Korea’s mobile banking app KakaoBank to push for 2021 IPO

By Sep 23, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The IPO, approved at a board meeting on Wednesday, is expected to take place in the second half of 2021 and to be the country’s biggest IPO next year.

“We decided to go public to raise capital needed for sustainable growth,” said a company source.

It will embark on the IPO process by selecting underwriters and auditors this year.

Kakao Corp. is the largest shareholder with a 33.54% stake, followed by Korea Value Asset Management Co. with 28.6%. Other institutional investors include Kookmin Bank and Korea Investment Holdings Co. with 9.86% and 4.93% stakes, respectively.

In the over-the-counter market, KakaoBank traded at 118,000 won ($101) per share on Wednesday, after climbing near 130,000 won earlier this month. That is almost three times the share prices of South Korea’s listed top banking groups, as retail investors flocked to the OTC market to grab the stock before an IPO.

Its OTC market value of 46 trillion won outweighs the combined 43 trillion won market capitalization of the four leading financial holding companies in Korea – KB, Shinhan, Hana and Woori. Brokerage companies estimate KakaoBank's corporate value between 5.6 trillion and 9 trillion won.

“We cannot ignore KakaoBank’s growth potential,” said a financial industry source. “But its growth could hit the brakes in the short term as it is in a regulated industry."

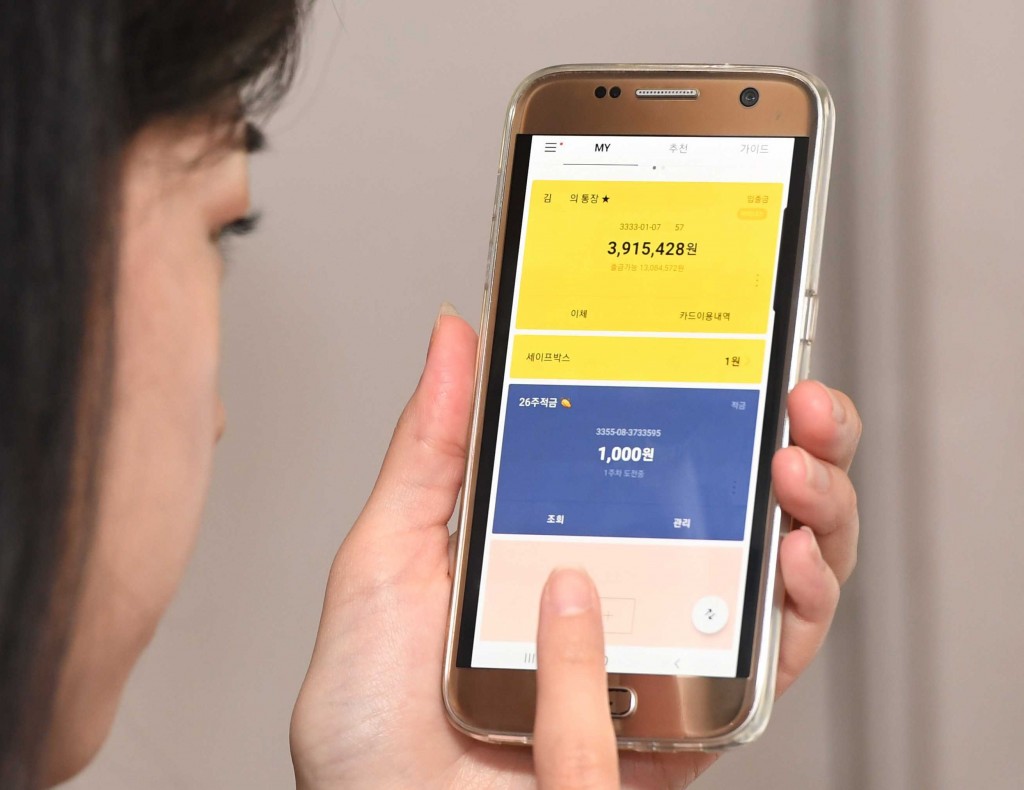

Founded in 2016, the mobile banking app. had assets of 24.4 trillion won at the end of June, with its number of customers topping 12.5 million in the country with a 50 million population.

With capital of 1.8 trillion won, it swung to a net profit of 13.7 billion won last year and posted 45.3 billion won in first-half net profit this year. The half-year earnings compared to Kakao Game’s net profit of 27.8 billion won during the same period.

Kakao Games raised 384 billion won through an IPO this month, enjoying overwhelming demand from both institutional and retail investors. The game unit is the fifth-largest stock on the junior Kosdaq, with a market value of 4.1 trillion won.

Its shares closed flat at 55,800 won, after seven consecutive days of declines. Retail investors turned sellers earlier this week to capitalize on its recent gains. The stock has lost 37% from its high of 89,100 touched on the second day of trading following its stock market debut on Sept. 10.

Other units of the online platform giant Kakao -- KakaoPage Corp. and Kakao Commerce Corp. -- are also preparing for IPOs. Kakao Page offers digital contents such as webtoons, novels and movies; Kakao Commerce is a mobile shopping operator.

Write to So-Ram Jung and Young Chan Song at ram@hankyung.com

Yeonhee Kim edited this article

-

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demand

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demandApr 30, 2025 (Gmt+09:00)

-

Real estateColliers to lead $689 million sale of IGIS Asset-owned Signature Tower

Real estateColliers to lead $689 million sale of IGIS Asset-owned Signature TowerApr 11, 2025 (Gmt+09:00)

-

Real estateIGIS taps Samjong KPMG, Cushman & Wakefiel, NAI for sale of AP Tower

Real estateIGIS taps Samjong KPMG, Cushman & Wakefiel, NAI for sale of AP TowerApr 11, 2025 (Gmt+09:00)

-

Travel & LeisureSoftBank-backed Yanolja raises stake in Modetour as No. 2 shareholder

Travel & LeisureSoftBank-backed Yanolja raises stake in Modetour as No. 2 shareholderMar 27, 2025 (Gmt+09:00)

-

Private equityMBK Special Situations relinquishes Korean investment advisory license

Private equityMBK Special Situations relinquishes Korean investment advisory licenseMar 21, 2025 (Gmt+09:00)