IPOs

Spaceflight venture Innospace eyes July Kosdaq IPO

Its market cap is expected to reach up to $294 million, the highest among firms to debut on the Kosdaq so far this year

By Jun 18, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean spaceflight startup Innospace, which fired the country’s first private launch vehicle last year, aims to list on the Kosdaq in July with a market cap of up to 406.2 billion won ($294 million), the highest among companies that have debuted on the junior bourse so far this year.

Chief Executive Kim Soo-jong said on Monday that the seven-year-old startup is set to go public through a special tech ventures listing track, which allows tech firms with great growth potential to list on the Kosdaq even if they are yet to make profits.

The startup will raise from 48.4 billion won to 57.6 billion won with an offer price band of 36,400 won to 43,300 won, via the initial public offering. It will receive subscriptions from retail investors on June 20 and 21, with Mirae Asset Securities Co. as the lead manager.

“We have proven our competitive technological edge with the successful launch of the test projectile HANBIT-TLV in March of last year,” said Kim.

“Space launch vehicles that transport satellites, people and goods are necessary for data service and space tourism using Earth observation satellites. Innospace will become the standard of space mobility platforms,” the CEO added.

Innospace is slated to launch small satellites and payloads for its clients from 2025 to 2027.

Kim said the startup, which operates affiliates in Brazil and France, will strive to generate revenue by winning overseas satellite launch projects as global demand for such projects is on the rise.

The company signed a memorandum of understanding (MOU) with Korea Aerospace Industries Ltd. (KAI) last December and another one with defense firm LIG Nex1 Co. in April. In May, it entered into an MOU with the United Arab Emirates Space Agency for a partnership in the space and defense industry.

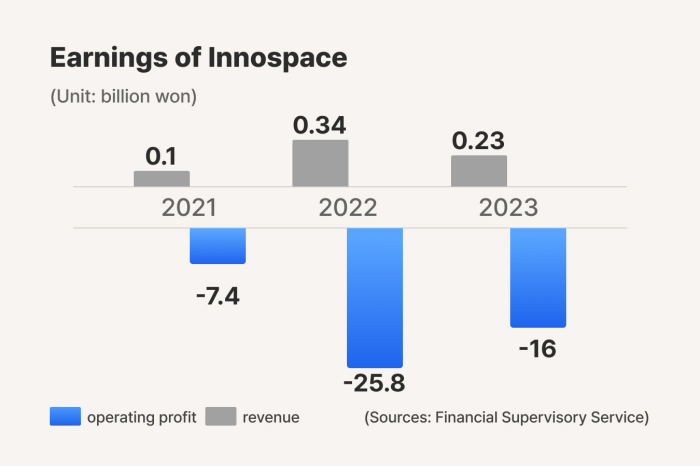

Innospace posted 16 billion won in operating losses and 230 million won in revenue last year. The company aims for 21.2 billion won in profit and 97.2 billion won in sales in 2026.

It plans to use the capital raised via the IPO for expansion of its launch vehicle production facilities, research and development of lightweight and reusable projectiles, advancement into overseas markets and to recruit talent.

Write to Jeong-Cheol Bae at bjc@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Aerospace & DefenseHanwha Aerospace, Poland sign $1.6 billion Chunmoo rocket launcher deal

Aerospace & DefenseHanwha Aerospace, Poland sign $1.6 billion Chunmoo rocket launcher dealApr 25, 2024 (Gmt+09:00)

1 Min read -

Aerospace & DefenseS.Korea taps ex-NASA exec John Lee as space agency R&D head

Aerospace & DefenseS.Korea taps ex-NASA exec John Lee as space agency R&D headApr 24, 2024 (Gmt+09:00)

1 Min read -

Aerospace & DefenseStartup Innospace launches Korea’s first private projectile

Aerospace & DefenseStartup Innospace launches Korea’s first private projectileMar 20, 2023 (Gmt+09:00)

3 Min read -

Aerospace & DefenseLaunch of Innospace's Hanbit-TLV rocket called off due to technical glitch

Aerospace & DefenseLaunch of Innospace's Hanbit-TLV rocket called off due to technical glitchDec 23, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN