Record-setting IPO boom may spell scanty profits

S.Korean companies likely to raise about $30 billion in 2021 IPOs

Jun 09, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean stock markets are on course to set a new record in the IPO volume with new issues estimated to exceed 30 trillion won ($27 billion) for the entire year of 2021, more than five times its previous record of 5.9 trillion won set in 2017.

The bulging IPO pipeline includes the blockbuster offerings, or those in the billion dollar range, from LG Energy Solution Ltd. and high-growth startups like Krafton Inc., the label behind the global hit game PlayerUnknown’s Battlegrounds (PUBG) and mobile giant Kakao Corp.'s fintech and banking platforms.

"We may never see such an unprecedented boom in the IPO market again in the next decades," said a domestic brokerage company's investment banking head.

The IPO bonanza is expected to spur more money inflows into stock markets in a lack of alternative investments in the ultra-low interest era, and help the listed companies finance their business growth.

From the investor's perspectives, however, a series of new offerings scheduled for the latter half of this year mean oversupply that may weigh on the stock markets until next year, analysts said. Their offering price inflation in the market awash with liquidity heralds lower profits from IPO issues as well.

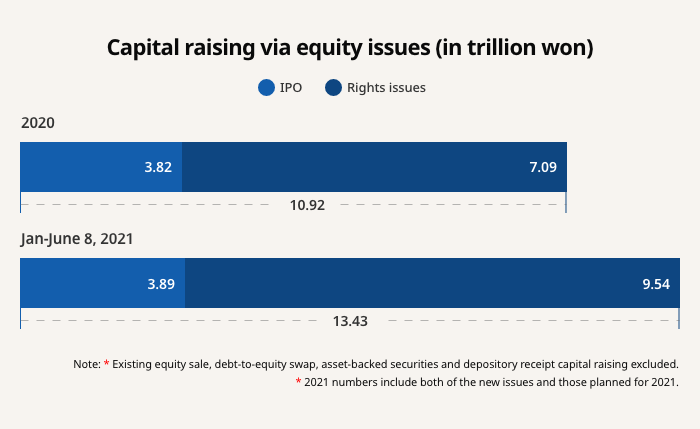

The IPO volume reached 3.9 trillion won year to date, surpassing the 3.8 trillion won for the whole of 2020, according to a calculation by Market Insight, the capital news outlet of The Korea Economic Daily. The second-half IPO volume is projected at 20 trillion won in proceeds.

The combined market value of the second-half IPO companies is estimated at 220 trillion won, about 8% of the current market capitalization of 2,740 trillion won on both the Kospi and Kosdaq stock markets in the country.

On top of the supply increase, another concern about the new share issues is that a growing number of loss-making companies are jumping on the IPO bandwagon in their rush to raise capital before market interest rates turn higher.

Among the companies listed on the junior Kosdaq market so far this year, 62% went public thanks to the so-called Tesla rules, or loosened IPO requirements. One of the upcoming IPOs, Kakao Pay, a mobile fintech platform, remains in the red but qualifies for a stock market listing under the Tesla rules.

RIGHTS OFFERINGS

Now, companies in cumulative losses are tapping the stock markets to raise new capital, too. As an example, Samsung Heavy Industries Co., has begun the process to raise 1 trillion won in a rights offering, after reporting 14 consecutive quarters of losses until the first quarter of this year.

Further, bondholders began exercising their rights to convert the bonds issued by small and medium-sized listed companies into equities.

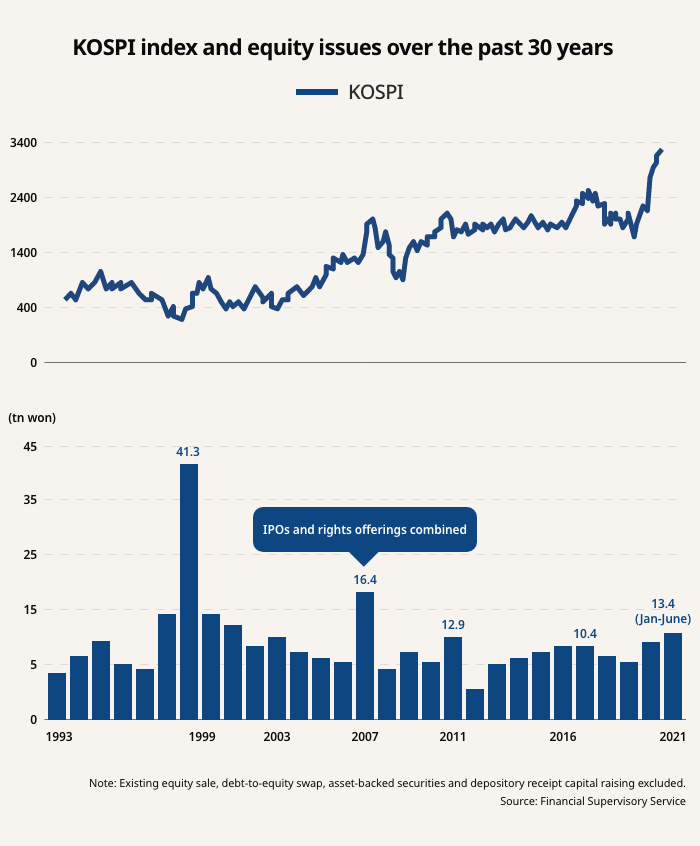

The amount of rights offerings by South Korean companies came to a total of 9.5 trillion won year to date, up 34.5% from the entire year of 2020. Combined with the rights issue volume, new equity sales are projected to reach 50 trillion won this year, on course to exceed the previous record amount of 41.3 trillion won set in 1999.

Some market analysts likened this year's IPO boom, in particular on the Kosdaq market, to the dotcom bubble in the late 1990s when excessive speculative trade in internet-related companies led to stock market collapse.

But some optimists shrugged off oversupply concerns, drawing a distinction between the dotcom bubble and the current stock market conditions. They cited steady inflows of new money into stock markets which topped 40 trillion won year to date, and noted that the prospective IPO companies are showing solid results.

Still, many analysts sound a note of caution over new supply.

"The IPO shares will not pose an immediate threat to the market, but when stock markets turn volatile, they can exacerbate market volatility," said Eugene Investment & Securities analyst Huh Jae-hwan.

PRICE INFLATION

Some 38 companies listed in South Korea so far this year, more than half, or 23 companies, revised their IPO prices upwards from their indicative ranges. Excluding one company that priced its shares at the bottom of the range, the others set their IPO price at the top end.

But many of Kosdaq-listed companies are now trading below or around their issuing prices after investors turned sellers immediately after the companies' stock market debuts.

Last month, H.PIO Co., a health food brand, saw its opening price drop nearly 20% from the IPO price. It is trading at over 20% below the IPO price. Genesystem Co., a medical equipment company that debuted on the Kosdaq market last month, opened its trade at below its IPO price and has been down over 20% from the issuing price.

Analysts warned of lower profits from new shares in the second half of this year as the IPO companies are striving to lift their issuing price in order to raise as much as they could.

"Until last year, IPOs had been priced at a discount of 20-30%, providing room for additional gains," said a brokerage industry source. "But the IPOs of late are priced too high, reducing their attractiveness as an investment."

By Ye-jin Jun and Jin-seong Kim

Yeonhee Kim edited this article.

-

IPOsLG Energy Solution applies for IPO seen to raise over $9 bn

IPOsLG Energy Solution applies for IPO seen to raise over $9 bnJun 08, 2021 (Gmt+09:00)

2 Min read -

PEF divestmentsPEFs knocking on door of Korean IPO market for profitable divestment

PEF divestmentsPEFs knocking on door of Korean IPO market for profitable divestmentMay 10, 2021 (Gmt+09:00)

3 Min read