K-pop giants poised for rebound with new fandom, rookies

K-pop companies are shifting their focus to Japan and North America amid signs of weakening fandom in China

By Apr 09, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

K-pop companies, led by HYBE Co. and SM Entertainment Co., are gearing up for a rebound from poor performances in the first quarter, with the release of new albums and artist debuts expected to create new fandom.

K-pop powerhouses HYBE, SM, YG Entertainment Inc. and JYP Entertainment Corp. all suffered double-digit falls in their share prices in the January-March quarter on the back of disappointing earnings in 2023.

However, analysts expect they are bottoming out with the comeback of K-pop idol groups.

HYBE, behind global sensation BTS, is forecast to report its highest-ever operating profit of 93.7 billion won ($69 million) in the current quarter, up 15% on-year, according to Hana Securities. That would reverse an estimated 78% slide in its first-quarter operating profit.

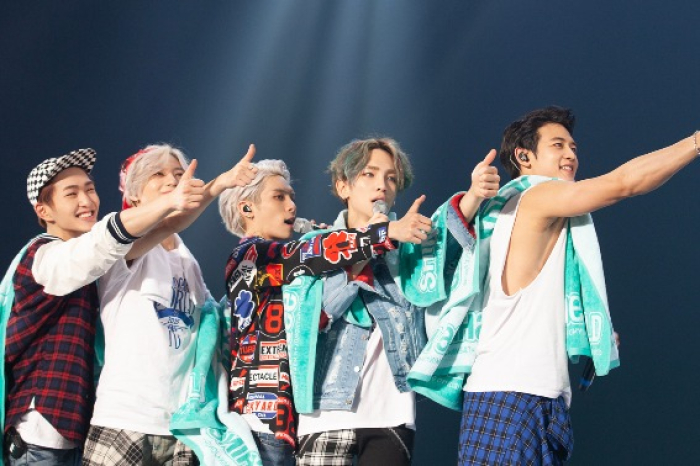

Its boy band Tomorrow X Together, or TXT, made a comeback with a new mini album last week, topping the charts of weekly album sales in Japan. The five-member group is preparing for a world tour.

“TXT, Seventeen and Enhyphen, who are making a comeback this quarter, are expected to attract 800,000 audiences from their US and Japan tours,” said Lee Ki-hoon, an analyst at Hana Securities.

HYBE is slated to release new mini or regular albums for boy bands Seventeen and Enhypen, as well as girl group New Jeans starting this month, according to the entertainment industry sources on Tuesday.

Lee said the K-pop company's operating profits had likely plummeted 78% on-year to 11.5 billion won in the first quarter of this year when its earnings were geared toward the girl group Le Sserafim.

J-Hope, a member of the BTS boy band, made a comeback at the end of last month after his military discharge, while other BTS members are still serving in the army.

SM ENTERTAINMENT

SM Entertainment's girl group aespa is preparing for a comeback with the release of a regular album next month. The K-pop pioneer is expected to stage a rebound after news of its member Karina’s dating life drove its share price lower last month.

Last week, her agency announced that she had broken up with Korean actor Lee Jae-wook, five weeks after confirming her relationship with him.

Its other boy bands Shinee and Riize and girl group Red Velvet under the K-pop powerhouse are scheduled to release mini albums. NCT Dream’s world tour in May is also expected to boost SM’s second-quarter earnings

NH Investment & Securities forecast SM Entertainment’s operating profit to rise sharply to 41.9 billion won in the current quarter from 24.4 billion won three months before.

YG ENTERTAINMENT

YG Entertainment and JYP Entertainment are focusing on their new artists after Black Pink’s four members decided not to renew their individual contracts with YG in December.

Analysts said the sensational K-pop group’s departure cut its revenue by about 15%.

However, BabyMonster, a new girl group of YG Entertainment, could fill the void left by them.

BabyMonster made its debut last week. Its first-week album sales exceeded 400,000 copies, setting a record for the first-week sales of a Korean girl group.

“More than half of BabyMonster’s initial album sales came from China and Japan, so it is expected to reduce YG’s dependence on Black Pink,” said Lee Hwajeong, an analyst at NH Investment & Securities.

JYP Entertainment is set to debut the seven-member boy group NEXZ, formed in Japan through an audition program in partnership with Sony Music.

FOCUS ON LIGHT FANDOM

According to KB Securities, South Korea’s preliminary exports of music albums to China, K-pop's core market, plunged by 92.5% on-year in April, compared to the same period of last year.

In their search for alternative markets, Korean music companies are shifting to Japan and North America, where they expect to create so-called “light fandom,” in contrast to the core fandom they had enjoyed in China.

Light fandom refers to a fan base that consumes music lightly on global music streaming platforms such as Spotify, unlike core fandom, where fans purchase several albums of a single group.

In 2023, HYBE's music streaming sales reached 298 billion won, 86% of which came from overseas markets, led by North America and Japan. For all of 2023, its sales came in at 614 billion won.

“First-quarter earnings to be announced soon will serve as a signal they are bottoming out and give new impetus to their (K-pop firms') stock prices," said a fund manager at a domestic asset management company.

Write to See-Eun Lee at see@hankyung.com

Yeonhee Kim edited this article.

-

EconomyBTS, Blackpink economy: Korea’s IP rights trade surplus hits record high

EconomyBTS, Blackpink economy: Korea’s IP rights trade surplus hits record highMar 21, 2024 (Gmt+09:00)

2 Min read -

Corporate governanceKakao to replace K-pop pioneer SM execs over poor governance

Corporate governanceKakao to replace K-pop pioneer SM execs over poor governanceJan 29, 2024 (Gmt+09:00)

4 Min read -

EntertainmentK-pop fan platform company DearU to enter into Japan

EntertainmentK-pop fan platform company DearU to enter into JapanOct 31, 2023 (Gmt+09:00)

1 Min read -

The KED ViewK-pop without ‘K’ nurtured to evolve into global mainstream genre

The KED ViewK-pop without ‘K’ nurtured to evolve into global mainstream genreSep 19, 2023 (Gmt+09:00)

3 Min read -

K-popK-pop rookies, fresh boost for Korean entertainment stocks

K-popK-pop rookies, fresh boost for Korean entertainment stocksAug 29, 2023 (Gmt+09:00)

2 Min read -

K-popK-pop label JYP Entertainment earnings disappoint; shares down

K-popK-pop label JYP Entertainment earnings disappoint; shares downAug 14, 2023 (Gmt+09:00)

1 Min read -

-

-

-

EntertainmentAespa, other SM artists to join BTS' K-pop fan platform

EntertainmentAespa, other SM artists to join BTS' K-pop fan platformApr 17, 2023 (Gmt+09:00)

1 Min read