Korean chipmakers

US chipmakers announce 10% hike in NAND flash prices

Prices of NAND flash memory chips fluctuate due to production disruption in Japan

By Mar 02, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Earlier this year, another US chipmaker Micron Technology Inc. also announced a 10% price increase.

The string of price hikes follows production disruptions at NAND flash memory plants in Japan jointly owned by Western Digital and Japan's Kioxia Holdings Corp.

Western Digital announced on February 10 that contamination of certain materials used in its manufacturing processes has led to disruptions at NAND flash production facilities in the Japanese cities of Yokkaichi and Kitakami.

The disruption has affected some 14 exabytes, which accounts for 8% of the world’s total NAND flash supply. One exabyte is equal to 1,000 petabytes or one billion gigabytes.

According to Q3 2021 figures, Western Digital and Kioxia boast market shares of 19.3% and 13.2%, respectively.

BENEFIT TO KOREAN CHIPMAKERS

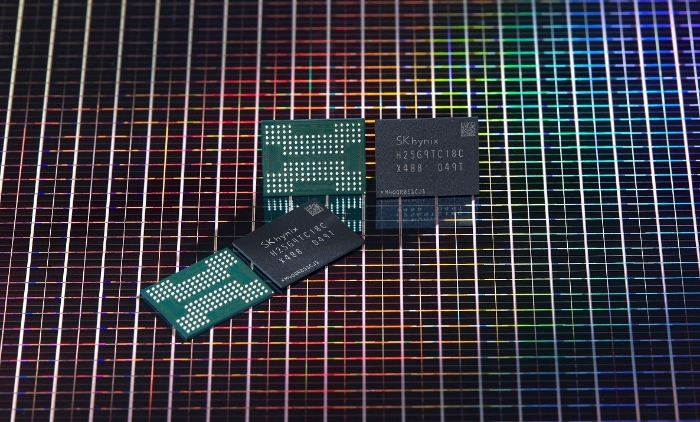

South Korea's Samsung Electronics Co. and SK Hynix Inc. have yet to announce such price adjustments.

Industry insiders expect the Korean juggernauts to be the main beneficiaries of the rise in the spot prices of 3D NAND flash memory chips.

Since the production disruption, the price of 512 gigabyte TLC NANDs increased 6% and that of 256 gigabyte TLC NANDs rose 7%. SATA SSD prices climbed 3%.

Market tracker TrendForce forecasts the two plants jointly owned by Western Digital and Kioxia will not be operating as normal until this autumn and thus expects the fixed transaction price of NAND chips to surge as much as 10%.

The fixed transaction price of NAND chips has been stable for the past eight months; after rising 5.5% last July.

The demand for memory chips is expected to increase around the globe on facilities expansion by tech giants.

Alphabet Inc., Meta Platforms Inc. (formerly Facebook Inc.,) and Amazon.com Inc. have all announced plans to increase facilities investments this year.

SK Hynix is expected to benefit significantly from its latest acquisition of Intel Corp’s NAND flash memory chip business and projects a two-fold jump in its 2022 shipments.

Write to Su-Bin Lee at lsb@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google19 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN