Goldman sees Samsung, SK Hynix shares up 50% over next 12 mths

Tight supply and strong demand for DRAM and NAND chips are likely to offset the impact of cost-push inflation

By Mar 11, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The share prices of the world’s two largest memory chipmakers Samsung Electronics Co. and SK Hynix Inc. each have room to rise by about 50% over the next 12 months to hit fresh highs, Goldman Sachs said on Friday.

Goldman raised its 12-month target prices of both Samsung and Hynix by 55% and 52%, respectively, based on Thursday's closing prices. It maintained a buy recommendation on the two South Korean chipmakers on expectations of higher memory chip prices.

“We believe the company will see sequential operating profit growth throughout the year, with the second half of 2022 in particular expected to be strong due also to the solid contribution from the foundry, OLED smartphones and consumer electronics,” Goldman Sachs analyst Daiki Takayama said in a research note on Samsung Electronics.

The new target price of 108,000 won ($87.5) for Samsung is 11.6% higher than its historic high of 96,800 won touched in January 2021, since it had a 50-for-1 stock split in May 2018.

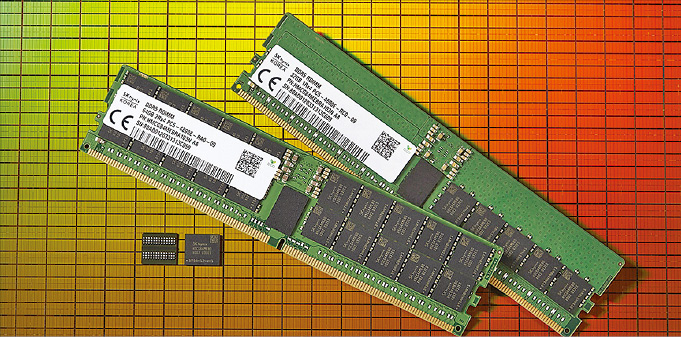

The target price upgrade comes a week after US chipmaker Western Digital Corp announced a 10% hike in the price of its NAND flash memory chips. Earlier this year, Micron Technology Inc. announced a 10% price increase.

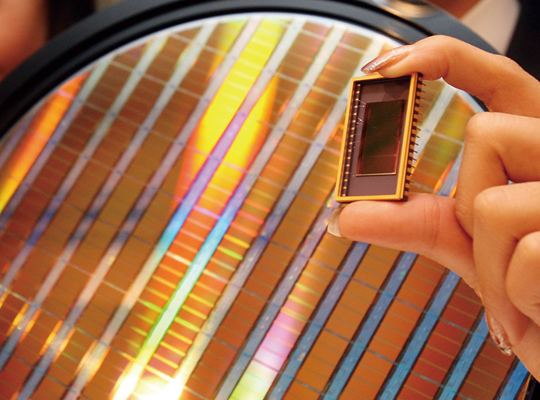

Their price hikes followed production disruptions at NAND flash memory plants in Japan, jointly owned by Western Digital and Japan's Kioxia Holdings Corp., after contamination of certain materials used in the manufacturing processes.

“We believe the Western Digital and Kioxia supply disruption has led to competitors such as Samsung Electronics seeing strong NAND orders, especially from enterprise SSD and client SSD customers," Takayama said in reference to solid-state drives, which use flash memory chips.

Foundry capacity shortages also contribute to the price increase in NAND chips as foundry companies have not met the growing demand from fabless chipmakers.

The higher price will offset rising costs amid strong inflationary pressures, with the softening won against the dollar boosting the price competitiveness of Korean shipments, he added.

Goldman revised upward its estimate for Samsung's operating profit in the current quarter by 3% to 13.9 trillion won, matching the chipmaker's operating profit posted in the fourth quarter of last year.

On Friday, Samsung Electronics ended 1.69% at 70,000 won, compared with a 0.71% slip in the main Kospi bourse.

For SK Hynix, Goldman's target price of 182,000 won is 21% above its record high of 150,500 won reached in March 2021.

Chip demand is being driven by the growing penetration of high-performance chips such as double data rate 5 (DDR5), reduced inventory at customers and facility expansion and upgrades by companies.

“We expect the recent supply disruption at Western Digital and Kioxia to materially impact second-quarter (NAND) pricing (in 2022) to the upside and drive our operating profit estimate 13% higher than consensus for the quarter,” he noted.

Shares in SK Hynix closed 2.50% lower at 117,000 won on Friday.

Meanwhile, Goldman Sachs on Thursday revised down its forecast for South Korea's gross domestic product growth by 40 basis points to 2.8%, below the Bank of Korea's (BOK) forecast of 3%, reflecting weaker external demand in the wake of the war in Ukraine.

Simultaneously, it revised upward its consumer inflation forecast for the fourth-largest economy in Asia by 60 basis points to 3.6%, higher than the BOK's latest projection of 3.1%, an 11-year high.

Write to Chang Jae Yoo at yoocool@hankyung.com

Yeonhee Kim edited this article.

-

Korean chipmakersUS chipmakers announce 10% hike in NAND flash prices

Korean chipmakersUS chipmakers announce 10% hike in NAND flash pricesMar 02, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersSK Hynix to benefit from Western Digital production disruption

Korean chipmakersSK Hynix to benefit from Western Digital production disruptionFeb 11, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chips

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chipsFeb 04, 2022 (Gmt+09:00)

3 Min read