Asset Owners Report

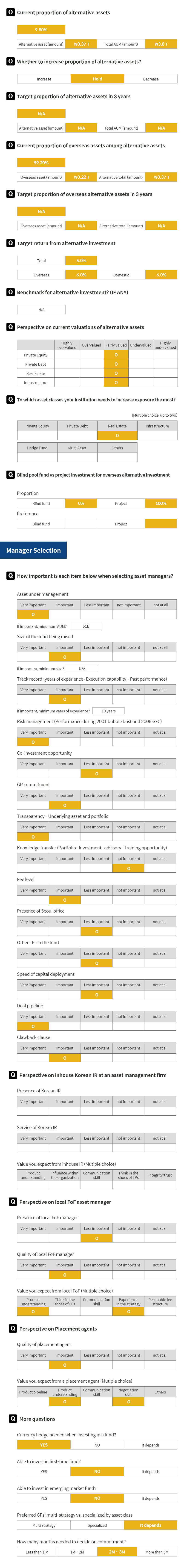

Hana Life Insurance Co. manages 38.3 trillion won ($34 billion) in assets, of which alternatives account for 10%. Overseas assets represent 60% of the alternative portfolio, with real estate accounting for 59% of the overseas alternatives. Among alternative assets, it plans to increase exposure to real estate. The unit of Hana Financial Group makes alternative investments entirely through project-based funds. It targets a 6% return from alternative investments.

- Overview

- Private Equity

- Private Debt

- Real Estate

- Infrastructure

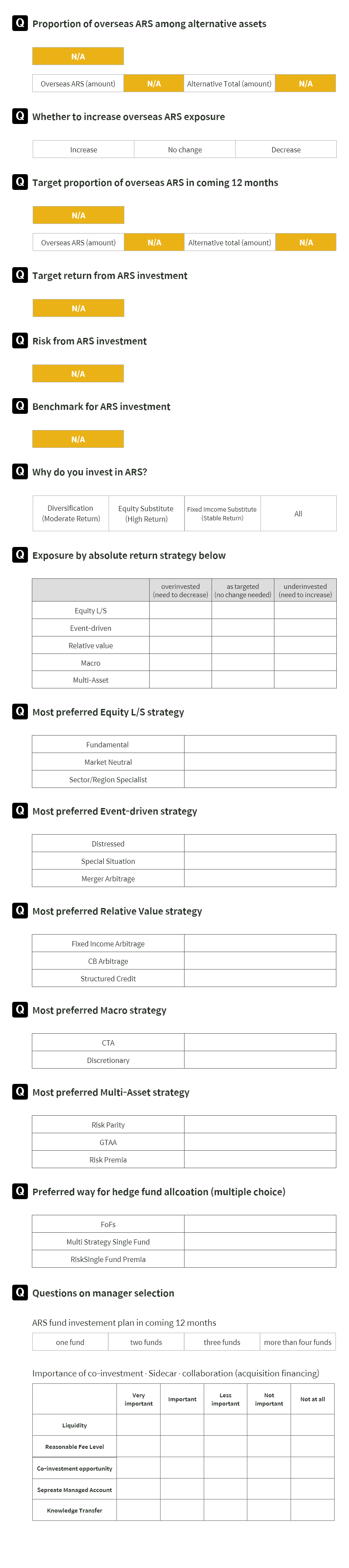

- Absolute Return Strategies