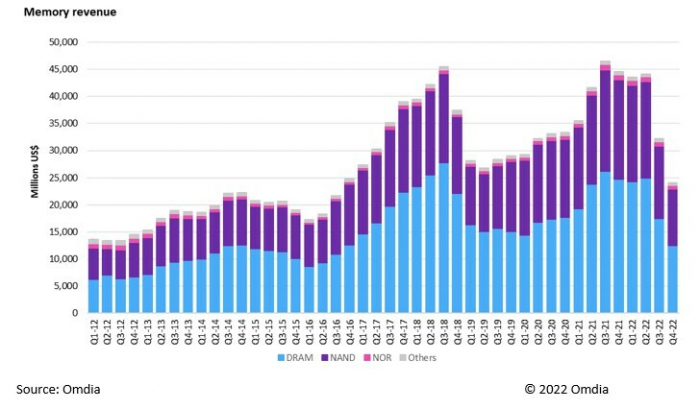

Despite the all-time high revenue in 2022, the semiconductor market declined for four straight quarters of the year. October-December revenue amounted to $132.4 billion, falling 18% on-year.

The global memory chip market was also hit hard, shrinking throughout the year. It posted $24.1 billion in October-December 2022, 52% of the quarterly record of $46.5 billion in July-September 2021.

"The sharp decline in sales in the memory market is attributable to the following three reasons. Firstly, a rapid decrease in information tech demand occurred with the end of the pandemic; secondly, excess inventory due to record-high investments by memory makers at the demand inflection point; lastly, macro economy contraction and IT demand slowdown due to interest rate hikes by central banks of each country," said Lino Jeng, DRAM senior principal analyst at Omdia.

The prices fell significantly due to suppliers' attempts to expand sales to reduce excess inventory in the fourth quarter of 2022, and Omdia expects this trend to continue in the first quarter, Jeng added.

Write to Sungsu Bae at baebae@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Korean chipmakersSamsung leader eyes memory chip packaging investment

Korean chipmakersSamsung leader eyes memory chip packaging investmentFeb 17, 2023 (Gmt+09:00)

2 Min read -

The KED ViewVietnam’s rise: An ominous sign for Korean chipmakers

The KED ViewVietnam’s rise: An ominous sign for Korean chipmakersFeb 16, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix may not slash chipmaking investment in 2023: vice chairman

Korean chipmakersSK Hynix may not slash chipmaking investment in 2023: vice chairmanFeb 15, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung secures $16 bn loan from display unit for chipmaking

Korean chipmakersSamsung secures $16 bn loan from display unit for chipmakingFeb 14, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsKorea proposes bigger tax breaks for chipmakers, key industries

Business & PoliticsKorea proposes bigger tax breaks for chipmakers, key industriesJan 03, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN