Taiwanese fabless firms outwit Korean rivals in chip supercycle

Foundry capacity shortage widens gap in sales and profit margins

By Jun 06, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Taiwanese fabless semiconductor firms, with backing from their hometown foundry companies, are reaping the benefits of higher chip prices and soaring demand from electronic goods brands to automakers. In contrast, their Korean rivals have yet to fully benefit from the global chip industry boom, struggling to find manufacturers for chips they have designed.

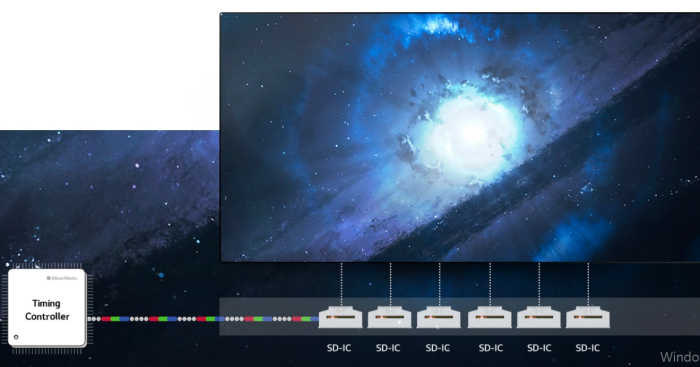

This year, Taiwanese fabless companies are expected to further expand their presence, even in premium markets, including the segment for organic light-emitting diode (OLED) displayer driver IC (DDI) chips dominated by South Korean chipmakers such as Samsung Electronics Co., Silicon Works Co. and MagnaChip Semiconductor Ltd., analysts said.

"Whatever price they say, we just want Taiwanese foundry companies to take our orders," lamented the chief executive of a leading South Korean fabless, after being recently notified that its regular Taiwanese foundry firm could not supply as many chips as it had requested.

The Korean fabless company's struggle to secure foundry capacity highlights the growing importance of foundry players in the global semiconductor industry amid supply shortages due to the faster-than-expected global economic rebound.

Taiwan is home to the world's largest foundry company, TSMC, with a market share of 56%, as well as third-ranked UMC. In aggregate, Taiwan commands 64% of the world's semiconductor foundry market, based on 2020 sales, followed by South Korea with 17% and China with 6%. That means fabless companies, if they fail to secure capacity from Taiwanese contract chipmakers, are unlikely to remain in business.

It is said that Taiwan-based foundry companies have increasingly placed their priority on the orders from domestic fabless companies such as MediaTek Inc. and Novatek Microelectronics Corp., as was required by the Taiwanese government.

The prices of chips used in electronic goods such as microcontroller units (MCUs) and DDIs have spiked by over 20% since the start of this year due to supply shortages. DDI produces images on a panel display.

Samsung's foundry capacity has already been fully occupied to meet orders from US chipmakers such as Qualcomm and NVidia. At its current capacity, Samsung cannot even produce enough chips for its own products.

At its April earnings call, Samsung said the mobile DDI chip shortage caused by a lack of foundry capacity was behind the lackluster results at its system LSI business unit.

WIDENING GAP

The difficulty in finding contract chipmakers has widened the sales gap between Taiwanese and South Korean fabless companies to 5.7 trillion won in the first quarter of this year. That compares with the year-earlier gap of 2.1 trillion won, according to an analysis by The Korea Economic Daily on June 6.

| Combined sales in Q1 2020 | Combined sales in Q1 2021 | |

| Taiwan's top 5 fabless firms | 2,578.9 billion won ($2.3 billion) | NT$158.8 billion ($5.7 billion) |

| South Korea's top 5 fabless firms | 443.6 billion won ($397 million) | 651.3 billion won ($583 million) |

| Source: The Korea Economic Daily | ||

Thanks to brisk sales, Taiwan's No. 1 fabless company Mediatek joined the list of the world's top 10 semiconductor companies by revenue in the first quarter of this year for the first time in its history. Last year, it ranked 16th. Among Taiwanese fabless players, fifth-ranked Novatek, specialized in DDI chips, is expected to climb to second place this year.

Additionally, Taiwanese companies far outstripped South Korean rivals in terms of gross profit margin ratio, or sales minus the cost of goods divided by sales.

In the first quarter of this year, Taiwan's top five fabless companies posted an average 47.5% in gross profit margin ratio, the analysis by this newspaper shows. That compared with the average 26% for South Korea's top five fabless firms.

The gap of 21.5 percentage points compares with the 15.2% in the year-earlier period.

The difference deepened even more in terms of operating profit. Taiwanese fabless manufacturers' operating profit margin averaged 25.4% in the first quarter, eight times that of South Korean competitors at 3.4%.

Operating profit margin of two leading Taiwanese fabless companies

| Company | Q1 2020 | Q1 2021 |

| MediaTek | 9.5% | 18.7% |

| Novatek Microelectronics | 15.4% | 27.3% |

Desperate to secure Taiwan's foundry capacity, Korean fabless companies now feel obliged to meet them face-to-face to place orders, industry sources said. But the two countries' still low vaccination rates and quarantine requirements have left them hesitant to make a trip to the Taiwanese suppliers.

As part of an effort to expand domestic foundry capacity, chip industry experts are calling for generous tax incentives on foundry companies, with SK Hynix mulling foundry expansion. Last month, Samsung announced a $17 billion investment plan to build a foundry factory in the US, but has yet to pick its site.

Write to Jeong-soo Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

Semiconductor rivalrySamsung loses ground in foundry market as TSMC ties in with Japanese firms

Semiconductor rivalrySamsung loses ground in foundry market as TSMC ties in with Japanese firmsJun 01, 2021 (Gmt+09:00)

2 Min read -

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSamsung Electronics buys land in Austin, eyes foundry expansion

Foundry expansionSamsung Electronics buys land in Austin, eyes foundry expansionDec 09, 2020 (Gmt+09:00)

2 Min read